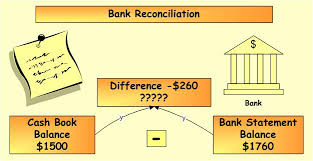

Bank reconciliation statement is a statement which reconciles the bank balance as per cash book with the balance as per bank pass book.There should be no difference between the balance shown by the pass book and the cash book.It is possible that on a particular date balances on both the books do not match, that is, some entries may have been recorded in the cash book but not in the pass book.So efforts are made for their reconciliation.

This reconciliation is prepared and presented in the form of a statement which is known as bank reconciliation statement.The need for reconciliation arises only when there are differences in entries posted in cash book and pass book which in turn leads to difference in balances in the pass book and the cash book.Bank reconciliation statement is a very important tool for internal control of cash flows.It also helps in detecting errors,frauds occurred at the time of passing entries in the respective books.Sometimes,it may happen that the balance shown by pass book and cash book is same but the entries posted do not tally with each other.Here,there is no need of preparing bank reconciliation statement.The differences in the balances of both the books can be because of the following reasons are timing differences and differences arising due to errors in recording the entries.

Under timing difference,the same entry is recorded in either of the book earlier and in the other book later.Here are the few examples of timing differences are as- cheque issued but not presented for payment,interest allowed by bank,direct payment into the bank by a customer and so on.In the above mentioned examples transactions are not recorded at the same time.Under differences arising due to errors in recording the entries,errors can occur both in the cash book and the pass book while recording the entries.Errors include omission of entry,wrong recording of amount,recording of entry on wrong side of the book.However,bank reconciliation statement works as an important mechanism of internal control.Also it helps in finding out the actual position of the bank balance.

Click here for government certification in Accounting, Banking & Finance

11 Comments. Leave new

Good efforts. The article explains the basic concept and has indeed made things simpler for those who wish to enter this field.

Thanks

Nice article..!

Thanks

Nice article

Thanks

Aptly explained.good article

Thanks

Informative!

Got something new to read 😀

GOod work 😀

Nice work