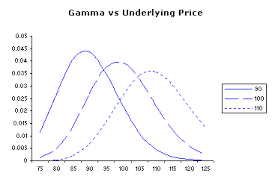

The next option Greek that deserves a mention at this point, and also the only other option that is to be discussed under this series is the gamma. The gamma is for the delta what the delta is for the premium.

Understand it in this way, as when we discussed that the option’s delta is associated with the underlying and the strike price, but what happens when the underlying moves? When the underlying moves, the delta of the option also changes. We know that the delta reveals the change in the premium resulting from the movement of the underlying, and taking this another step ahead is the gamma, which in turn, reveals the movement in the delta that can be accounted for to the movement in the underlying. In terms that students of calculus would understand, the delta is the first order derivative, while the gamma is the second order derivative.

To understand the gamma better, we must take the help of an example, which goes like this: The spot is 8200, option is 8300 CE, and the delta is 0.3. The underlying then moves to the level of 8400, which implies that the option which was earlier out of the money, is now in the money. This naturally means that the delta of the option shall lie between 0.5 and 1, say 0.8. This difference in the delta is what is captured by the gamma.

For the same spot price, and when the option under consideration is 8100 PE with the delta of 0.4, a movement of 400 points that takes the current spot to 7800, will result in a change in the delta, say, that is increases to 1.0, then this change is reflected by the gamma.

Since the gamma reflects the change in the delta, it is really important that we consider the gamma while selecting the option, as gamma is one of the main components of the pricing equation for options, according to Black-Scholes.

Click here for government certification in Accounting, Banking & Finance

15 Comments. Leave new

Great work!

Well Written 🙂

nice explanation

Informative

Quite informative

Something interesting.

Nice! well written 🙂

Informative 😀

good

NYC article……worth reading

Informative one, Anant!

good effort!

Nicely explained and presented.

Well explained.

well written! good job 🙂