Any business organization is required to take several decisions in its lifetime. Most of these decisions involve an element of finance in them. Business and Financial Modelling helps the organization to be aware of the outcome of its financial decisions. It tries to ensure that the amount invested in any project or security doesn’t go waste. Financial Modelling can be done for a variety of purposes.

Financial Modelling – Meaning

A financial model refers to a mathematical representation of financial variables and their relationships pertaining to an organization. In simple words, it means to construct formulas, using given inputs, in order to make recommendations regarding ‘which securities to invest in’, ‘how much sales to expect’, ‘which projects to undertake’, etc. It can be defined as: “A tool that forecasts the performance of a security, financial instrument or a company’s financial position based on its historical performance.”

Methodology of Financial Modelling

Financial Modelling makes use of comprehensive tools and formulas, which are formulated with respect to the given problem. The most commonly used is a spreadsheet. Let’s take an example to understand how an organization can use financial modelling to reach a financial conclusion.

ABC Ltd. asks its financial analyst to recommend the amount of fund, it should allocate towards employee expenditure the following year. Now, the financial analyst can use a spreadsheet to calculate a forecasted amount, based on the past allocation trend of the company. He will put the amount of expenditure of ‘nth’ year in one column. Then, he will put the amount of expenditures of ‘(n+1th)’ year in the corresponding second column. In the third column, he will calculate the increase in expenditure from every previous year. Based on the calculations, he’ll suggest the company, how much amount should be allocated for the next year.

The following are instrumental in financial modelling:

- Pattern analysis

- Tend analysis

- Ratio comparison

- Financial statement analysis

- Industry comparatives

- Mathematical formulations

- Knowledge of excel/spreadsheet

Goals of Financial Modelling

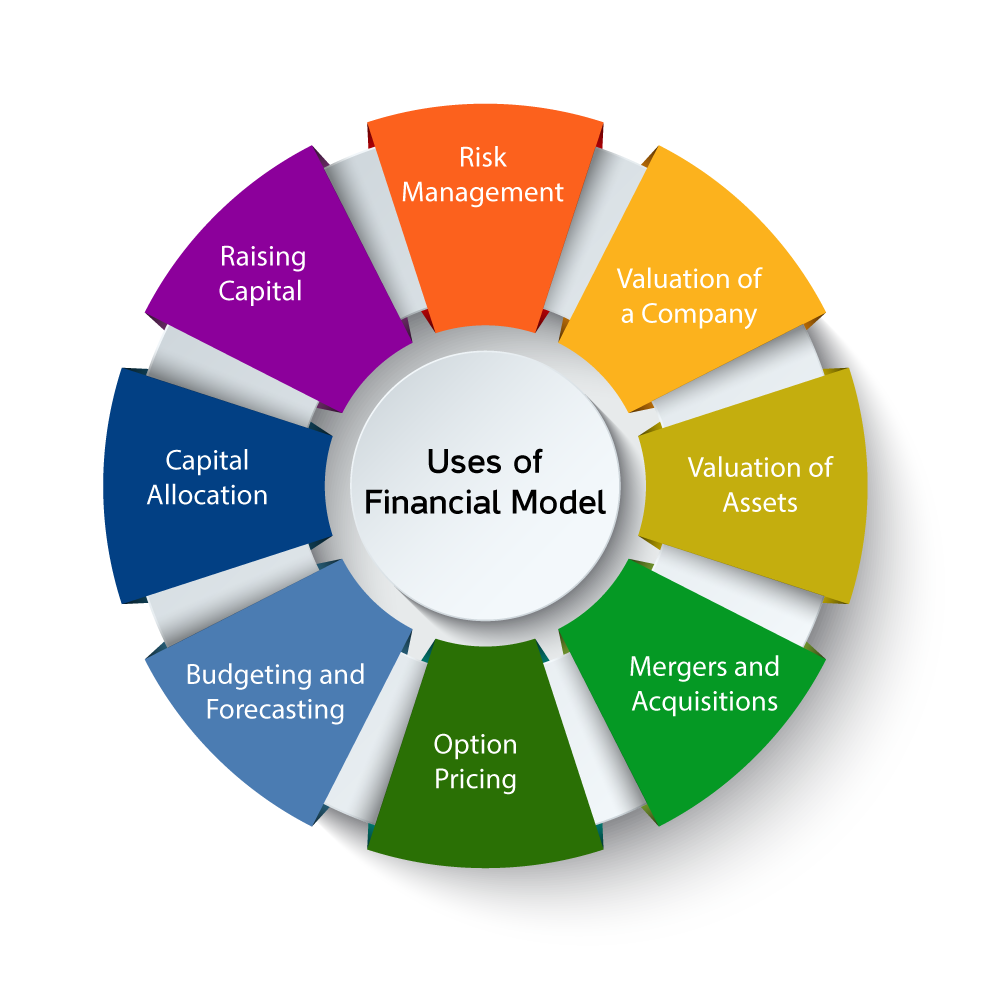

Financial Modeling helps an organization in forecasting financial implications of a policy or decision. Thus, its main goal is to accurately predict and ensure returns. Financial Modeling can be done for a various purposes, which are as follows:

- Investment Analysis: It involves the use of financial modeling to ascertain which securities one should invest in. It also involves predicting the return from a particular investment. In context of an organization, it helps in capital budgeting, which ultimately results in increased value of business.

- Business Valuation: It helps in reflecting the true value of business in financial terms so that the shareholders can make sagacious investment. Business valuation also comes handy when an organization plans to invest in other businesses.

- Project Decisions: An organization encounters situations, whereby, it is required to decide which project it should undertake out of the available options. It becomes difficult to theoretically weigh each project’s pros and cons. Thus, financial modeling is used to compare the options keeping multiple parameters as base.

- Inflation Rate: It can also be used to calculate the rate of inflation which an organization bears corresponding different inputs. In a company, human capital cost, material cost, overheads cost, etc. keeps varying. There is a need to establish a trend so that future costs can be estimated.

- Cash Flow Projections: By making use of the record of inflow and outflow of cash, an organization prepares projections which determine the need of cash in the following period. It also reflects the thrust of expenditure and major source of earnings for an organization.

- SWOT Analysis: By using financial modeling, a company can find out its strengths &weaknesses. Furthermore, opportunities and threats can be found out by number crunching. The idea is to grab and polish the best along with preparing for and tackling the worst. Numbers convey more than words can ever do. So, a company relies on its financial analysts and their predictions.

- Cost of Capital: While investing in a new project, any company demands to understand its investor’s expectations. It helps the company to set standards and goals which it should meet without failure. Financial Modeling carries out analysis of returns expected, cost to be incurred, period of return generation, etc. before it invests its money in any project.

- Debt-Equity Ratio: A company has to make a choice between various sources of capital generation. A major choice remains between Debt and Equity. Since both the options serve the same purpose, there arises a need to weigh their suitability. By conducting a cost-benefit analysis using financial modeling, one can easily suggest which one the company should go for.

- Analysis of Financial Statements: The role of a charted accountant is limited to preparation and audit of financial statements. But, if he is a CFA, he can also analyze the financial statements; compare them with past records, with competitors, with companies of other nations and so on. Such an analysis is extremely beneficial for a company to plan its future actions.

- Predicting Financial Impacts: Financial Modeling helps in analyzing the impact that a company’s policy will have on its sales, production, growth, customer base, employee satisfaction, etc. It enables an organization to understand pre-hand, the consequences of any policy that it is planning to implement. Any policy should be shown a green flag only after it is ascertained that its returns exceed its cost.

Conclusion

It can be realized that a financial model is the most important tool in hands of a financial analyst. It is neither convenient nor affordable to carry out manual calculations to arrive at any financial decision. It takes plenty of time, effort and money, whereas, by converting the entire business problem into a financial model, one can reach conclusions in no time. It requires only a few clicks to direct the right path to a company. Thus, financial modelling can be used to:

- Build scenarios, to plan in advance

- Predict performance, to reflect a picture to stakeholders

- Compare ratios, to suggest alterations

- Introspect, to find out strengths and weaknesses

- Ascertain Fund Requirement, to avoid delay or shortage

- Identify Trends, to move accordingly

- Value firms, to invest in the right ones

- Predict returns, to ensure safety