A repurchase agreement or REPO is a contract for short-term loan wherein the seller of a security agrees to sell a security at the start of the transaction and agrees to repurchase the same asset from the buyer at a specified price and time. The difference between the price at which the security is sold and re-purchased is known as the REPO rate. A REPO acts as an equivalent of a spot sale combined with a forward contract in which the cash and securities are transacted as part of a spot sale and the seller as a forward contract agrees to re-purchase the same security in the future.

If the seller defaults during the life of the REPO, the buyer (as the new owner) can sell the asset to a third party to offset or mitigate the risk or his loss. The asset, therefore, acts as collateral and the security deposited are of good grade usually having a higher value than the price at which is sold by the seller. There is a minimal risk in this type of transaction and it is one of the best ways to earn a profit on a short-term without taking a huge risk.

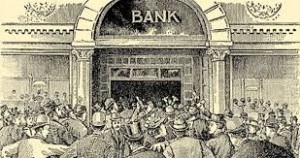

The spread between the original price and the repurchase price is the interest being charged for the short-term loan. In India, the REPO rate is fixed by the Reserve Bank of India. Commercial banks can borrow money from the RBI to fulfill any temporary shortfall of funds. The RBI reviews and changes the REPO rate on a regular basis to safeguard the economy.

When there is a surplus supply of money in markets which could raise inflation the RBI increases it’s REPO rate and then as commercial banks have to pay a larger interest on their borrowings they will also increase the interest rate that they charge to the general public. Hence the flow from the bank to the public and helps control inflation. The RBI reduces the REPO rate when it wants more activity in the market or if the economic situation demands a higher rate. When the cost involved with borrowing from RBI is cheaper automatically all commercial banks can provide loans at a cheaper rate maintaining the same profit margin and hence people are encouraged to borrow from the bank and spend more.

So, the REPO rate is one of the tools used to control the supply of money in the market by fixing the rate at which banks can borrow from the Central Bank. It is used to set the tone for the economy. The REPO rate is increased when the economy has an inflationary trend to decrease the money being circulated. When REPO rates are increased banks can borrow less from the RBI and as a result the amount of money they will be lending to the public also decrease. In the case of a deflationary trend when RBI will want to inject more money into circulation and hence they will reduce the REPO rate to facilitate the proper flow of cash in the economy.

Click here for government certification in Accounting, Banking & Finance

8 Comments. Leave new

Well explained. Repo rate and reverse repo rate as an instrument to control money supply is actually not preferred because it causes banks to take aggressive actions which might harm the economy.

Very well written..my concepts got revised.

Informative article… Nice…!

Well explained

nice one

Awesome work 😀

nice

aaich pote…