Many a times we are baffled with the demarcation of debt from Equity, unable to figure what really is a debt and what is an equity.

The primary distinction that exists is the ownership. Equity represents ownership funds and debt represents borrowed funds.

Debt Market can be subdivided into Money Market and Capital Market.

Now what exactly money market is- money market accounts for those transactions that get settled within a year. For example- Treasury bills, these are issued by the government with a maturity of 3 months and 6 months, similarly commercial papers, all these instruments denote short term borrowings, the basic premise behind investing in money market is to maintain high level of liquidity at every point of time so that you have enough cash in your hand to set off any immediate liabilities.

On the other hand capital market includes all those transaction that are undertaken for a period of more than 1 year.

These include government bonds, corporate bonds, fixed deposits and other long term instruments; your cash gets locked in for a longer period of time.

However capital markets hampers the liquidity conditions , as if any uncertain contingencies crop up, in that case you don’t have the liquid cash to settle such liabilities.

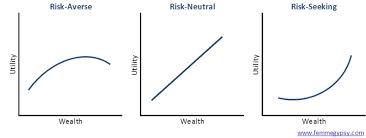

Debt market is the most secured and risk free market with stable and good returns thus it is generally perceived as the most preferred destination by risk aversive investors to park their cash

But people who risk lover would always give a try to those investments wherein instead of stable and stagnant returns they get growing returns, for a little sacrifice that is, they are willing to put their investments at stake to some extent , that is where the equity market comes into play, the market where you can have the taste of exemplary and whooping profits, but you can also miserably fail, because in this market you are the owner of the business you are investing in , which brings to the fore that whenever your company performs extraordinarily or you bag many contracts, then jeer up because you have added phenomenal numbers to your kitty

Ultimately it is very subjective and depends on the ideology of the investor , is he a risk lover or a risk aversive person

Click here for government certification in Accounting, Banking & Finance