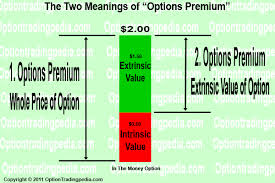

We have already understood that when we trade in options, we trade in premiums. Now this premium has two components- 1. Time value and, 2. Intrinsic value. Time value is nothing but the value attached to the time at which the instrument ceases to exist, or the date of expiry. Intrinsic value is the value by which the option is said to be in the money. To understand this, we must understand the concepts of in-the-money, at-the-money and out-of-money.

All options contract which will yield a positive result (disregarding the premium) if exercised immediately are said to be in the money. The contract whose value is equal to the market price is said to be at the money while all contract which shall result in a loss at the moment are called out of money options.

Now, getting back to intrinsic value. Intrinsic value is the value by which the option is said to be in the money. So if our underlying, say NIFTY is trailing at the level of 8000, and we have a call option of 7900 strike price, the intrinsic value will be equal to Rs. 100. For the same market level, suppose we have a put option of the strike price of 8500, it is said to have an intrinsic value of Rs. 500.

The time value of options is based on the days left for the maturity/expiry of the index. Options of expiry in the near, next and far month shall have time values in increasing order. We shall discuss more about the expiry, and detail the exact meaning of near, next and far months in future discussions.

Click here for government certification in Accounting, Banking & Finance

7 Comments. Leave new

Good job

Good effort..!

really informative article.

(y)

Good effort..

Informative

very well explained 🙂

quite informative as well !