The idea was not new but official term for this curve was coined by Jude Wanniski in 1978. Once on a dinner with Arthur Laffer who on a napkin sketched the curve explaining the relationship between the Tax rates and tax revnues. But he himself said that the curve was introduced back in 14th century by a Muslim philosopher Ibn Khaldin in “The Mugaddimah” which says larger tax revenues with lower tax rates and smaller the revenues with larger tax rates

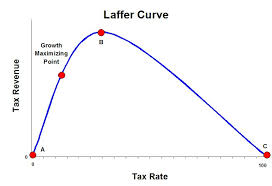

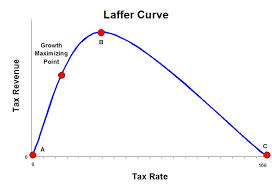

The idea says, the government won’t be able to collect any revenues if the tax rates are 0% i.e the point A in the graph but neither government will collect any revenue when the tax rates are 100% afterall who will work if the government seizes all the wealth earned by the people. But certainly there will be a tax rate (i.e point B) which maximizes the tax revenue. Any point in between A and B there will be an increase in tax revnue with increase in tax rate, but increase in tax revenue will be at a decreasing rate. Beyond B any point between B and C, as the tax rates increases the amount of tax revnue decreases. Beacause now there is less incentive to work, and people try to hide their money from the government.

Laffer curve was one of the main reason of revolution in the Supply Side.

Laffer curve has two effects on revnues: One is the Arithmetic Effect which is purely static and says if rates are lowered, revenues will decrease and if tax rates increases so will the revenues . But it has an Economics effect as well which says there will be a positive impact that is if the tax rates are lower people haved more incentive to work and earn and hence more taxable income would be there and larger revenues will be generated.

One of the most important point to make here is that Laffer curve does not say whether a tax cut will raise or lower revenues nor it predicts that reduction in tax rates would increase total revnues, what it actually concludes is that lower tax rates will result in smaller loss in revenues.

This theory has never been confirmed by facts, but there were events which proved the theory to be correct like during the Reagan years and when Reagan left tax rates where slashed down to 28% from 70% and there was a substanial increase in tax revenues.

Laffer concluded in the end that “if you tax something you get less and if you tax something less you will get more.”

11 Comments. Leave new

Nicely explained!!

Nice work

Good article

Very well written. nice!

KEEP IT UP.

Unique and informative!!

Explained well..

Good effort! I really liked it

good work !

very informative and very well written 🙂

great one

Nice work!