A debt instrument issued for a period of more than one year with the purpose of raising capital by borrowing is called Bond.Bond is a way of financing the operations of a company.The federal governments, states, cities, corporation, and many other types of institutions sell bonds.Major issuers of bonds are governments of countries(Treasure bond in U.S., Gilts in U.K., Bunds in Germany).Bonds could be categorized as short term bonds, medium term bonds and long term bonds.Short term bonds have a maturity period of up to 5 years.medium term bonds have 5 to 15 years of maturity period and long term bonds have a maturity period of over 15 years.

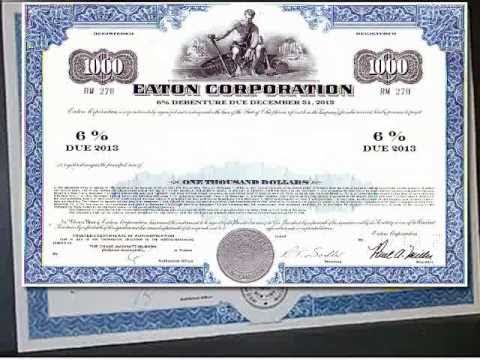

Corporate as well as government bonds vary very considerably in terms of their risk.Some corporate bonds are secured against assets of the company that issued them, whereas other bonds are unsecured.Bonds secured on the assets of the issuing company are known as debentures.Bonds that are not secured are known as unsecured bonds.The fact that unsecured bonds do not provide their holders with a claim on the assets of the issuing firm in the event of default is normally compensated for by means of a higher rate of coupon payment.

U.S. treasury bonds are generally considered as the safest unsecured bonds, since the possibility of the treasury defaulting on payments is almost zero.A riskier bond has to provide higher payout to compensate for that additional risk.Some bonds are tax-exempt, and these are typically issued by municipal,country or state governments.

Characteristics of Bonds or Bond Terms:

Principal amount– The total investment made by a bond holder on the bond.

Number of years of maturity– it could range from 1 year to 20 years or more.

Contract interest rate– It refers to the interests on the bonds based on the contract, the same is printed on the bond.

Market interest rate– It refers to the interest rate prevailing in the market.

Interest payment schedule– The bonds could be annual, semi-annual, quarterly or monthly.

Types of Bonds:

Corporate Bonds- It is a bond issued by a corporation to raise money effectively to expand its business.

Government Bonds- It is a bond issued by the central government , generally with a promise to pay periodic interest payments and to repay the face value on the maturity.

Zero-Coupon Bonds- It is a bond bought at a price lower than its face value(issued at a discount), with the face value repaid at the time of maturity.It does not make periodic interest payments.

Junk Bonds- These are unsecured bonds from issuers with a poor credit rating, which affects the probability of repayment of bonds.

Convertible Bonds- It is a type of bond that a holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value.These are most often issued by companies with a low credit rating and high growth potential.

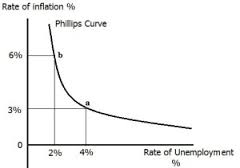

Inflation Indexed Bonds- These are the bonds, where the principal is indexed to inflation.In these bonds rate of return is higher than the prevailing inflation.

Foreign Currency Bonds- These bonds are issued by governments, companies and large corporate entities in a foreign country to raise capital.These are basically, issued to take advantage of interest rate differences between countries.

Perpetual Bonds- It is a bond with no maturity date.It may be treated as equity but not as debt.issuers pay coupons on perpetual bond forever, and they do not have to redeem the principal.

Deferred Bonds- These bonds pay interest only upon maturity.Unlike most of the bonds, a deferred bond does not make periodic or coupon payments over its lifetime.

Callable Bonds- A bond that can be redeemed by the issuer prior to its maturity.usually, a premium is paid to the bond owner when the bond is called.The primary reason that companies issue callable bonds is to protect them in the event when interest rate drops.

Puttable Bonds- It is a bond with an option to return it to the issuer before maturity.The holder of the puttable bond has the right, but not the obligation to demand early repayment of the principal.

Click here for government certification in Accounting, Banking & Finance

33 Comments. Leave new

nice article

Thanks vinny!

Thanks soham!

nice

Put up in a very simple manner!

Thanks Vinita!

Well explained

Thanks ria!

Informative

Thanks surya!

well explained

Well explained!

Thanks megha!

So easily u explained….. Good job

Thanks Monika!

Well explained..

Thanks stephy!

Informative Article . Good Work

Thanks ani1!

Bonds are very important and should be present to have a balances portfolio

yeah, true!

well explained article with use of simple language.

thanks sunaina!

Very informative

thanks akansha1

Short and effective

thanks shubhral!

Nice but you have to add more information..

Yeah,but this forum has certain limits!

Great article.

Thanks akul!

Compiled it well, Aman!

very nicely explained with the help of points