Inter-dealer Broker – the critical role of facilitating trades among big banks

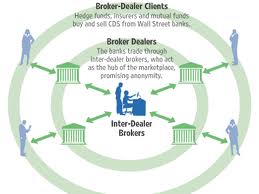

Inter-dealer brokers (IBD) are brokerage firms that facilitates the trade of bonds,interest rates,currency & commodities along with shares between market makers,dealers,banks and broker-dealer rather than providing brokerage service to the public or individual investor. Market makers avail the service of IDB to get rid of illiquid securities and hence better manager their portfolio.Whenever Market makers have such a portfolio and want to get rid of it, the moment they contact others revealing their identity the securities become more difficult to sell.They would have no option but to sell at a lower price as they want to get rid of those securities.

The role of an inter-dealer broker can be compared with an exchange. Like all exchanges, they have trading floors, which are noisy and lively places.Most Inter-dealer brokers provide brokerage service in the following three types: voice broking, hybrid broking and electronic broking.There is no regulatory body as the clients are specialists in these fields and hence don’t require a regulatory body to ensure the safety of their investments.

In the OTC derivatives market the price and liquidity are quite irregular. Hence,Inter-dealer brokers perform the function of price-discovery where in they help banks get a clearer picture of securities in the market.Intra-Dealer Brokers also provide a specialized service to the market makers enabling them to sell the securities in incognito mode in the OTC market.The intra-dealer brokers would contact various financial institutions such as a bank,other market makers,brokerage firms and investment banks and market the securities as if it were the firm’s own.This ensures fair play in the market and as a result no party is exploited.These banks usually operate internationally and they can sell the securities to one or more sellers to balance the sales and purchases of the securities.

IDBs usually charge a brokerage fee which is a very small percentage of the total transaction but the amount that lands up on their lap runs into a huge amount and hence such firms are highly profitable.Recently,due to economic conditions there earnings have fallen and these firms have diversified to ensure existence in the market.

Click here for government certification in Accounting, Banking & Finance

24 Comments. Leave new

nice one

Well-written article!!

IDB 😀

MMm really interesting as well as informative work 😀

Good work

nice article

Well researched!

Well researched.

Informative! Nice article

informative

Well written!

Interesting and informative.

Worth reading!

Nice

Nice

Amazing article

worth a read

interesting one 🙂 and very well written 😀

Worth reading.

Well written!

Explained such a difficult to understand thing in a simple manner. Impressive 🙂

Keep up the good work

very good

Really informative.. One must know behind the scene things.

Nice article!