What is a financial statement? A financial statement simply reports the financial status of a company. It is usually compiled quarterly or annually. As an investor, a financial statement is important to you because it shows how a company uses its funds you and other shareholders have entrusted it with. A financial statement has three basic parts. These are the cash flow statement, income statement and the balance sheet. Let’s look at these three elements more closely, as it is important for an investor to know how he/she should review them.

Cash Flow Statement- A cash flow statement tracks the movement of cash inflows and outflows through operations, investments and financing. It measures the ability of a company to generate cash through various activities. One thing you should remember about the cash flow statements is that cash flow is not equal to profit. Why? Let me give you an example. As we all know, chief executives and general managers have to ensure that two duties are done: first, to earn profit and second, to convert the profit into cash as soon as possible. If the second stage takes too long, then the profits will be reduced due to the diminishing time value of money. So, when looking through financial statements, check if the company’s profitability is high, and check it against the cash flow from operations. Over several years, the company must generate positive cash flow, from its operations, especially so if it is profitable.

Income Statement- The income statement shows how a company generates its revenues and expenses, and how these lead to the company’s net income. When looking at an income statement, it is important to pay attention to two things: the company’s revenue and profits. If a company’s profit goes up, you should check whether it’s because of an increase in revenue, or because of cost-cutting. Increase in revenue is of course, more favourable of the two, and is a sign of healthy growth. However, if the values of revenue and profits decrease, you should carefully analyse whether the decline is temporary or it shows signs of being permanent.

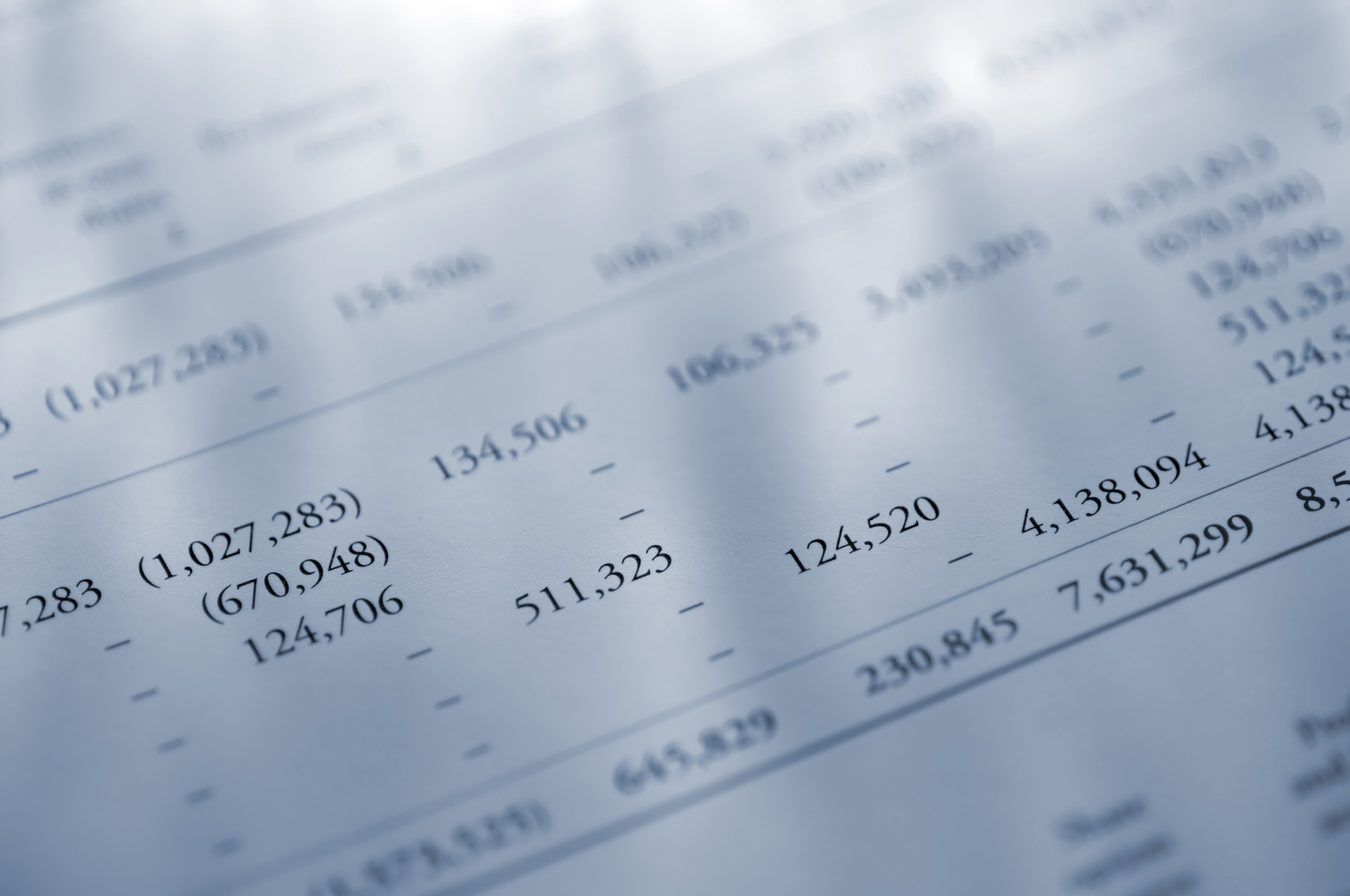

Balance Sheet- A balance sheet is a quantitative summary that shows a company’s financial position at a given point in time. This includes the company’s assets, liabilities and net worth. When looking at a balance sheet, the most important thing to note is its liquidity. In principle, a wise investor finds it safer to invest in liquid assets because it is easier to get one’s money out of the investment.

Remember, all investments have risks. But they can be minimised with the right knowledge.

Click here for government certification in Accounting, Banking & Finance

4 Comments. Leave new

keep it up!

Nice explanation..

Good work 😀

really worth reading and one must have some basic knowledge about finance too