The payoff concerned with options different from that of conventional securities like common stock or shares, where the payoff is the difference between the selling price and the purchase price. Options, however, were introduced with a view of minimizing losses, or we can say as a mode of diversifying risk. Always, the buyer of the options limits his risk to a maximum of the amount of premium that he has paid to acquire the option.

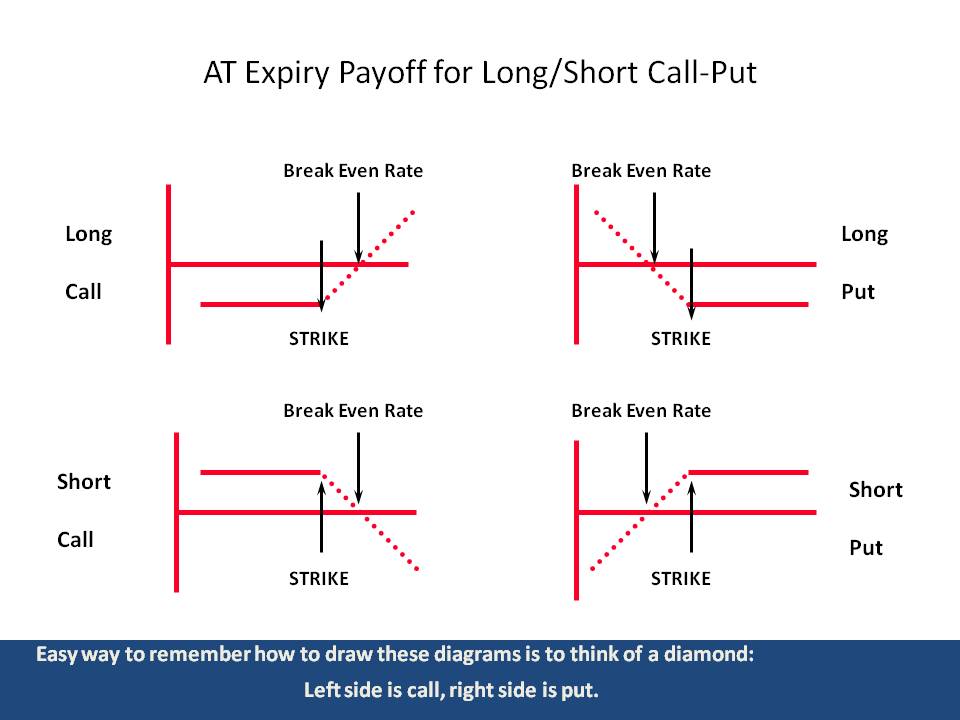

Suppose the case of Rohan and Rajiv, as in the previous discussion. In case of call options, Rohan was the writer of the contract. In case the prices of cabbage were to rise to Rs. 125 level, Rohan would have to incur a loss of Rs. 20, Rs. 50 if the prices touch Rs. 155 level and so on. The losses that are possible for Rohan are unlimited, while the maximum amount Rajiv stands to lose is the amount of his premium. Thus, his losses are limited while Rohan’s profits are limited (to the amount of premium).

Similarly, it goes for put options as well. The writer of the put option stands to lose unlimited amounts while his profit is limited. At the same time, the buyer of the call option is secured with a possibility of unlimited gains and losses limited to an amount equal to the premium.

In a way, the buyer of an option is buying an insurance against the price movement of the underlying. A person who anticipates a fall in the prices of an underlying shall buy put options while the bullish trader shall purchase call options.

Now, when we trade in options, we are actually trading in the premiums of the options. Recall the definition of derivatives: An instrument which derives its value from the value of the underlying. The value of the underlying is the actual value of the stock/index/currency, and the value of the option is the value of the premium, which comprises of time value as well as intrinsic value. Also, remember that when we are talking about options here, we refer to American options, i.e. options that can be exercised any time till the date of expiry, unless otherwise stated.

Gradually, over the course of these articles, we shall bring the concepts of options together with the ground realities of the Indian Derivatives market. Since, we are now adept with the basic terms and mechanism of the options markets, we shall delve into the market straightaway in the next article.

8 Comments. Leave new

nice article.

nice and informative….i like the way u use examples in ur articles!! i have read the earlier one as well…great effort

Good article

Nice article.

Concept of option payoff is excellent..!

nice article. thanks for sharing such an informative piece of work.

Nice article.. Infomative too :O

very informative 🙂

liked it !

very well explained with the help of examples 🙂