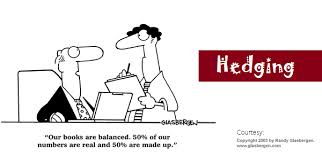

Now a Days, there can be seen a large investment in the capital market and other markets. Due to tough competition in the world everyone tries to put the best leg forward to be the leader in its sphere and one of the ways to be best is to employ large amount of capital. But it is not always the position that all who invest always are able to earn profits or gains. Many of them loose money, hence I will share about a well known technique to save one from such losses. The process is known as HEDGING.

A risk management strategy used in limiting or offsetting probability of loss from fluctuations in the prices of commodities, currencies or securities. In short, hedging is a transfer of risk without buying insurance policies. We use hedging also to protect oneself against effects of inflation through investing in high yield financial instruments like bonds, notes and shares, real estates or precious metals. There are various techniques to do hedging but it basically involves taking equal and opposite positions in two different markets.

If my explanations have become two technical then let we explain you in simple language. A hedge is used to reduce any substantial losses/gains suffered by an individual or an organization. We can create a hedge through many financial instruments, which includes stocks, exchange traded funds, insurance, swaps, future contracts etc. These public future markets were established in 19th century to allow transparent, standardization and efficient hedging in agricultural commodity.

There are various risks which can be protected through a hedge:-

Click here for government certification in Accounting, Banking & Finance

14 Comments. Leave new

Unique article..!

Nice!

Nice article… The conclusion could have been better written.

Absolutely Vinita..I myself was thinking for a good end…but could not get a one… 🙂

Well explained

a very good topic, very beautifully presented.

worth reading.

nice effort….it would have been better if u would have used an example to explain it…

I did not knew what is hedging ..After reading the article came to know about it..You have written in very simple and understandable way!!

Something new i got to learn today. Good one!

Very informative.

Splendid work.

Great effort!

Informative one.

interesting topic !

good work 🙂

liked it !