Do you have an interest in becoming a financial risk manager? Then there’s never been a more crucial time to stand out. As the financial industry is growing very rapidly with the professionals validating their ability to add value to an organization. Moreover, getting certified as a financial risk manager will prove that your knowledge and skills are up to the latest international standards. In addition, it will help you connect you with the best network of expert risk professionals. In this article, you will learn about the basic details and other important things that will guide you to become FRM.

Understanding the role of Financial Risk Manager

Financial Risk Manager refers to a professional having specialized knowledge in assessing risk and typically work for major banks, insurance companies, accounting firms, regulatory agencies, and asset management firms. Moreover, an FRM also identifies the threats to assets, earning capacity, or the success of an organization. They mainly work in financial services, banking, loan origination, trading, or marketing with a specialization in areas like credit or market risk. FRMs determine the risk by analyzing financial markets and the global environment to predict changes or trends. And, it is the duty of FRM to develop strategies to prevent the effects of potential risks.

What does a Financial Risk Manager do?

The basic role of a financial risk manager is to identify and analyze the threats to the assets, earning capacity, or success of a business. Moreover, they work in sales, loan origination, trading, marketing, financial services, or private banking. Where, they analyze the data, financial markets, and world events to forecast changes and trends that can impact a business. They also suggest or implement strategies for protection.

Financial Risk Manager (FRM): Certification Overview

The Financial Risk Manager Exam covers the basic application of risk management tools and techniques for the investment management process. In the exam, you will deal with the questions of practical knowledge and related to real-world work experiences. Moreover, for this exam, the candidates should understand the concepts of risk management and approaches as they would apply to a risk manager’s day-to-day activities. However, the exam will test your knowledge about the tools used for assessing the financial risks that include quantitative analysis, fundamental risk management concepts, financial markets and products, and risk models.

Most importantly, the FRM exam is divided into two parts FRM exam one and FRM exam 2.

Prerequisite for FRM

To get certified as Financial Risk Manager you have to pass the FRM Exam Part I & II with having a minimum of two years of risk-related full-time professional experience in positions that include portfolio management, risk consulting, and other fields. Below, we will understand the prerequisite more accurately.

FRM Part I Exam

Passing the FRM Exam Part I is the first step for a candidate to become a Certified Financial Risk Manager. However, the candidates are expected to have knowledge and understanding about the risk management concepts and theories as they apply to a risk manager’s daily work. Moreover, the Part I exam mainly focuses on the essential tools and concepts required for assessing financial risk. In this exam, you will get 100 multiple choice questions that have to be completed within the duration of 4 Hours.

Coming on to the part 2 exam.

FRM Part II Exam

The Financial Risk Manager Exam Part II is the second exam that a candidate has to pass to become a certified FRM. The FRM Exam Part II focuses on the applications of risk management tools that are covered in Part I including the specific areas of risk management like credit risk and operational risk. In this exam, there will be 80 multiple choice questions to be completed within the duration of 4 Hours.

Next is the important requirement to get two years of experience.

Get Two Years of Experience

The final step for the FRM exam is demonstrating that you’ve had at least two years of full-time work experience in the field of risk. However, the Finance-related positions are the only ones considered as acceptable work experience that include portfolio management, industry research, trading, and risk consulting. Moreover, to validate this experience, you have to describe your professional role in FRM in at least five sentences and submit within five years of passing Part II of the FRM exam. After submission, a confirmation will be provided that you are a certified FRM holder and have been included in its registry.

Important points for FRM

- Firstly, a candidate must demonstrate work experience by submitting a minimum of 4-5 sentences describing a professional role in the management of financial risk.

- Secondly, the work experience submitted cannot be more than 10 years prior to having passed the FRM Exam Part II.

- Thirdly, the designation of practitioners, academic teaching and research in areas relevant to financial risk management can be considered as relevant work experience.

- Lastly, a candidate has 5 years to submit his/her work experience after passing the FRM Exam Part II. And, candidates cannot use the FRM designation after their name in any manner until they have been certified.

Now, we have understood the prerequisites and basic requirements. In the next section, we will learn about the different ways of preparing for the exam.

Ways to Prepare for the FRM exam

Financial risk manager exam is considered as a practical oriented exam. That is to say, the questions will be both theories as well as real-world experience-based. So, candidates are required to have a good understanding of risk management concepts and approaches. Moreover, they should know the ways to apply this in day to day activities. Coming on to the exam, you all know you have to pass FRM part one and two exams to get the certification. So, to help you in preparation there is some material provided.

Learning Objectives

The FRM Learning Objectives document will provide you a comprehensive framework to help you in the self-study preparation for the FRM Exam. This contains information and weightings for each domain covered by the exam and individual learning objectives for each reading. However, the topics are divided into the exam.

Firstly, for FRM exam one some of the topics are,

- Firstly, the basic risk types, measurement, and management tools

- Secondly, creating value with risk management

- Thirdly, risk governance and corporate governance

- Fourthly, credit risk transfer mechanisms

- Then, capital Asset Pricing Model (CAPM) and risk-adjusted-performance measurement

- After that, data aggregation and risk reporting

- Lastly, financial disasters and risk management failures

And for FRM part 2 some of the topics include,

- Firstly, VaR and other risk measures

- Secondly, parametric and non-parametric methods of estimation

- Thirdly, backtesting VaR with expected shortfall (ES) and other coherent risk measures

- Then, extreme Value Theory (EVT) and modeling dependence

- Lastly, Term structure models of interest rates

Study Guide

The FRM Exam Study Guide contains the primary topics and required readings for exam preparation. Moreover, the FRM curriculum is revised annually to ensure that the FRM Exam remains a valid assessment of the knowledge and skills necessary to manage financial risk. However, to help you in preparation there are books provided for both FRM part 1 and 2 exams.

The books for the FRM Exam Part I:

- Firstly, Foundations of Risk Management

- Secondly, Quantitative Analysis

- Thirdly, Financial Markets and Products

- Lastly, Valuation and Risk Models.

The FRM Exam Part II books,

- Firstly, Market Risk Measurement and Management

- Secondly, Credit Risk Measurement and Management

- Then, Operational Risk and Resiliency

- Lastly, Liquidity and Treasury Risk Measurement and Management

Get Certified!

That to say, there are various training providers out there that provide online training to help you get certified as a Financial Risk Manager. There you will get good study material with the assistance of experts. This includes,

- Vskills- India’s Largest Certification Body

- Udemy

- Educba

- Simplilearn

Practice Exams

Practice exam tests play an important role during the preparation. As with good study material and information, you can understand the concepts but including practice test questions can get you perfection in it. To help candidates, there are various sources out there that provide free practice tests for FRM.

Financial Risk Managers: Industry Outlook

The employment of FRMs is expected to grow faster than the average for all occupations at 16% from 2018 to 2028. And, according to a survey, it has stated that FRM is expected to be in high demand over the next decade. This is the next most important part of the article to understand the things after getting the certification. So, first, let’s understand the job roles that you can apply for.

Top FRM Job Roles

Candidates who earn FRM designation typically hold positions that focus on analyzing and measuring risk. Some of the most common job roles for Certified FRMs includes:

- Firstly, Risk analyst. They use analytical skills and knowledge of international business and currency markets for examining the investment portfolios and then analyze the risk involved.

- Secondly, Risk manager. They help a business to identify and assess the potential risks that could affect it in the future. Moreover, they also zero potential threats to assets, earning capacity, or success.

- Then, Credit risk analyst. They evaluate financial history to determine if a person or a company is good for a loan.

- Fourthly, Market risk analyst. They are for providing companies or investors with a comprehensive market assessment to help them make decisions about future investments.

- After that, Regulatory risk analyst. Help in studying new and proposed laws to determine how they will affect a company or firm.

- Operational risk manager. It helps to investigate how an organization or business is run. Moreover, they fix or prepare for anything that might harm the company.

- Lastly, the Chief risk officer. They help in implementing policies at the senior executive level to reduce operational risks and minimize losses.

Top Companies

The companies which are looking FRm includes,

- ICBC

- Bank of China

- HSBC

- Agricultural Bank of China

- Citigroup

- KPMG

- Deutsche Bank

- Credit Suisse

- UBS

- PwC

Areas to work

Certified FRM candidates can work in any number of industries, including:

- Banks

- Investment banks

- Asset management firms

- Corporations (including non-financial corporations)

- Consulting firms

- Hedge funds

- Insurance firms

- Credit agencies

- Government/regulatory agencies

- Risk and technology vendors

Pay Scale

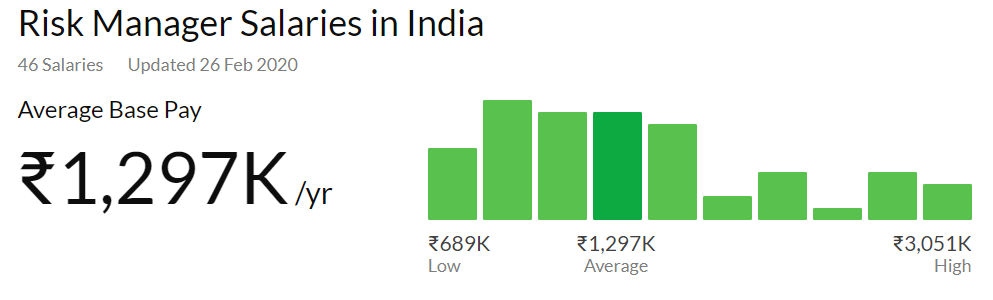

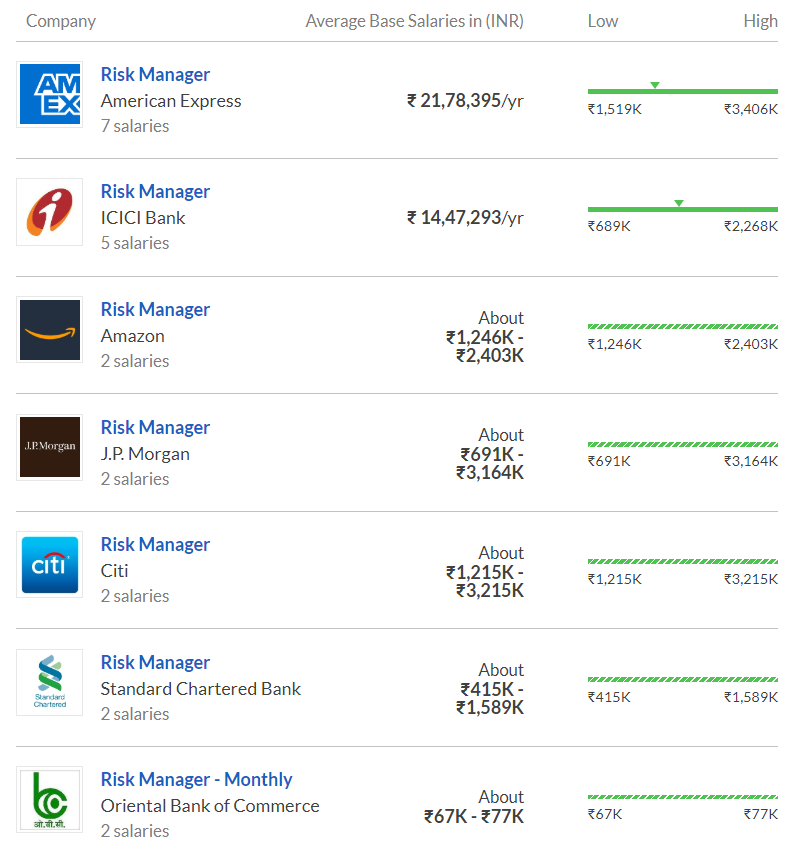

The average pay scale for a risk manager is ₹1,297K per year.

However, this varies from company to company. So, below you can see the table showing average salary companies wise.

Expert’s Corner

As the financial industry has shown good growth in the past years and is increasing at a good rate. Thus, certified FRMs are getting under the eyes of top companies and organizations. But, the one who succeeds has to prove that they have advanced skills according to the latest standards. Therefore, to get perfection in this field there is a need for hard work. That is to say, you have to prepare as well as get real-time experience to better understand the role of a financial risk manager. Prepare well for the exam and crack the certification.

All the best!

Learn and enhance your financial risk management skills. Become a Certified Financial Risk Manager Now!