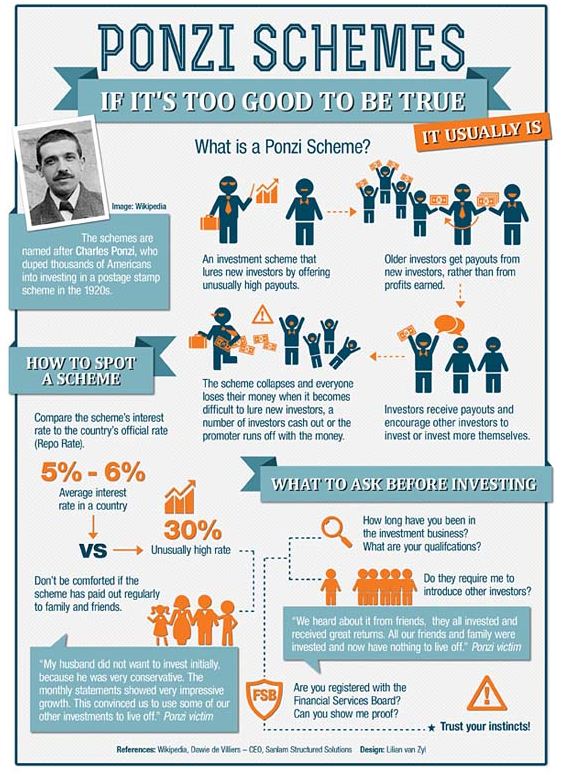

Ponzi Scheme was named after Charles Ponzi who was able to spread his operation all over the US. However it had an existence way before him. A Ponzi Scheme is a fraudulent operation by an individual or organization where the operator pays returns to its current investors form the capital of new investors rather than from the returns of investments.These companies usually offer higher returns than normal to retain and attract new investors.The returns are abnormally high or abnormally consistent.People hence should be conscious while investing money into organisations which provides returns which are too good to be true.

Ponzi schemes usually begin as a legitimate business.When businesses fails to achieve the promised high or expected returns ,incurs unexpected loss of money or fails to legitimately earn returns such a business becomes a Ponzi scheme if it chooses to continues under fraudulent terms .It is usually done by misrepresenting the audit reports and fabricating false returns.

These operations use classy and professional sounding words and names to miss- guide and take advantage of the general population.They may call themselves hedge funds or offshore investment companies who claim to have investment strategy which provides them leverage that requires to be kept secret to have an competitive edge in the industry.

The promoters of these schemes usually pay out the high returns promised to attract investment and lure prospective investors.The pay-out validates the scheme and influences people think that the scheme is a valid but in reality it is a plan of the promoters to make the population believe that the company can attract,retain and lock in capital of investors for a longer duration of time.

Eventually there wont be enough money and Ponzi schemes do get exposed .Majority of the investors suffer highly from them, few of the initial investors stand to win if they have already withdrawn or received their investments as returns.These schemes gets exposed when one of the following happens:

- Promoters run away with the remaining investment money taken from its investors

- If the stream of new investment are slow due to any economic,political or other reasons the have scheme collapses as they have problems paying the promised returns to investors.

Please be aware of schemes that are too good to be true as they might be fraudulent.The schemers can be well established companies using a very low risk instrument also.Allen Stanford used these scheme to get $7 billion in certificates of deposits,which was considered to be quite safe.Bernie Madoff was able to pull the largest financial fraud in US history and has been punished with 110 years of life imprisonment.

Click here for government certification in Accounting, Banking & Finance

4 Comments. Leave new

Informative and well explained.!!

Well explained!

Informative 🙂

informative.. loved reading it