Everyone must have heard words like “SENSEX” “NIFTY” and ups and downs in the share market so now let’s look that what exactly these things mean in the world of SHARE MARKET (Stock Market).

The securities contract and regulation act defines stock exchange as “An organisation or body of individuals, whether incorporated or not established for the purpose of assisting, regulating and controlling of business in buying, selling and dealing in securities”.

Basically, stock exchange is the body where one can buy and sell securities like shares, bonds and government securities.

Every stock exchange has a specific location. In India, there are 23 stock exchanges among which Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), now before going further let’s talk about the organisation which regulates the exchange of securities in India which is SEBI.

Security Exchange Board of India (SEBI)

Securities And Exchange board of India was setup on 12th April 1988 to regulate the functions of security market. SEBI was given statutory status and powers through an ordinance promulgated on January 30, 1992. The reason why SEBI was established because with the growth in the dealings in stock markets, lot of malpractices also started in stock market such as ‘price rigging’, ‘unofficial premium on new issue’, delay in delivery in shares, violation of rules and regulations of stock exchange and listing requirements. Due to these malpractices the customers started losing confidence and faith in the stock exchange. So government of India decided to set up an agency or regulatory body known as Securities Exchange Board of India. The office of SEBI is situated at Mumbai.

The main Objectives of SEBI are:-

- To regulate activities of stock exchange.

- To protect the rights of investor and ensuring safety to their investment.

- To prevent fraudulent and malpractices by having balance between self regulation of business and its statutory regulations.

- To regulate and develop a code of conduct for intermediaries such as brokers, underwriters, etc.

National Stock Exchange (NSE)

The National Stock Exchange of India Ltd. (NSE) is the leading stock exchange in India and the second largest in the world by nos. of trades in equity shares from January to June 2018, according to world federation report. It was established in 1992 and commenced operations in whole-sale debt market in June 1994 and trading in equities has been started in the Capital Market Segment (CM) in November, 1994. NSE launched electronic screen- based trading in 1994, derivatives trading (in the form of index futures) and internet trading in 2000, which were each the first of its kind in India.NSE has a fully-integrated business model comprising exchange listings, trading services, clearing and settlement services, indices, market data feeds, technology solutions and financial education offerings. NSE also oversees compliance by trading and clearing members and listed companies with rules and regulations of the exchange.

Objectives of NSE are:-

- To provide a fair, transparent and efficient securities market to investors using electronic trading system.

- To establish nationwide trading facility for equities and debt instruments.

- To ensure equal access to investors all over the country through an appropriate communication network.

- To improve the standard of securities market to international level.

Nifty 50 indexes is NSE’s benchmark broad stock market index for Indian equity market it was found on 21st April, 1996. It is derived from the word NSE + Fifty= NIFTY. Its movement depend upon the share price of top 50 companies of different sectors included in it. NIFTY is calculated on the bases of Free Float market Capitalisation. One who needs to invest in shares should focus only on the movement of NIFTY that whether it is increasing or decreasing.

Bombay Stock Exchange (BSE)

The Bombay Stock Exchange (BSE), also known as the Stock Exchange of Mumbai, is one of the oldest stock exchanges in all Asia dating back to 1875 when it was known as the Native Share and Stock Brokers Association and became the first stock exchange in the country to be recognised by the government. In 1956, BSE obtained a permanent recognition from the government of India under the securities Contracts (Regulation) Act, 1956. It is the Fastest Stock Exchange in world with the speed of 6 micro seconds and one of India’s leading exchange groups.

In 2017 BSE became the 1st listed stock exchange of India. Today BSE provides an efficient and transparent market for trading in equity, currencies, debt instruments, derivatives, mutual funds. BSE’s popular equity index-the S&P BSE SENSEX- is India’s most widely tracked stock market benchmark index. It is traded internationally on the EUREX as well as leading exchanges of the BRCS nations (Brazil, Russia, China, and South Africa).

Objectives of BSE are:-

- To promote and inculcate honourable and just practices of trade in securities transactions, and to discourage malpractices.

- To check the abnormal variations in the price as well as the volumes of the Securities are scrutinised and appropriate actions are taken.

S&P BSE SENSEX index is the benchmark index of the Bombay Stock Exchange (BSE) in India. It is derived from the word Sensitive + index = SENSEX. SENSEX movement is based on the 30 of the largest and most actively-traded stocks on the BSE, providing an accurate gauge of India’s economy. SENSEX is also calculated on the bases of Free Float Capitalisation Method, which provides a weighting for the effect of a company on the index.

Bullish and Bearish Market

Bullish market is a period when the price of shares and other investments are higher than usual, and many people invest because they expect to earn large profits. It is the market which is characterised by ‘confidence’, ‘optimism’ and ‘positive expectations’ that the market will grow. During bull market GDP grows, employment opportunities increase and stock value rises. For e.g.:-

In India bullish market was lasted for 31 months from 2016 to 2018.

Bear market is just opposite to the bull market it is a period when the price of shares and other investments are falling down and people find it difficult to invest in the stock market. The bearish market is characterized by “bad economy”, “fewer jobs”, “pessimistic” and “recession”.

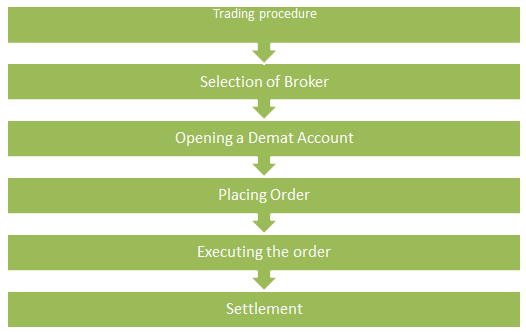

Trading Procedure on a Stock Exchange

1. Selection of Broker: – The first step is to select a broker who can trade securities on behalf of the investor and these brokers must be registered under SEBI. A broker can be an institution, partnership firm or an individual.

2. Opening a Demat Account: – As per the reforms no securities are traded in physical form they are now traded in the electronic from. So a Demat Account is opened with a depository participant. Depository is an institution or an organisation which holds securities while depository participant is an agent of the depository with the help of whom depository interacts with the investors as depository has no direct contact with investor. There are two depositories in India

- National Securities Depositories Ltd (NSDL)

- Central Depository Services Ltd (CDSL)

3. Placing Order: – After creating the account the investor will place the order. The order is placed by the investor through its broker or DP personally or through any other medium. The order should be clearly transferred so that there must be no misunderstanding. All the details or ranges of price must be clearly mentioned. For e.g.:- Buy 150 shares of TCS for not more than Rs400 per share. The broker will place the order according to the instructions and may be place the order on a more fare price.

4. Executing the order: – After execution of the order the broker issues a Contract Note within 24 hours. A Contract Note is the document which contains all the relevant information like – No. of shares, price, date and time, name of the security, name of the parties and the brokerage charged by the broker. This Contract Note is signed by the broker. This document is very important in case of any legal dispute as it contains the Unique Order Code assigned to it by the stock exchange.

5. Settlement: – This is the final stage of trading in securities. In here the actual transfer of security from buyer to seller takes place. At this stage the broker will deal on behalf of the investor. There are two types of settlement:-

- On the spot Settlement: – In this the settlement is take place immediately and on the spot and it follows the T+2 rolling settlement, here T= Transfer and 2= Grace Days. According to this pattern if any transaction has occurred on Monday then it gets settled by Wednesday.

- Forward Settlement:- In this the settlement take place on any future date which is decided by both the parties or by mutual understanding of both the parties it can be take place on T+5, T+8 etc.

All trading in stock exchange takes place between 9:55 am to 3:30 pm Monday to Friday.

How to Choose a Stock

Every person loves money whether a teen, an adult or a child. They all know the value of money in their life. There are so many options available nowadays where a person can invest money but the return from that money is not as high which can change the living standard of a person. So for higher returns one invests in the share market.

So for a beginner who wants to invest in the share market and earn lots of profit first question arises in his mind that which stock he should pick as his first investment. First and for most things a person must keep in his mind that there is not any kind of surety that the first investment will bring profit as a beginner one has to face losses.

So never ever gets discourage or de-motivate yourself after your 1st experience because in beginning facing loss is general due to lack of experience. So before choosing your stock one must keep the following things in mind:-

1. Selecting the industry: – The first step is that you should select the type of industry in which you have a little bit of interest about which you can dig up.

2. Research about the selected industry :– After selecting the industry one must start gathering information about the industry like-

- Growth of the industry

- Demand of its product in the market

- Reviews of the existing shareholders

- Annual sales of the company

- How its competitors are doing

- Any Fraud the company has done in the past

- A little bit information about the owner of the company like- about his salary, leadership style, management , and response towards the shareholders

- Track record of the company

- Management’s track record

- Annual report of the company

3. Choose Low debt companies:- Low debt companies means the companies which are not under the burden of high amount of loan no matter that they are earning less profit than the high debt companies because there are chances that they won’t be able to earn high profit for longer period they may be shut down due to burden of loan. So always prefer low debt companies.

4. Choose company whose Sales and Profit both are increasing: – Always choose a company whose both sales and profit are increasing as only sales making companies are generally running their companies in loss. So higher and higher sales does not imply that the company’s position is good in the market as anyone can sell the product but selling the product with the profit is the characteristics of a good company. So increasing sales with increasing profit is important.

5. Return on Capital: – Return on capital is the profitability ratio which shows that how much profit the company is generating from the capital invested. Return on capital of the firm shows the strength and size of its moat. The company is good for doing investment if only it is more than 20% return annually. As an investor one must know that in the company where they are investing their money it is capable of giving them good return.

6. Quality + Valuation: – Valuation of the share refers to buying the share at the time when the price of share is low and selling them when their price is high. Quality of shares tells that how much worth does this share has in the market in current and in future. Quality can be checked by analysing the balance sheet of the company and by different ratios.

7. Customer Satisfaction: – Customer satisfaction is necessary in investing in the stock as it shows that how much longer the product of the company is going to survive in the market and about the future demand of the product this can be done by checking the reviews of the customer online or by using that product on your own. So that you can understand the life or the future demand of the product.

8. Read business magazines: – For updating your knowledge regarding the companies daily or monthly performances magazines play an essential role as it keep the investor in touch with the new and old company’s performance.

9. Do not rely on the past performance blindly :- While investing always keep in mind that do not rely on the past performance as many a times they are misleading and as you want to invest currently in its stock so that performance was of last year not current time. So be sure that you are investing at lesser risk.

10. Invest in established brands: – A new investor who does not know very much about different companies must try to invest in those companies which are very old and have a good brand image in the stock market. So the risk of losing is quiet less.

11. Try to invest for long term: – The beginners must try to invest for long term as the company might be not making profit at present but there is probability that it will make in future. In this situation “less risk more profit” fits very well.

5 most successful Investors

1. Warren Buffett

He is 3rd richest person in the world. He is the successful investor of all time. He is the CEO of Berkshire Hathaway. He invested first time at the age of 11 and first filed taxes at the age of 13. At very small age he told his family that he will become the millionaire till the age of 35. And he also proved what he said. He also said that after his death he will give 99% of his wealth in charity. Buffet still lives in the Omaha Nebraska home which he purchased in 1958 for $31,500.

He was rejected from Harvard business School so he got his master’s degree from Columbia University he actually went there because of Benjamin Graham. Warren got attracted towards the thought of Graham by reading his famous book “Intelligent Investor” and later on he became the mentor of Warren. Warren’s two rules which a investor should never forget is

“Rule no 1. Don’t lose money, rule no 2- Don’t forget rule no 1”

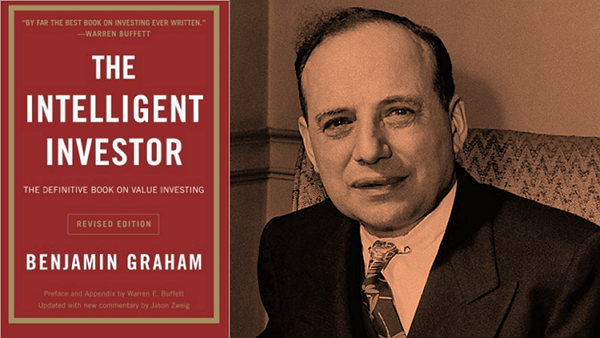

2. Benjamin Graham

He was a great investor he was a professor at Columbia University and o writer of many books related to investment like – “Intelligent Investor”, “Security Analysis”. He was the mentor of great investor Warren Buffett. He is known as “The father of value investing” and “Dean of Wall Street”. His method of selecting the stock was “Low risk and high return” this philosophy of his make him true pioneer of financial analysis. Reading his books and following his methods of investing help many of the people to gain profit from the share market. His investing strategy was:

- Only buy when there is a certainty that the company is worth more than its cost

- Sell when the company is overvalued

- Know that the market is constantly fluctuating\

3. Rakesh Jhunjhunvala

He is an Indian investor and trader. He is the Big Bull Badshah of Dalal Street. He is also referred as India’s Warren Buffett. He also co-produced various Bollywood films. He started his investment in stock market when BSE SENSEX was at 150 in 1985. He started his investment with Rs5000 and now he is a billionaire.

His 1st mentor was his father. He also told in the interview with Economic Times that One should not get fixated on macro events but on great businesses at an attractive price. All kind of events have taken place in the last 30 years which had negatively impacted the stock market from Kargil to Demonetisation to the global financial crisis. But the index always finds its way higher. His investment philosophy said that

“Buy right and hold tight”

4. John Templeton

John is the most famous investor who took risks on companies others would have shied away. He invested in 100 companies most of them were at the point of bankruptcy and his bold moves paid off and he ended up selling all but four of the companies at substantial profit. His strategy of investment is very clear

- Buy low and sell high

- Pay attention to the companies that others investors ignore

- Be bold

5. Radhakishan Damami

He is an Indian investor a self made billionaire and the owner of India’s 3rd largest mega retail stores’ chain “Dmart”. He never had interest in the stock market but the untimely death of his father led him to step in the stock market. He made his first stock market investment at the age of 32. His core mentor was Chandrakant Sampat whom he met in the early 1990’s. He succeeded when he started investing for the long term.

All these investors are the inspiration for the investors that one should never lose hope that after failing first time doesn’t meant that ever thing is ended up it can turn up into a new beginning also so these investors are the biggest examples of all time. So have patience and earn money!

1 Comment. Leave new

– Quite valuable insights & inputs shared on Stock market in India

– A must read for any beginner or someone who wants to gain idea about stock & market terminologies