Are you looking for some stability in your professional life and wish to give your career a boost? If you are, then probably this amazing career as a GST Practitioner can help you achieve so. Honestly, you can make up a handsome payout with this hassle-free job. Here in this blog, we will be providing comprehensive details about GST starting from the skills required to how you can successfully become one.

Therefore, let’s start your journey to become a GST Practitioner with the introduction.

What is Goods and Services Tax (GST)?

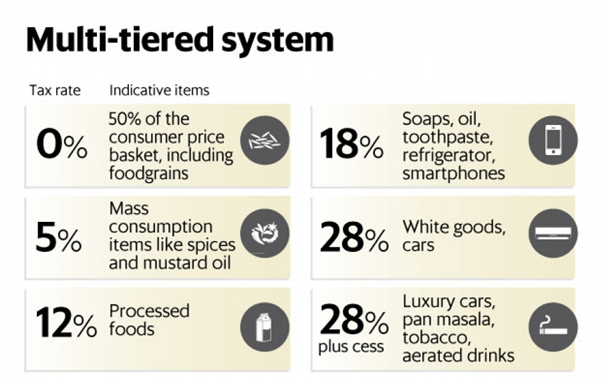

Goods and Services Tax (GST) is a type of indirect tax that is applicable to the supply of goods and services in India. Further, it is a comprehensive and multistage tax as it is applicable at every step in the production process.

The tax came into effect from July 1, 2017, through the implementation of the One Hundred and First Amendment of the Constitution of India by the Indian government.

Who is a GST Practitioner?

GST Practitioner is a consultant who provides services to other taxpayers through online mode. A GST Practitioner requires registration on GSTN Portal and must hold a certificate by going through an application procedure before starting his/her career.

Solid Reasons to become a GST Practitioner

Before you land in the GST practitioner exam, it becomes important to understand the benefits associated with the same. Below are some benefits which a GST Practitioner enjoys.

- Firstly, a GST practitioner can view the complete list of taxpayers who are engaged in your account.

- Secondly, s/he can furnish details of inward and outward supplies.

- After that, the authority to furnish the monthly, quarterly, and annual returns on behalf of taxpayer clients.

- Moreover, can make a deposit for credit into the electronic cash ledger.

- Besides this, s/he can also make certain changes in the profile of the taxpayer client like a place of business, contact details, and other business information. However, a GST practitioner only has the right to save such information and cannot submit it under any condition.

- Further, the ability to help the client in the issuance of tax invoices, delivery challan, a procedure for GST registration, cancellation, and any GST Updates.

- Last but not the least, enabled to accept or reject the application as a consultant from fellow taxpayers.

Must-Have for GST Practitioner

Like every other exam, the GST Practitioner exam requires certain things with you to take up the exam. Therefore, for your convenience following are the must-have to become a GST expert.

- Firstly, a candidate must be a graduate or postgraduate or must possess an equivalent degree in commerce, law, banking, business administration, business management.

- Secondly, s/he must possess a clearance through an examination run by the government of India.

- Thirdly, s/he must also possess a degree from an Indian University or a Foreign University equivalent to – Finals of Institute of Chartered Accountants of India, Finals of Institute of Cost Accountants of India and Lastly, Finals of Institute of Company Secretaries of India

Role of a GST Practitioner

Being a GST practitioner comes with a lot of roles and responsibilities. Today, the role of GST practitioner is shifting to align with more forward-thinking practices. Therefore, GST practitioner has to undertake any or all of the following activities:

- Firstly, furnish details of outward and inward supplies.

- Secondly, furnish monthly, quarterly, annual or final returns.

- In addition, deposit any credit into the electronic cash ledger.

- Further, file a claim for a refund.

- Lastly, file application for cancellation or amendment of registration.

Roadmap to Become a GST Practitioner

Now that you have understood all the relevant details, it’s time we move on to the roadmap to appear for the GST Practitioner exam.

Prerequisite for GSTP exam

Different exams have different eligibility requirements. In the same vein, the GSTP exam has its own. Therefore, the aspirant must comply with the following requirements.

- Firstly, the applicant should possess a valid PAN card.

- Secondly, the applicant should possess a valid mobile number.

- After that, the applicant should possess a valid E-mail ID.

- Then, the applicant should possess a Professional address.

- Above all, the applicant should possess all the required documents and information.

Exam Details

Date of exam

The GSTP exam takes place twice a year across India at designated centres. The candidate has the option to choose the centre of his choice. Further, the date of the exam is notified by NACIN and is available on the GST portal and CBIC website.

Registration Process

The registration for this exam takes place on below registered link – nacin.onlineregistrationform.org. Candidates login with the help of the GST enrolment number (user id) and PAN (password).

Fees

Examination fees of INR 500 are payable by the candidate at the time of enrolment.

Nature of exam

The exam is a computer-based test consisting of Multiple-Choice Questions only.

Result declaration

Generally, NACIN declares the result within one month of the conduct of the examination. Further, it is communicated to the candidate by email/post.

Passing marks

In order to become a GSTP, the candidate must score at least 50% of the total marks. The candidate has to pass the exam within a period of 2 years of enrolment. Moreover, the candidate can make unlimited attempts during the period of 2 years.

Course Outline

GSTP exam covers the following legislation –

- The Central Goods and Services Tax Act, 2017

- The Integrated Goods and Services Tax Act, 2017

- State-specific Goods and Services Tax Acts of 2017

- The Union Territory Goods and Services Tax Act, 2017

- The Goods and Services Tax (Compensation to States) Act, 2017

- The Central Goods and Services Tax Rules, 2017

- The Integrated Goods and Services Tax Rules, 2017

- All-State Goods and Services Tax Rules, 2017

Application Procedure

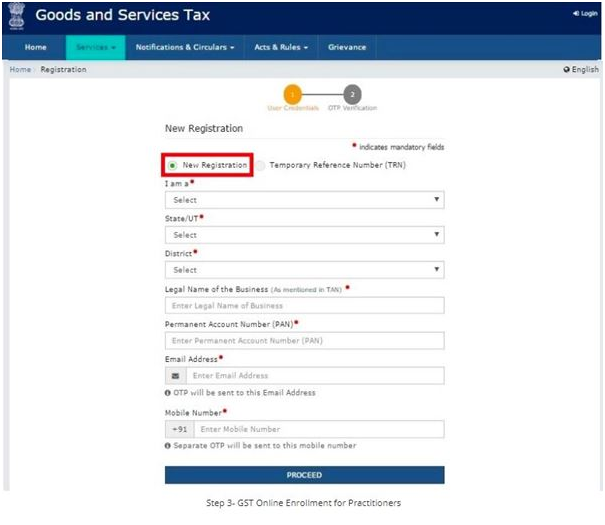

Application procedure for GST Practitioner exam falls under two parts i.e Part A and Part B. Follow the steps below to register for a GST Practitioner on the GST Portal.

Part A

- First Step: Log on the website

- Second Step: Click on the Register option

- Third Step: Registration Page appears

- Fourth Step: Select GST Practitioner

- Fifth Step: Select the State

- Sixth Step: Enter the Name.

- Seventh Step: Enter the PAN

- Eight Step: Enter the EMail ID

- Ninth Step: Enter the Mobile Number

- Tenth Step: Clear the Captcha Code

- Eleventh Step: Click on Proceed

- Twelfth Step 12: Enter the OTP

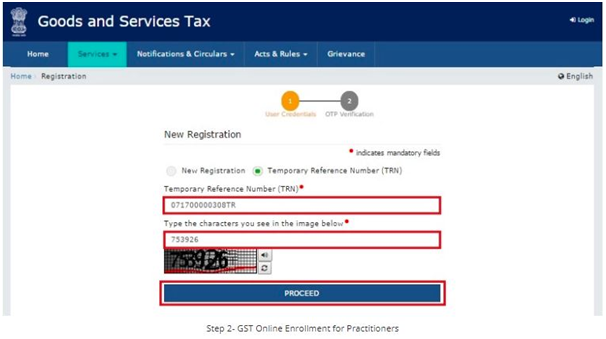

Part B

- First Step: Receiving the TRN

- Second Step: Clear the Captcha Code

- Third Step: Enter the OTP

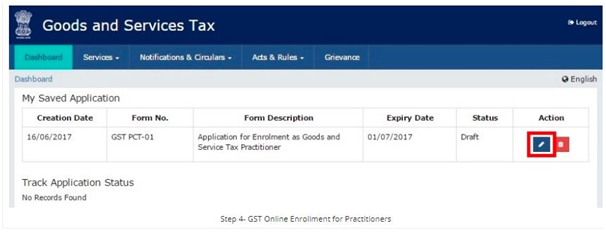

- Fourth Step: My Saved Application page appears

- Fifth Step: Fill in the General Details section

- Sixth Step: Enter the Applicant Details

- Seventh Step: Enter the Professional Address

- Eighth Step: Verification Page

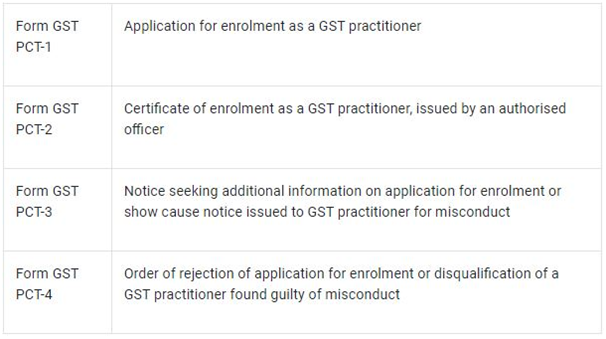

Forms required by a GST Practitioner

The following forms will be of prime importance to one as a GST tax practitioner –

Do’s and Don’ts for GSTP Exam

Since you cannot jeopardise your career, it becomes important for you to know what are the do and don’ts of the GSTP exam. Therefore, let’s give a quick look at the same.

Do’s:

- Firstly, make sure you register for the exam on the NACIN website well in advance.

- Secondly, pay your examination fees.

- In addition, study the GST laws and return filing processes thoroughly.

- Moreover, keep yourself updated with amendments in GST law.

- Further, carry original identity documents such as PAN, Voter ID & Passport.

- Most importantly, don’t forget to carry your admit card to the examination hall.

Don’ts:

- Firstly, arriving late by half an hour for the examination. Remember gates close fifteen minutes before the commencement of the exam.

- Then, bring prohibited items such as mobile phones, Bluetooth devices inside the examination hall.

- After that, use unfair means or practices during the examination.

- Lastly, rely on and practice essay type questions.

Validity of License

The GST Practitioner license is valid until it receives the cancellation by the relevant authority. However, achieving your GST Practitioner license is not the end. In other words, it requires timely maintenance. Saying so, practitioners have to pass the exam run by the GST Authority and notified by the Commissioner from time to time.

How to file returns as a GST Practitioner?

Once you become a practitioner, it becomes important to know how to file the returns. Filing a return is an easy feat. Just follow the steps below.

- First Step: A potential client views the list of GSTPs on Form GST PCT-5 on the Common Portal. Further, s/he authorizes a GSTP to prepare any or all of the prescribed statements using Form GST PCT-6.

- Second Step: After getting authorized, a GSTP should prepare the required statements and affix his / her digital signature on them, or electronically verify them using his / her credentials.

- Third Step: Once a GSTP furnishes a statement, a confirmation will be sought from the client via SMS or Email. The statement furnished will also be available to the client on the GST Portal.

- Fourth Step: The client must ensure that the statement submitted by the GSTP is true. Once verified, the client must confirm the statement within the specified due date only.

Want To become Certified GST Professional?

After reading this, don’t you think this exam can be the best opportunity for you which will elevate your career in the most positive manner? If so, then you can join us without any hassle. That is to say, the application process is a cakewalk, and you don’t have to go on a trip. Here, you would receive proper training and detailed advice on the proper process. Therefore, join Certified GST Professional and become a part of one of the best known and trustworthy Government body without a second thought.

Expert’s Corner

After providing all the information above, passing the GST Practitioner Exam wouldn’t be difficult. You just have to follow the blog and we’re sure you’ll qualify the exam in the first attempt. Remember becoming a registered GST Practitioner would definitely be a profitable option in the GST regime. Moreover, passing the concerning examination, all the enrolled aspirants would legally become eligible to comply with all the stated terms and conditions. So, start preparing for the exam now.

All the best!

Get job-ready and become a Certified GST Professional with hundreds of GST real-time practice exam and expert guidance with preparation material Now!