Equity research is of paramount importance in terms of its use by large as well as small investors large to make better-informed investment decisions in the stock market. It not only helps traders gain profits by generating profits from stocks but also analyzes the historical results and builds a forecast about what the company is capable of in the future. Hence, their are numerous opportunities for equity research analyst in today’s business world.

As a career, equity research has become a highly-competitive and sought-after area. Infact, in the financial world, equity analyst is one of the most in-demand job profiles as companies demand them to review their historical financial performance, and forecast their future financial performance along with supporting arguments for the estimates. Therefore, opting for a career in equity research analysis in 2022 is definitely a good decision.

In this blog, we’ll be looking at the scope and career opportunities for equity research analyst in 2022 in order to help you build a successful career in this field. So, let’s begin with knowing the fundamental skills required for one to possess in order to enter the field of financial research and analysis.

Skills Required

An equity research analyst must possess the following skills and abilities-

- Excel skills

- Valuations

- Writing skills

- Business knowledge

- Financial modeling skills

- Knowledge of accounting

Career Prospects

With expertise in equity research you can work in the following firms-

- Investment banks

- Asset management companies

- Investment advisory firms

- Insurance companies

- Boutique investment firms

Roles and Responsibilities

The major responsibilities of equity research analysts are-

- Preparing equity research thesis for different investment positions.

- Conveying the investment ideas to other analysts as well as portfolio managers.

- Recommending security investments for sale, purchase or hold.

- Studying public information on individual companies.

- Updating and managing the financial models of each company.

- Interacting with company’s management with respect to equity research regularly.

Job Opportunities

With associates and analysts working 60+ hours a week, there is a lot of competition for positions in this field and therefore, a career in equity research is very demanding, the compensation is solid, and also the work is very cerebral. Hence, there is an increasing demand for equity research analysts in organizations which makes it one of the most desirable careers in 2022.

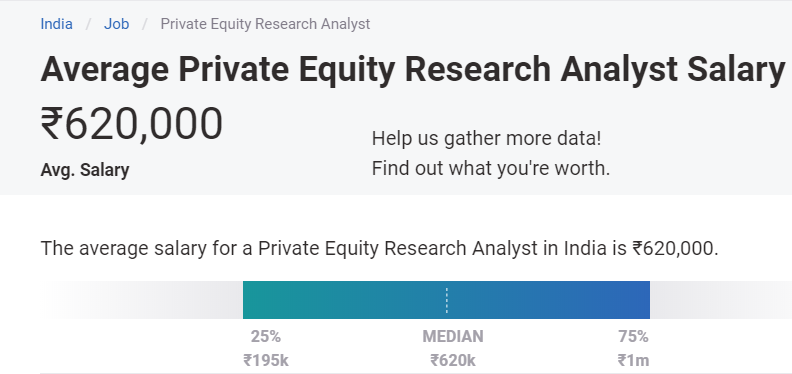

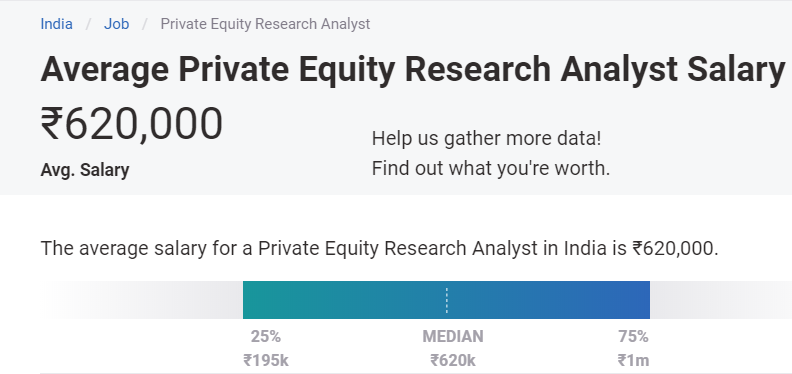

So, let’s have a look at some facts and figures of the highest-paying careers in the field of finance analysis-

Equity research analysts

Equity research analysts are the professionals primarily responsible for providing detailed research reports of the stock market industry. Hence, their in-depth knowledge of the market helps the investors in taking major decisions such as selling, purchasing, and possessing a certain investment.

Average salary- Rs.7,25,473

Investment analysts

Investment analysts are responsible for providing research and information to help traders, stockbrokers, and fund managers in making decisions regarding investments. Thus, they are helpful in providing information so as to ensure proper management of investment portfolios and highlight potential investment opportunities.

Average salary- Rs.10,87,031

Financial analysts

Financial analysts are the professionals who undertake financial analysis for internal or external clients as a major feature of the job. Moreover, their role can be titled specifically as securities analyst, equity analyst, investment analyst, research analyst or ratings analyst.

Average salary- Rs.4,28,465

Risk managers

Risk managers are responsible for managing the possible risk to an organisation, its customers, employees, reputation, assets as well as interests of stakeholders. Thus, they identify and assess the threats to the organisation, put plans in place if the things go wrong and accordingly decide how to avoid, eliminate or transfer risk.

Average salary- Rs.13,19,869

Investment bankers

Investment bankers’ role is to maximize investment returns, and attempt to set the IPO at the highest possible price. Thus, it requires one to possess an excellent grasp of the investment climate along with knowledge of the popular investment vehicles.

Average salary- Rs.9,61,000

With the advancement in market turmoils and technology, the demand for research analysts is growing at a fast pace. Therefore, becoming an equity research analyst in 2022 and coming future is excellent in terms of pay based on the competitiveness of the industry. Once you are ready to enter this field, all you require is to follow a proper route to reach your goal. So, let’s look at the basic route to be followed to get you a job as an equity research analyst-

How to proceed?

First and foremost, you are required to get a bachelor’s degree in your field of interest, preferably commerce, finance, or investment. After this, it is advised to gain some work experience in this area because eventually, what’s going to get you a perfect job in equity research is the skills that you possess. Moreover, it is a highly-skilled job that needs enough exposure to the financial markets as well as the ability to communicate in both reports and in person. So, ultimately you should equip yourself with relevant skills and techniques which can be best gained through certification programs that validate your skills and knowledge in the field. Hence, you can refer to the following tutorial to understand in detail the certification programs on equity research offered by Vskills that not only provide you with the necessary skill-set but also awards government certification as a proof your knowledge. Alongside, you can try out the practice tests in order to test your level of preparation and analyze your performance at each step.

So, what are you waiting for? Get yourself certified in Equity Research with Vskills to start your career in this field!!

With the advancement in market turmoils and technology, the demand for research analysts is growing at a fast pace. Therefore, becoming an equity research analyst in 2022 and coming future is excellent in terms of pay based on the competitiveness of the industry. Once you are ready to enter this field, all you require is to follow a proper route to reach your goal. So, let’s look at the basic route to be followed to get you a job as an equity research analyst-

With the advancement in market turmoils and technology, the demand for research analysts is growing at a fast pace. Therefore, becoming an equity research analyst in 2022 and coming future is excellent in terms of pay based on the competitiveness of the industry. Once you are ready to enter this field, all you require is to follow a proper route to reach your goal. So, let’s look at the basic route to be followed to get you a job as an equity research analyst-