GST Return Process | When to file GST Return

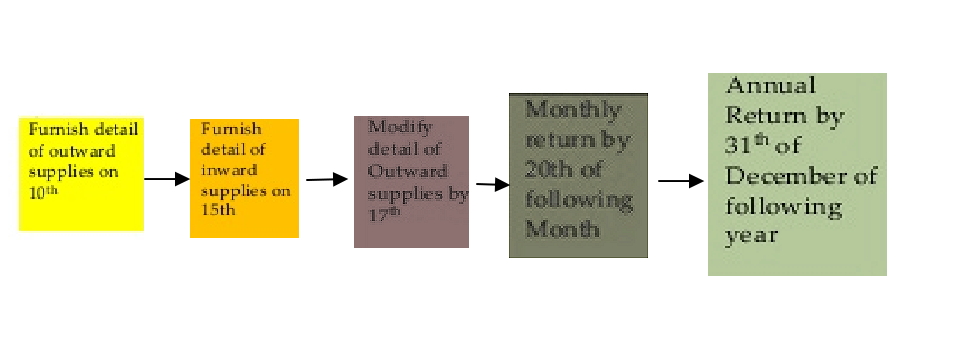

Steps for Filing GST Return

- Step 1: The taxpayer will upload the final GSTR-1 (Outward supplies made by a taxpayer other than compounding taxpayer and ISD) return form either directly through data entry in the GST Common Portal or by uploading the file containing the said GSTR-1 return form through Apps by the 10th day succeeding the month.

- Step 2: GST Common Portal (GSTN) will be auto-generated in the provisional GSTR-2 of a taxpayer.

- Step 3: Purchasing taxpayer will have to either accept, reject or modify that provisional GSTR-2.

- Step 4: Purchasing taxpayer shall be able to add additional purchase invoice details in his GSTR-2 which have not been uploaded by the supplier as mentioned in Step 1&2, to ensure the valid invoice issued by the supplier and receiving of supplies.

- Step 5: Taxpayers will have the option to do reconciliation of inward supplies with suppliers during the next 7 days by following up with their counter-party taxpayers for any missing supply invoices in the GSTR-1 of the suppliers.

- Step 6: Taxpayers will finalize their GSTR-1 and GSTR-2 return.

- Step 7: Taxpayers will pay the amount as shown in the draft GSTR-3 (Monthly return other than compounding taxpayer and ISD) return generated automatically generated at the online Portal Post Finalization of activities mentioned above in Step 6.

- Step 8: Taxpayer will debit the both ITC, cash ledger, and mention the debit entry number in the GSTR-3 return and would submit the same.

Professionals, tax consultants, accountants can use the below links to be updated on Goods and Services Tax