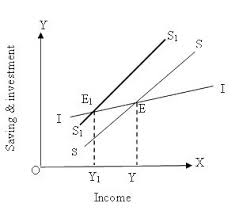

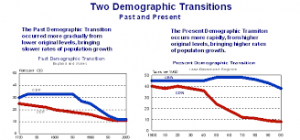

The hypothesis of the “Paradox of Thrift” was given by famous economist John Maynard Keynes which states that during an economic recession consumers try to save more, which eventually leads to a fall in aggregate demand and hence in Economic growth. The theory which precedes this talk about that in equilibrium total investment must be equal total savings. So, if the central bank can cut interest rates, investment and hence savings may rise. But if Central Bank cannot cut rates because there are already zero investments it is likely to fall, and hence income have to fall so much that when people try to save more they actually end up saving less. Keynes said such a mass increase in savings eventually hurts the economy as a whole.

But non-Keynesian economists highly criticized his theory on grounds that an increase in savings allows banks to lend more. This will make investment rate go down and increase in lending which further will lead to increase in spending.

Paradox of Thrift was seen in 1930’s great depression where GDP fell, unemployment rose and deflation for a long period in UK. Government took up many policies where in they cut unemployment benefits, reducing government debts, by reducing benefits they further reduced consumer spending and aggregate demand in the economy which made areas of high unemployment even more worse and people started saving rather spending their money which made recession even worse off. The solution given by Keynes was that government should borrow from private sector and inject money into the economy

14 Comments. Leave new

Something new and informative for me. Well written .

This is interesting. Well written

good job! an interesting topic in economics!

informative.

Informative 😀

Informative 😀

well explained

Informative and well presented.

nice article!

Interesting concept.

well described

you just very beautifully simplified a complicated concept

Innovative blog 🙂

great.