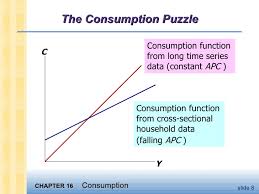

Earlier without any sophisticated techniques of data analysis, without the help of computers the analysis of consumption function was not that easy, though to analyse aggregate data on the overall economy was tough it was not impossile for few economists. One of the very first theory on consumption was given by Johnn Maynard Keynes. Keynes gave 3 conjectures about consumption function. First that Marginal proprnsity to consume is between 0 and 1 . Second Keynes said that average propensity to consume i.e the ratio of consumption to income falls as income rises and third income was the primary determinant of consumption and interest rate doesn’t have that an important role. When studies were conducted on the basis of these 3 conjuctures reasearchers found that Keynes theory did hold but only for short run. In long run Keynes 2 conjectures that APC falls as income rises and income was the primary determinant for consumption didn’t hold. When Simon Kuznets assembled the data on consumption and income dating back to 1869, Kuznets analysis indicated that the APC is fairly constant over long period of time. This fact presented a PUZZLE that motivated much research in cnsumption.

Economists wanted to know why some studies supported or confirmed Keynes’s conjectures and other refuted them. To solve this puzzle two economists Franco Modigliani and Milton Friedman have two Hypothesis “Life cycle Hypothesis” and “Permanent Income Hypothesis” respectively to solve consumption puzzle.

Franco Modigliani gave “Life Cycle Hypothesis” which says any individual with wealth w and expect to earn an income Y till she retires R , the consumer will divide up her lifetime resources among T remaining years of life and wish to achieve smooth consumption. On the basis of this hypothesis Modigliani solved the puzzle by putting forward the argument that; because wealth doesn’t vary proportionally with income from person to person or from year to year we should find that high income corresponds to a low average propensity to consume, when looking at data across individual over short periods of time. But over long periods of time , wealth and income grow together which results W/Y ratio to be constant.

According to Friedman, the solution to the consumption puzzle was that according to Permanent Income Hypothesis (where consumption depends only on the permanent income of the consumer). APC depends only on the ratio of permanent income to current income. When current income temporarily rises above permanent income APC falls, when current income falls below permanent income APC temporarily rises. Which says Keynes should have used Permanent income variable to calculate APC instead cureent income.

19 Comments. Leave new

Good article.

well defined!

nice 🙂

Interesting article with a even more interesting heading! nice work 🙂

Great job (y)

Do the rich save more or do they spend more? An important puzzle well explained in this article.

Good to know you are interested in politics prachi!

Great job:D

Very well written.

explanation is really good

well explained and interesting! nice heading too!!… Good job 🙂

Well executed. 🙂

So interesting and informative too! 🙂

Nice topic.

nice.

good one 🙂

Really helpful! nice work

well researched

good effort!

Unique