A swap is a type of derivative where a parties exchanges a cash flow in return of a financial instrument from other party.It involves two parties.For example, in the case of a swap involving two bonds, the benefits in question can be the periodic interest payments associated with such bonds.The swap agreement decides the date on which the exchange would take place and even the calculation of the amount paid.Swaps can be used to hedge certain risks such as interest rate risk, or to speculate on changes in the expected direction of underlying prices.

TYPES OF SWAPS

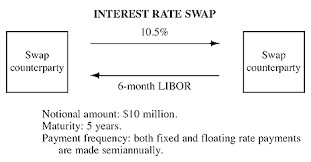

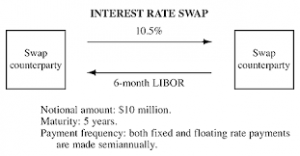

- INTEREST SWAP-This is the most common type of swaps. It is the exchange of a fixed rate loan to a floating rate loan. The life of the swap can range from 2 years to over 15 years.For example,A makes payment to B on the basis of fixed interest rate whereas B makes payment to A on the basis of variable interest rate.

- CURRENCY SWAPS-It involves exchange of principle amount and interest payment in one currency for principal amount and interest payments in another currency.It is just like interest swaps but the main difference is that it involves exchange of principle amount as well whereas,interest swap involves exchange of interest payments only.

- COMMODITY SWAP-A commodity swap is an agreement whereby a floating (or market or spot) price is exchanged for a fixed price over a specified period. The vast majority of commodity swaps involve crude oil.

- SUBORDINATED RISK SWAP-A subordinated risk swap (SRS), or equity risk swap, is a contract in which the buyer (or equity holder) pays a premium to the seller (or silent holder) for the option to transfer certain risks. These can include any form of equity,management or legal risk.

The value of swaps is the net present value of all estimated future cash flows of the financial instrument.The value of a swap is zero initially but it may turn out to be negative or positive in the long run.Swaps can be valued in terms of bond prices or as a portfolio of future contracts.

Click here for government certification in Accounting, Banking & Finance

14 Comments. Leave new

Unique article…!

Uniquely written

The knowledge about swaps is very miserable in India. One must read this article to know swaps better.

Good and unique!!

Nice and informative

Great!

informative

A well written and formulated article.

A very important concept explained in a very easy and interesting manner, great work!

its different and you have written it very well !

‘SWAP’ is desribed in a good way by further bifurcating it !

well explained

Informative! Very well written!

Now this is something new for me! New and innovative. Good job 🙂

well written