Before learning deep about Equity Research, you need to understand the basic meaning of the word equity. Equity in simple terms represents the value that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debts were paid off. Furthermore, we can also think of equity as a degree of residual ownership in a firm or asset after subtracting all debts associated with that asset.

We all have heard about the Scam web series, based on the life of Harshad Mehta. He inspired many to go to market but never discussed his technique. The technique we are talking about is research. Research the fundamentals of the company. What if the technique used by Harshad Mehta before picking his stocks is also known as equity research in the modern world. What if you could also learn this? Well as per the Global Financial Literacy excellence center only 24% of the Indian population is financially literate. The financial literacy rate in India is the lowest.

Before getting deep into it, let us learn about what actucally Equity research means.

What is Equity research?

- The equity research analyst job includes monitoring the market data as well as the news reports. After that, they begin speaking to their contacts in the companies and organizations that they have been studying and following to update their research daily. New hires may work with a variety of analysts over months as a general introduction to the job. In the career of equity research analysts, individuals generally spend most of their time writing reports as well as they get involved in developing recommendations rather than spending their time on financial modeling.

- A senior equity research analyst who has got a high level of expertise in his or her area of specialty also has a choice of moving into an investment management role where one can do the job of overseeing a research team and an investment portfolio.

Role of an Equity Research Analyst

Now that you are well aware of what is equity research, the next question which comes to your mind will be what will I do as an Equity Research Analyst. We all listed all the roles and responsibilities below:

- An equity analyst is a professional who works in the financial security industry or popularly known as the securities industry.

- An equity analyst offers his or her services to investment firms (buy-side) as well as individuals or brokerage firms (sell-side) that sell products to the buy-side.

- In a sell-side firm, such as a brokerage or a bank, an equity research analyst’s job is to produce reports and recommendations for the firm’s sales agents. The information is important for the sales agent as then he or she can go on to use the information to sell investments to their clients and the general public.

- Equity research analysts’ job is to analyze the bits of financial information so that he or she can conduct analytic and strategic research. Research is a very vital part played by an equity research analyst. To meet several client needs, he or she provides support to the research teams of the organization one is working for.

- The job function of equity research analysts includes using the information that came from their research, equity research analysts then make reports based on their analysis of the financial statements they researched. Reporting helps the companies’ institutions or government make decisions in real-time, make choices, as well as schedule.

- Equity research analysts’ job is also to synthesize data to come up with new investment ideas and make recommendations about financial actions and decisions. An equity research analyst can help a consumer safeguard their wealth and reduce costs and charges to a minimal level.

Types of an Equity Research Analyst

The equity reseach analyst job is not only restricted to only this position. This tree has very long branches as well.

- Equity Research Associate: Most equity research analysts begin in entry-level research associate positions after completing bachelor’s degree programs. Research associates work under the direction of a senior equity research analyst who creates and conducts research and financial models.

- Equity Research Analyst: Equity research analysts analyze data to develop new investment techniques to make specific suggestions on financial decisions and choices. Equity research analysts are analyzing opportunities and threats in their research and assessments.

What are the skills and qualities required to become an Equity Research Analyst?

The equity research analyst skills requirement depends on the experience level of an individual in the field. If the candidate is a fresher, the employer wants a working knowledge of how to use Excel in equity calculations and knowledge of various equity-related concepts.

Equity research analyst skills required are as follows:

- Critical Thinking: Critical thinking is an important equity research analyst skill. This means the ability to use logic and reasoning for ascertaining the weaknesses and strengths of any problem. In the workplace, critical thinking skills should be developed.

- Problem Solving Ability: The candidate should possess decision-making and complex problem-solving skills in the career an equity research analyst. Even though the equity researcher works with a team, he/she often needs to think independently, be accountable and take self-motivated initiatives.

- Analytical Skills: An equity research analyst has to be strong in analytical ability. They need to draw out the story behind a company’s data, whether qualitative or quantitative. Strong analytical and reasoning skills are also one of the most important equity research analyst skills that aspiring students need to possess.

- Financial Knowledge: Big banks conduct their training programs and teach their upcoming batches everything from scratch. However, during lateral hiring or in the case of boutique firms that don’t have training resources, a candidate that knows the basics of financial analysis would have an edge over others. Associates are encouraged to invest in a CFA program (Most firms usually refund the exam fees if cleared in the first attempt).

- Communication Skills: An equity analyst must communicate well, at least in the written form to begin with. As he/she becomes an Analyst, apart from coming up with well-written reports with reasonable predictions, networking abilities also become important as he/she may have to do marketing events like arranging non-deal roadshows for their clients.

Career Path Progression for Equity Research Analyst

- Equity Research: The most obvious equity research analyst career path is to carry on doing what they know best. Equity research analysts and associates rise through the ranks to become AVPs, Directors, and managing directors. At each of these levels, the work gets progressively better, the hours get easier, and you get quite a decent bump in compensation.

- Trading analyst: Some equity research analysts’ job is to manage the private portfolios of high net worth individuals. This essentially means that you work for one or more rich people and manage their investments. The reason this may be preferable over other exit options is that you have a lot of flexibility in terms of the amount of workload that you want to take on. You can operate as your business entity rather than as a salaried employee.

- Fund Manager: As a fund manager, you use the same research skills to determine whether a security is worth investing in or not. The main difference is that rather than just looking at one single security at a time, you look at your entire portfolio and then do a relative analysis of which security to invest in.

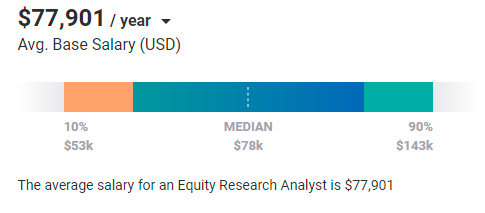

Average Salary of Equity Research Analyst

Yes, we understand that earnings and salary is the main reason why we work so hard. The amount you will earn depends upon your experience in this industry. On average, an equity research analyst earns just about $120,000 to $500,000. To add on, the amount earned here is not only restricted to the salary. Additionally, you can easily earn incentives, commissions, and bonuses on making an outstanding deal. Now that you know how lucrative the opportunities to become an Equity Research Analyst.

Vskills Certified Equity Research Analyst

The course focuses on developing the necessary skills for the purpose of advising investors and financial institutions to make profitable investment decisions in the capital market by providing a brief overview of the global markets and an understanding of the stock market movements. Furthermore, the certification assesses the candidate’s qualitative and quantitative skills for stock evaluation, analyzing and interpretation of annual reports and the basic techniques of valuation. Last but not least, Vskills certified candidates in Equity research will find employment in companies like Religare Securities Ltd, ICICI Direct, Aditya Birla Money Ltd, Kotak Securities Limited, HDFC Securities Limited, India Infoline Services.

Benefits of the Certification

- First of all, you will be getting a Government Certification

- The Certification is valid for life

- Candidates will get lifelong e-learning access.

- The best part is that you will get access to free Practice Tests.

- Last but not least, candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine Shine.com.

Concepts covered

- Economic Analysis

- Corporate Finance

- Industry Analysis

- Company Analysis Valuation

- Modelling

Start preparing to become an Certified Equity Research Analyst

To help you in your preparation, we have prepared a guide to which you can refer to. Furthermore, following this preparation guide will help you learn and understand every exam’s objectives. Here we are providing you with the best learning resources to qualify for the exam. Moreover, here we are going to illustrate a detailed description to help you prepare for the exam. Let’s start with expert learning resources and a study guide.

Books for Reference

Reference Books can provide an advantage to learn and understand things more accurately. For the Certified Equity Research Analyst exam, there are various books available which you can find online or in libraries. Some of the books are as follows:

- Financial Modeling for Equity Research: A Step‑By‑Step Guide to Earnings by John Moschella CFA CPA

Join a Study Group

It is very important to interact with people who have a common aim in life. Joining study groups is a good way to get yourself fully involved with the certification exam you applied for. Furthermore, these groups will help you get up to date with the latest changes or any update happening exam. Also, these groups contain both beginners as well as professionals. Furthermore, these groups will help you get up to date with the latest changes or any update happening exam. Also, these groups contain both beginners as well as professionals. Moreover, This is a nice way for the students to discuss their issues.

E-Learning and Study Materials

Learning for the exam can be fun if you have the right set of resources matching your way of studying. Vskills offers you its E-Learning Study Material to supplement your learning experience and exam preparation. This online learning material is available for a lifetime and is updated regularly. You can also get the hardcopy for this material, so, you can prefer either way in which you are comfortable. Furthermore, you can refer, Vskills Certified Equity Research Analyst online tutorials as well. Start your preparations with free practice test papers!