Goods and service tax (GST)

The GST is a new concept that simplifies the giant tax structure by supporting and enhancing the economic growth of a country. It is a comprehensive term levy on manufacturing, sale and consumption of goods and service at a national level.

Goods and service tax bill or GST also referred to as the constitution (one hundred and twenty-second Amendment) bill 2014 initiate a value added tax to be implemented on national level. In India, GST will be an indirect tax at all the stages of production to bring about uniformity in the system.

On bringing GST in practices, there would be amalgamation of the central and state taxes as well as enhance the position of India in both domestic as well as international market. Consumer level, the GST would reduce the tax burden which is now estimated at 25.30%.

In order to avoid the payment of multiplexes, such as excise duty and services tax at central level an VAT at state level, GST would unify these taxes and create a uniform market throughout the country.

Benefits of GST

- It would introduce two-tiered one country one tax regime.

- Will subsume all indirect tax at the centre and state level.

- Widen the tax regime by covering goods and services but also make it transparent.

- Free the manufacturing sector from cascading effects of taxes, thus by improve the cost and competitiveness of goods and services.

- Bring down the prices of goods and services and thereby increase consumption.

- Enhance the ease of doing business in India.

There appears to certain loopholes in the proposed GST tax regime, which may be detrimental in delivering the desired result. They are:-

- India has adopted dual GST instead of national GST.

- It has made the entire structure of GST fairly complicated.

- The centre needs to coordinate with twinty nine states and seven union territories to implement such tax regime. Such regime is likely to create economics as well as political issues.

The proposed GST bill is likely to achieve if the country has a strong IT network. The proposed regime seems ignore the emerging sector of the E-commerce. It does not learn any sign of the transaction outside the internet. As a result, it become almost impossible to truth the business transaction that is taking place through internet, it can be business to business, business to customer and customer to customer.

New techniques can be developed to track such transaction but until such technologies become readily workable, generation tax revenue from this sector would continue to be uncertain and must below the expectation.

GST will change the way of India

Indirect taxes in India have been driven businesses to restructure and model their supply chain and system owing to multiplicity of taxes and cost Involved. With hopes that the goods and service tax (GST) will see the light of the day, the way India does business will change forever.

- Total tax collection in India (both direct and indirect) currently stands at rupees 14.6 lac crore, of which almost 34% comprise indirect taxes with rupees 2.8 lac crore coming from excise are rupees 2.1 lac crore from service tax.

In developing countries indirect tax comprises a higher share of total taxes. But in developed countries their contribution is low. For example, Australia, indirect tax contribute is expected just 13% of tax collection.

After GST the percentage of indirect tax is expected to increase to India.

GST objectives

- Ensuring availability of input credit across the value chain.

- Minimizing cascading effects of taxation.

- Simplification of tax administration and compliances.

- Harmonization of tax base, laws across the country.

- Prevention of unhealthy competition among state.

- Increasing the tax base and raising the compliances.

Implementation Challenges in GST

- Lack of adaption

- Untrained staff, they need to be first trained on GST

- Double registration can increase cost

- No clear mechanism to control tax evasion

- Hard to estimate the exact impact of GST

GST Impact on inflation

Due to the implementation of GST, the tax rates on goods and services will decline. At present, service-oriented components constitutes 25.30%of the CPI basket with a major share belonging to housing, transport and communication. Services tax is net imposed on certain services and these services are expectedly remain exempt under GST.

A hike in tax rate on services will not be having any material direct impact on CPI. Hence, the overall transition to GST will not have a significant impact on inflation.

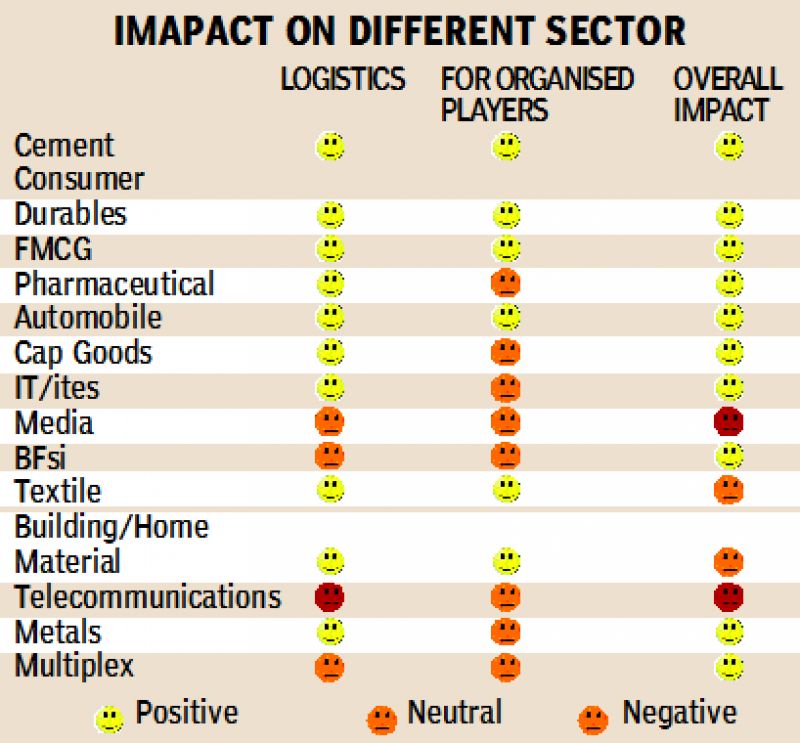

Sector wise impact on GST

Automobiles

The effective tax rate in the sector currently ranges between 30-47%.

Highlights:-

- Implementation of GST is expected to range between 20-22%.

- It is expected to drive the overall demand and reduce cost by 10%

- The transportation cost and the overall cost will be reduced as the goods will be transferred from one state to another by passing easily various Octroi and check points.

Impact on Autombile sector:-

In long run, GST is expected to remain positive for automobiles sectors.

Consumer durables

The current tax rate ranges between 7-30%

Highlights:-

- The implementation of GST will greatly benefit these companies, which have not availed tax exemption in the past.

- It will lead to reduce gap between organized and unorganized sector.

- The 7th pay commission is also expected to boost demand and inflow in the consumer durables sector by the end of the year.

Impact on Consumer durables:-

The impact may remains neutral or negative, specifically for companies which either enjoys tax exemption or fall under the tax.

Furnishing and home decor

Currently, the effective tax rate for the sector ranges above 20%.

Highlights:-

- After the implementation of GST, paints and other construction chemicals companies will benefit from lower tax rate.

- At present, the market share for the organized sector is a about 65-70%.

- Effective tax correction practices under the GST regime will ensure that the price difference among the organized and unorganized sector is narrowed.

- This will improve opportunities for organization.

- The overall cost and competitiveness in products such as like ceramics tiles, faucets, sanitary ware and plywood will be curbed.

Impact on furnishing and home decor:-

Implementation of GST is expected to bring the unorganized Sector under a uniform tax base and improve growth opportunities for the organized sector.

Key beneficiaries: Asian paints, Berger paint, Kansai Nerolac, Pidilite, Greenply, H&R Johnson, Kajaria Ceramics.

Logistics

- Implementation of GST will lead to cover transit time and thereby generate higher truck utilization.

- This will boost demand for high trucks and leads to overall reduction in transportation cost.

Impact:-

The logistics sector is largely fragmented and comprises unorganized players. Several player in the unorganized sector avoid tax which generates a cost between them and the organized players.

With the GST bill coming into the picture, we except an overall positive impact with a reduction in the cist competitiveness as all the players will be brought under a uniform tax base, thereby improving growth opportunities for the organized player.

Key Beneficiaries- VRL logistics, Transport Corporation of India.

Cement

Tax rate ranges from 27-32%

Highlights:-

- The tax rate for the cement sector is expected to decline to 18-20% under the GST regime

- This is expected to lead to saving in the transportation cost which currently comprises upto 20% to 25% of the total revenue.

Impact:-

The impact of GST will be positive as companies will be able to save cost, due to warehouse and lower transportation costs due to decline transit time.

Key Beneficiaries- ACC, Ultratech, JK cement, Shree cement.

Entertainment

We have divided in two main category, that is, mutliplexes and media. We expect a significant impact on both the sector after implementation of GST. This category attracts different faces such as service tax, entertainment tax, VAT and effective ranges lies between 22-24%.

Highlights:-

- It is expected GST tax rate will trickle down to 18% to 20%

- Reduction in taxes will leads to an increase in average ticket price(ATP) and higher revenues

- No credit is available on taxes paid on capital expenditure.

- Entertainment tax rate on box office collection ranges between 22-27% and same is nit convertible against any taxes.

Impact:-

Overall impact is expected to be positive

Key Beneficiaries- PVR, Inox leisure

Media

Currently, the effective tax rate of the DYH provides ranger between 20-21% (includes services tax 14% and entertainment tax rate 5-7%.)

The effective tax rate ranges between 14-15%

Impact:-

Implementation of GST will be healthy for the DTH providers and the board caster

Key Beneficiaries- DISH TV Marginally negative- Zee, Sun, HT media, Jagran Prakashan

Textiles/Garments

Effective tax rate ranges between 6-7%

Highlights:-

- Under the GST regime, there is no clarity whether a lower rate will continue for the readymade garments.

- Companies may be negatively impacted increase the output as tax rate is high

- Several export company may also avail duty drawback benefit.

Key Beneficiaries- Arvind , Raymond , page industries

Pharma

The sector enjoys various location based tax incentives. The effective tax rate (excise duty) for most companies is much below the statutory tax rate 16%.

Highlights:-

- The existing tax exemption will continue until expiry of the tax expected period.

- GST is also expected to address invested duty structure and lower logistics cost of the sector.

Impact:-

It is expected remain neutral or negative for the pharmaceutical sector.

IT & ITES

Currently, the IT industry is subject to an effective tax rate of 14%.

Highlights:-

- The tax rate under GST is expected to increase to 18.20%.

- The industry earns a large part of revenue from exports which will continue to exempt under GST

It is expected to range from being neutral to slightly negative.

Telecom

Currently, telecommunication services are subject to servive tax of 14%.

Highlights:-

- The tax rate is expected to 9% to 18% under GST

- It is expected that telecom operators may pass the increased tax burden on postpaid subscribers

Impact:-

Increase in effective tax rate may be marginally negative for Telecom. Telecommunication companies may not be able to pass on all the increase in taxes to all the end consumers.

Metal

Currently, effective tax rate for base metal products is 19 to 21%.

- VAT ranges from 4-5% depending on state.

- Excise 12.5% CST 2% and entry taxes in respective state.

Impact:-

Under GST, it is not known whether the metal products will attracts a special rate that is lower than the standard GST rate.

Banking and financial services

Currently, the effective tax rate is 14% which is levied only on fee component of the transaction.

Highlights:-

- Under GST, effective tax rate on fee based transaction is expected to increase to18%-20%

- As the taxes on the input services will increase, operating expenses(comprising of rent, legal and professional fee, advertisement increase, telecommunication other expense.) will also increase.

Impact:-

With the implementation of GST on moderate increase in the cost of financial services such as loan processing fees, credit/debit card charges, insurance premium is expected.

Positive impact of GST

- A unified tax system removing a bundle of indirect tax like VAT, CST, service tax, CAD,SAD, Excise tax.

- Less tax compliances and a simplified tax policy as compared to earlier tax structure.

- Removes cascading effects of taxes.

- Due to lower burden of taxes, a manufacturing sector, the cost will be ultimately reduced, prices of consumer goods will come down

- Due to reduced cost some products like cars will become cheaper.

- Common man will be having lower burden of tax

- Low prices increase the demand and consumption of goods.

- Increased production will leads to job opportunities in the long run. But this can happen only if consumer actually get cheaper goods

- It will curb circulation of black money

- A unified tax regime will lead to less corruption which will indirectly effects the common man

- Most importantly, GST will help to boost the Indian economy in the long run.

Negative impacts of GST

- Service tax rate 15% is presenting charged on the services, so, if GST is introduced at a higher rate which is likely to be seen in near future, the cost of services will rise. In simple words, all the services like telecom,, banking, airlines, etc will become expensive.

- Increased cost of services means an add to your monthly expenses.

- You will have to reschedule your budget to bear additional tax

- Increase in inflation might be seen initially

- Being a new tax, it will take some time for the people to understand it completely, its actual implications can be seen only when the rate of tax is determined.

- If the actual benefit is not passed to consumer hand then the seller increase his profit margin, the prices of goods can also see a rising trend.

- Although a large number of officers are being trained and a systematic software is being developed for the successful implementation of GST.

- But it will take some time for the people including the manufacturer, the wholesaler, the retailer or the final consumer to understand the whole process and apply it correctly

CONCLUSION

However, GST is a long term strategy planned by government and its positive impacts will be seen in the long run only. Also, this can happen if GST is introduced at nominal rate to reduce overall tax burden.

Get a complete course on GST (goods and services tax) and become a Certified GST Professionals

Post Written By Hardeep Kaur (Vskills Intern) SPM College, Delhi University

1 Comment. Leave new

Thank you so much to vskills internship