The Melbourne Mercer Global Pension Index that measures countries retirement pension system has ranked India’s pension system at the lowest among the 25 countries they reviewed in 2014.

About the index

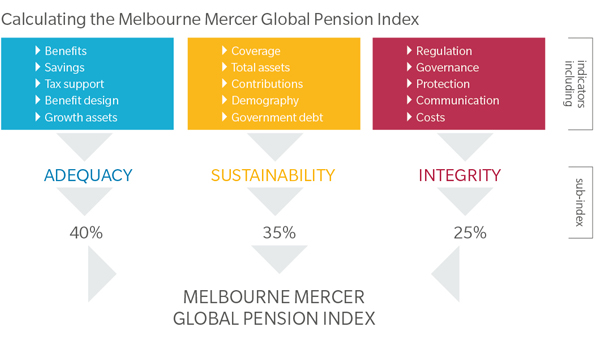

The index uses 3 sub indices:

- Adequacy

- Sustainability

- Integrity

The adequacy sub index has its focus on the benefits that are currently being provided by the pension system in the country. It includes items like benefits, saving, tax support etc. Some of the questions addressed by the index are:

- What is the minimum pension that an average wage earner receives?

- Has it changed over time?

One of the important aspects of this index relates to the household saving rate as the living standard of aged will depend upon the amount of pension as well as saving apart from pensions.

The sustainability index lays importance on the question that whether the current system will be able to provide these benefits in future as well. It contains indicators which influence the long term sustainability of current systems. The most important question that it addresses is coverage i.e. what proportion of working age population are members of private pension plans. Here, private pension plan covers pension plans for the public sector employees and the military. It also includes factors such as the economic index of private pension system, its level of funding, the length of expected retirement both now and in future, and the labour force participation rate of the older population and the current level of government debt.

The integrity sub index has its focus on regulation & governance, protection for members and costs of providing pensions. Do pension plans need regulatory approval, do they submit a report to the regulator annually. This index focuses on the need of regulations on private sector pension plans and the fact that they should be well operated as they represent a critical component of a well governed and trusted pension system. Because without them government will become the only provider. The questions addressed are:

- Do pension plans need regulatory approval?

- Do they submit a report to the regulator annually?

- Are the financial accounts of private pension plans required to be audited annually by a recognized professional?

- What is the capacity of government to effectively formulate and implement sound policies?

Findings of the report

- The report claimed that India has a pension system that has some desirable features but also major weaknesses or omissions that need to be addressed. Without these improvements its efficiency and sustainability are in doubt.

- As compared to previous year Indian value increased slightly from 43.3 to 43.5.

- The adequacy index shows that India does not have a minimum pension system for all.

- Rates of coverage are i.e. working age population under private pension plans including pension plans for public sector employees are less than 6%. This indicates a heavy reliance on social security systems in future.

- Regulation and governance question in integrity Index ranked India amongst the best.

Suggestions by the report

The Melbourne Index has made several suggestions to improve our country’s retirement income system. Some of them were:

- Introducing a minimum level of support for the poorest aged individuals.

- Increasing coverage of pension arrangements for the unorganised working class.

- Introducing a minimum access age so that it is clear that benefits are preserved for retirement only.

- Increasing the pension age as life expectancy continues to increase.

Click here for government certification in Accounting, Banking & Finance

16 Comments. Leave new

Informative

Good stuff!

Knowledgeable!

very informative!i was not aware of this!India’s pension system needs some urgent reformations as we are very laid back!

ya a lot of changes are needed.

Very informative..well written..

Good Article!!!

informative article…good one..

Well explained.

Well written!

Infromative 😀

Informative.

Ya evn I saw a report of news channel yesterday about the irregularities in paying pensions in India……

informative!

Very informative 🙂

Great!