On Thursday 2nd July, Reserve Bank of India governor Mr. Raghu Ram Rajan commented on India’s Economic growth, he said India’s economic growth is set to accelerate as capital investment gather pace and government tackles bottleneck that have stalled industrial projects. Also chief Economic advisor of India Mr. Arvind Subramanian on 26th may 2015 said that Indian economy is in recovery mode. There are signs of picking up, but in short run it is important for the economy to propose policies that boost consumption through cheaper financing. International Monetary Fund IMF also said that India’s economy is recovering and its ability to withstand external shocks has improved.

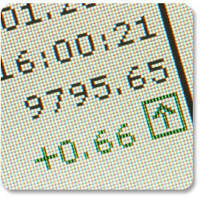

Mr Rajan on Thursday said that “we can see some signs of capital investment picking up. There is a continuing need, which the government is trying to address of putting some of the stalled projects back on track”. He also added that better than expected monsoon rainfall in June is also a factor portending higher economic growth. Economic growth is forecasted to be 7.6% in the year to march . In may government said that economy grew at 7.3% in the last fiscal year, using new method to calculate GDP. Rajan seemed more optimistic in his recent statement than in June. After effecting last of three interest rate cuts this year Rajan said the “central bank was under no illusion that the economy, especially investment is up and running” . Data from research centers for Monitoring India Economy Pvt. Ltd has shown that new investment announcements during quarter ended 30 June rose 33% to Rs 1.15 trillion from a year earlier and 498 new investment projects have been proposed during the period. The very important factor that will aid economic growth was the better than expected monsoon. Also the ongoing Greek crisis will have only a limited impact on India because of the little direct exposure to the European countries.

Since there is a risk because of there is a change in the sentiments of global investors. there might be a initial burst of volatility, investors will start differentiating and they will be able to distinguish India’s story which is of growth and stability. India’s macro policies are good and India has enough buffers including forex reserves to protectagainst any possible eventuality.

Also the investments that has to come to India’s debt market this year is worth $6.4 billion. India’s current limit is only $25 billion and there is a need to increase it.

The only problem is assets quality of banks. “We are working with banks to ensure that they recognize the problem early and take actions to remedy it. Clearly the government has to play a role here as well by helping resolve the stuck projects and that is being worked on” said Mr Rajan. RBI is also ensuring that 5/25 scheme is properly implemented. In5/25 scheme the lender is allowed to extend the tenure of infrastructure loan to 25 years. Also RBI will put regulatory framework to allow non bank finance company (NBFC) which could act as an account aggregator to enable common man to see all his accounts across financial institutions in a common front.

Mr Rajan mentioned that only way to get out of financial stress is to address the problem as soon as possible.

18 Comments. Leave new

Very informative and well explained

Quite informative:)

very informative article!

very good article!

Well done.

Good work

Infirmative article!!

informative*

well written!

Nice article.

Informative

VEry Informative 😀

good article..

Very well written 🙂

these investment if handled well can do wonders for India

Yess agree with AIshwarya , these investments can do wonders if they are properly taken care off !

Informative!!

Worth reading