Options theory makes use of delta for its calculations, and thus it makes it all the more necessary to understand the delta. In the last article, we discussed the practical application of delta, but not into very detail. In this discussion, we shall take another step in understanding the delta.

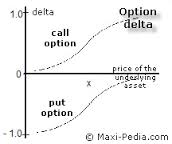

Last time we understood how the delta affects the premiums, and to some of you, one thing might have struck, that why is the delta in the put options negative, while for call options, it is positive. Now, this has a very logical explanation. A call option becomes more favorable when the market level goes up, while the put option becomes more lucrative when the market level goes down. And when the option becomes more lucrative, it is natural that its value, i.e. the premium, increases.

Now, also remember that the delta is the rate of change of the premium with respect to the movement in the underlying. Thus, when the market level rises and calls become more lucrative, their premium increases by the rate of delta, which is positive as positive movement in the underlying makes the option more favorable. On the other hand, when the market gains value, the puts become less unfavorable, thus, their value is decreased, as signified by a negative delta.

Now, we talked in the last article that the delta is range bound, that is, its value shall not exceed 1, or fall below -1. To elaborate it, now we can say that the value of call options ranges between 0 and 1, while for put options, this value lies between -1 and 0. The reason of the association of positive and negative delta has just been explained, but still the question that remains is why the value of delta is range bound. To answer this question, one must go back to the definition of derivatives, which goes like this: A derivative is an instrument which obtains its value from an underlying.

So, it seems only reasonable that the derivative, at most, match the change in the value of the underlying. This is the reason that the values do not exceed one on either side of zero. Another thing worth noting is that although according to the delta calculations, the premium may turn negative, the loss to the buyer is always limited to the extent of the premium he has already paid, that is to say, the premium shall, atleast be 0.

Click here for government certification in Accounting, Banking & Finance

13 Comments. Leave new

Informative and nice collection of information.

informative 🙂

Informative 😀

Good efforts!

good effort

good efforts..

Nicely framed!!

good work!

Informative

Nice.

Well compiled, Anant!

Well done 🙂

Well presented!