There are numerous regulations for businesses to navigate when it comes to compliance. Anti-money laundering (AML) regulations are mandated by national and international authorities worldwide, and financial institutions are subject to a wide range of screening and monitoring obligations. These AML obligations include the Know Your Customer (KYC) process, which allows businesses to identify and understand their customers’ financial behavior. You might be curious about AML KYC Analyst salaries and career opportunities in India. Let us walk you through it!

AML KYC Analyst Compensation

AML KYC Analyst salaries in India range from 2.4 Lakhs to 7.0 Lakhs per year, with an average annual salary of 3.9 Lakhs. As an entry-level analyst, you may be responsible for research and analysis tasks related to due diligence. Some of the duties could include:

- Identification, verification, and screening of customers

- ensuring high-quality standards for KYC reviews

- Bringing suspicious transactions to the attention of senior management

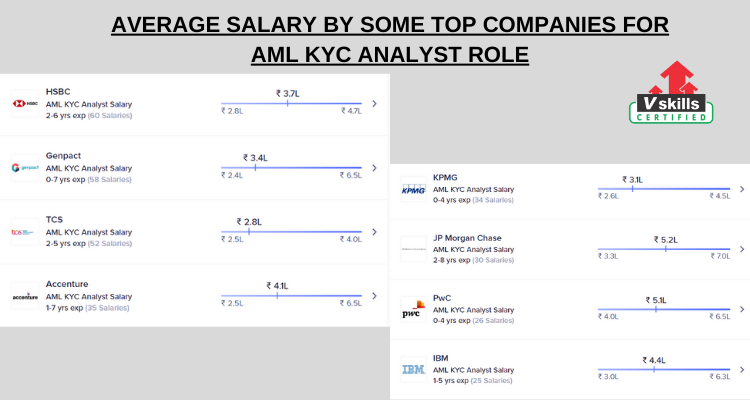

KPMG, EY, State Street, Bank of America, Credit Suisse, Deutsche Bank, J.P. Morgan, BNP Paribas, NatWest Group, Morgan Stanley, CRISIL Limited, TCS, Genpact, IBM, IDFC FIRST Bank, Barclays, Delta Capita, and DBS Bank are among the top companies in India hiring for AML and KYC jobs. Here is a snapshot of average salaries offered by some leading companies –

Apart from being an AML-KYC Analyst, you can also work as a compliance analyst, compliance officer, and Forensic manager as well as in risk management and transaction monitoring. Compliance Analysts are paid anywhere from 3 lacs to 10 lacs per year, with the national average salary being around 6 lacs. Compliance Officers can expect to earn up to 3.2 lacs per year, with the national average being around 6.7 lacs. The salary trajectory of Compliance Officers begins at 6 lacs per year for 2 to 4 years of experience and can progress to a Lead Compliance Officer role, which can earn up to 17 lacs per year.

Let us now take a look at some of the roles and responsibilities that you will be expected to carry out –

Responsibilities of an AML KYC Analyst

Your investigation could include:

- Assess risk appropriately when making business decisions, demonstrating particular concern for the firm’s reputation and protecting Citigroup, its clients, and assets, by driving compliance with applicable laws, rules, and regulations, adhering to Policy, exercising sound ethical judgment regarding personal behavior, conduct, and business practices, and escalating, managing, and reporting control issues with transparency.

- Investigating alerts thoroughly while managing and prioritizing caseload. While adhering to strict controls, contact required teams/banks to obtain customer information relating to alerts received.

- Perform necessary training and stay up to date on policy changes in order to be appropriately trained and skilled to carry out duties.

- Ensure that all activities are carried out in accordance with the processes, procedures, and control framework in place. Any opportunities to improve processes, procedures, or controls should be reported to management.

- Assist with the preparation, development, due diligence, and approval of the electronic Know Your Client (KYC) record and supporting appendices in collaboration with the Relationship Management and Compliance teams.

- Create and maintain KYC records using information obtained from internal and external sources (firm website, regulatory websites, etc.)

- Work with the Relationship Management and Compliance teams to update system information from the time a KYC record is initiated until it is approved, and report workflow progress to the supervisor.

- Validate the information in KYC records and Customer Identification Program (CIP) documents to ensure its accuracy and completeness.

- Ensure that KYC records comply with local regulatory requirements and Global Business Support Unit (BSU) standards. Maintain the BSU tool.

In order to grab this role, you must know the different ways you can enter this field –

What qualifications do you need to be an AML-KYC Professional?

Here are some strategies for getting along:

Extensive experience (preferably in a bank or financial institution): To increase your chances of landing your first job, apply for AML-KYC analyst or compliance positions at a variety of financial institutions. In the case of experienced candidates, make sure to highlight in your CV the responsibilities you had at your previous job that are relevant to the required skills listed in the job application.

Work on improving your social skills and adhering to high ethical standards: Leadership, Analytical Thinking, Time Management, Excellent Communication, Collaboration, and Attention to Detail are some other skills that can help you advance in your career. Multitasking and prioritization abilities are also required in most roles.

AML-KYC certification: Because of the exposure they will have, certified professionals are perceived as more meaningful and high profile. Also, This is where premium certification platforms like Vskills come in handy. Students can gain insight into the AML-KYC arena and land their dream job with the Certified AML-KYC Compliance Officer program, which includes an industry-ready curriculum, practice tests, and a dedicated placement portal.

Pursue an internship: It is not a bad idea to pursue an internship alongside your qualifications as your first experience in the Banking and Finance industry. Furthermore, It can aid in the development of your understanding of the AML-KYC Principles. Vskills also has a flagship internship program in which selected interns work with the academic council.

Other roles to explore

You might be curious to climb up the corporate ladder as soon as possible or might be interested in exploring some other options in this field later in your career. So, here are some of the other options where your knowledge can prove to be a cherry on the cake –

Forensics Manager

A Forensic Manager oversees laboratory units in the Forensics and Evidence Division. They oversee first-line Forensic Supervisors, Criminalist Supervisors, and/or individual contributors. Additionally, they screen, treat, and manage clients, as well as investigate and recommend supportive services to them.

Average Salary: INR 3.5 Lakhs per year

Compliance Specialist

Starting a career in compliance is a rewarding, exciting, satisfying, and varied experience. These professionals ensure that organizations follow all applicable laws, regulations, and policies. They are also in charge of monitoring and documenting compliance activities; advising leadership and management on compliance issues, and communicating with government agencies. Moreover, If you want to pursue a career in compliance, this is the best path for you.

Average Salary: INR 4.2 Lakhs per year

Anti Money Laundering Manager

An AML Manager works to make the investigation of suspicious activities easier and more effective. Furthermore, They combine cutting-edge technology and a user-friendly, data-rich interface with strong prevention and detailed tracking tools. Because these professionals work on risk management and reporting suspicious activities; they are in high demand by MNCs across the country.

Average Salary: INR 5.1 Lakhs per year

Last Words

KYC and AML regulations are in place all over the world. Unfortunately, financing for terrorism does not always stop at the country’s borders. Economic crime and money laundering are on the rise all over the world, and they must be addressed. Regulators are enforcing significantly stricter KYC and AML standards in order to fulfill this function. Furthermore, KYC and AML compliance is not only important for customer safety and satisfaction but it is also required by law. Moreover, Regulations require all banks and FIs to follow a set of AML standards. KYC initiatives are the starting point for a comprehensive anti-money laundering strategy.