Want to become a GST Practitioner, but don’t know how? Well together with the skills, you must meet the minimum prerequisites to become a qualified GST Practitioner. Also, you should have a good understanding of the core concepts and functionalities before you start practicing.

Types of GST

Indirect taxes of both central governments (excise duty, customs duty, service tax, etc.) state governments (VAT, Luxury tax, etc.), are subsumed by the GST and both now depend on GST for their indirect revenue. Thus, the GST rate is comprised of two rates. In which case, the Intra-state transactions will carry one of CGST and one of SGST (if in case of state) or CGST or UGST (in case of union territory). Therefore, while making an intra-state sale i.e. a sale within the same state, the CGST collected will go directly to the Central government and the SGST collected will to the respective state government in which the sale’s made. Similarly, the IGST will replace UGST or SGST at the time of the intra-state transaction. We will discuss each one separately –

Central Goods and Services Tax (CGST )

The tax levied by the Central Government of India on any transaction of goods and services tax taking place within a state is referred to as CGST. This is one of the two taxes charged on every intrastate i.e. within one state, transaction. Moreover, all the existing Central taxes including Service Tax, Central Excise Duty, CST, Customs Duty, SAD, etc are being replaced by the CGST. Generally, the price of CGST is equal to the SGST. As, both the taxes are charged at the base price of the product.

State Goods and Services Tax (SGST)

SGST is one of the two taxes levied on every intrastate (i.e. within one state) transaction of goods and services. Above all, the SGTS is levied by the state where the goods are being Purchased/Sold. All the existent taxes including VAT, State Sales Tax, Luxury Tax, Entry Tax, State Cesses, Entertainment Tax, and Surcharges on any kind of transaction involving goods and services have been replaced by the SGST. Thus, the sole claimer of the revenue earned under SGST is the State Government.

Integrated Goods and Services Tax (IGST)

Integrated GST is applicable on interstate (i.e. between two states) transaction of goods and services, as well as on the imports. This tax is collected by the Central Government and further, it’s distributed among the respective states involved. Generally, the IGST is charged when the product or service is moved from one state to another state. IGST ensures that the state has to deal with only the Union government and not with every state separately to settle the interstate tax amounts.

Union Territory Goods and Services Tax (UTGST )

UTGST is the type GST applicable on the goods and services supply that takes place in any of the five Union Territories of India. Therefore, involving – Andaman and Nicobar Islands, Dadra and Nagar Haveli, Chandigarh, Lakshadweep and Daman and Diu. Further, this UTGST is charged in addition to the Central GST (CGST) explained above. CGST + UTGST are charged for any transaction of goods/services within a Union Territory.

“Within our dreams and aspirations, we find our opportunities.”

We in this article detail every aspect and requirement to help you become a Qualified GST Practitioner.

How to become a Qualified GST Practitioner?

The CGST Act under section 48 provides for authorization of an eligible person to act as an approved GST practitioner. Although, any registered person may authorize an approved GST practitioner to endow information on his/her behalf to the government.

Additionally, Rule 24 and 25 of the Return Rules prescribe the eligibility conditions including,

- Firstly, Manner of approval of goods and services tax practitioners

- Next, the manner of removal

- Also, Duties and obligations

- Further, conditions relevant to their functioning.

GST PCT- 1 to GST PCT-5 has prescribed list of formats available for GST practitioner –

- First, form GST PCT – 1 – Application for Enrolment as Goods and Services Tax Practitioner

- Second, GST PCT-02 – Enrolment Certificate for Goods and Services Tax Practitioner

- Third – GST PCT-03 – Show Cause Notice for disqualification

- Fourth – GST PCT-04 – Order of Rejection of Application for enrolment as GST Practitioner/ Or Disqualification to function as GST Practitioner

- Fifth – GST PCT-05 – Authorization/ withdrawal of authorization of Goods and Service Tax Practitioner

Eligibility criteria to become a GST practitioner

Further, as per Rule 24 of the GST return rules, you must meet the required eligibility state to get yourself enrolled as a GST Practitioner-

- Firstly, you should be a citizen of India

- Secondly, you should be a person of sound mind

- Also, you should not be adjudged as insolvent

- Lastly, you must not be convicted by a competent court for any offence with imprisonment not less than two years

Qualifications Requirement for GST Practitioner

In addition, you should also satisfy one of the following conditions to be a qualified GST Practitioner –

- Firstly, you should be a retired officer of the Commercial Tax Department of any State Government or of the CBEC and you had worked in a post not lower in rank than that of a Group-B Gazetted Officer for a minimum period of two years; or

- Secondly, you should be enrolled as a sales tax practitioner or tax return preparer for a period of not less than five years;

- Also, you are required to qualify atleast one of the following conditions –

- Firstly, you should hold a Graduate or Post-Graduate degree in- Commerce, Business Administration or Business Management, Law, or Banking including Higher Auditing, from any of the Indian Universities established by any law for the time being in force; or

- Secondly, you should hold an equivalent degree examination from any Foreign University must be recognized by any Indian University to the degree examination mentioned in sub-clause (1); or

- Thirdly, you should pass any other examination notified by the Government, on the recommendation of the Council, for this purpose; or

- Next, you should have any degree examination of an Indian University or of any Foreign University recognized by any Indian University as an equivalent of the degree examination or

- Lastly, you should qualify any of the following examinations – (a) Final exam of the Institute of Chartered Accountants of India; or (b) Final exam of the Institute of Cost Accountants of India; or (c) Final exam of the Institute of Company Secretaries of India.

Roles and Responsibilities of a GST Practitioner

In general, as a GST Practitioner, you will required to undertake any or all of the following actions on behalf of a registered person –

- Firstly, you will be responsible to supply details of outward and inward supplies;

- Secondly, you will be responsible for supplying monthly, quarterly, annual or final return;

- Thirdly, you will be required to make the deposit for credit into the electronic cash ledger;

- Lastly, you will be required to file a claim for refund; and

- Also, you will be required to file an application for alteration or cancellation of registration.

Conditions for GST Practitioner

In particular, any person registered has the authority to give you consent for authorizing a GST practitioner in the form GST PCT- 5. Further, this involves listing the authorized activities in which they intend to authorize you as the GST practitioner. Also, the registered person authorizing you as a GST Practitioner shall have to authorize in the standard form Part A of form GST PCT-5 and also the GST practitioner will have to handle the authorization in part B of the form GST PCT-5. Moreover, as an authorized GST practitioner you are permitted to undertake only such tasks which are indicated in the authorization form GST PCT -5. Also, the registered person has the authority, to withdraw such authorization in the prescribed form GST PCT -5 at any time.

How to acquire the right to become a GST Professional?

GST is now an inevitable part of our country’s economy thus leading to be one of the most demanded professions in the industry. With the above-listed eligibility criteria adopting GST as your profession is quite technical. If somehow unable to meet the said eligibility there is still hope. If you’re from a taxation or accounting background and want to learn and practice the GST. Then there are numerous training and certification courses available for you to make your dream true. You can enroll yourself with any of the available certification bodies like – EduPristine, Vskills- India’s largest certification body, etc.

If you have the zeal to learn and shape your career as a Certified GST Professional to learn the concepts. You will be required to learn and understand deeply the following concepts –

- Taxation and GST Basics

- GST Administration

- GST Registration

- GST Payment

- GST Accounting or Record Keeping

- GST and Law

- IGST

- GST in Other countries

This is the need of the hour, if you are accounting professionals, Tax consultants or even students pursuing a course in accounting or finance will be required knowledge on GST, to shape your career better. The course is followed by an assessment exam to assess your proficiency and become a certified candidate.

Companies that hire GST Professionals

Whether it is a manufacturing or a service industry, almost every company (small or big) need to maintain their proper books of accounts. And, for this purpose, they require Accounts executive, accounts manager or even chartered accountants, who are having good knowledge in GST. So, there is a great demand for Certified GST Professionals.

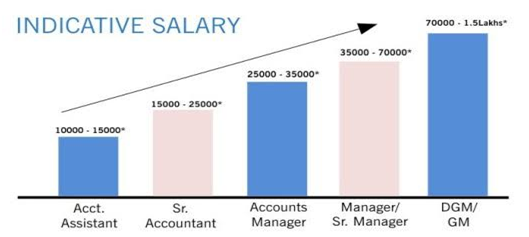

Top Companies include – Capgemini, Times Group Publications, and EY, etc. They are hiring for GST jobs with an average salary Rs. 600,000 per annum. And with the required knowledge and skills, you may make to these organizations.

Expert’s Corner

Since you have all the required knowledge and information. It then becomes important to tick the skills you have and work on skills you are yet to acquire. Moreover, as suggested you may also refer to certifications and training programs that will facilitate you to become a GST expert. You can also go for freelancing and make it your part-time profession. There are many ways to earn but doing what you love makes all the difference. Start building your skills and qualify as a GST Practitioner for better job opportunities.

Get ready to boost your learning and prepare to qualify as a Certified GST Professional Now!