Credit Risk means the possible loss that a financial institution might have to suffer because a borrower fails to make payments on a loan. A Credit Risk Manager is responsible to use several strategies to minimize the risk of financial loss to a lending organization. However, the job involves implementing the correct strategies and policies for a financial institution with the aim to reduce risk and increase profits. This role requires a good understanding of finances and defining governing policies for loans. Let’s dive deep into learning about the roles and responsibilities of Credit Risk Manager and preparation guide to become certified.

Roles and Responsibilities of a Credit Risk Manager

- Credit risk managers lead and deliver credit card fraud mitigation support. They also ensure that alerts are readily available for business channels transactions.

- They utilize customer data for building risk segmentation and mitigation strategies.

- They establish and monitor policies and procedures that will foster the company’s potential to meet its sales and risk management goals.

- Credit Risk managers communicate current policies and procedures to subordinates and other affected parties. Moreover, they also assist in controlling costs associated with operating and collecting credits

- Further, they produce key management reports and respond to ad hoc requests by managing consumer credit risk reporting resources.

- Lastly, they support Senior Management with consumer risk reporting needs. And, ensures effective design and oversight of the consumer quality function.

Career as Credit Risk Manager

Credit analysts deal directly with individual and corporate creditors in most institutions. Credit analysts are expected to work hand-in-hand with loan officers or sales agents who negotiate directly with consumers in other institutions. This career can be very lucrative as well as exciting. Let us discover the Career as Credit Risk Manager.

Vskills Certified Credit Risk Manager

Credit risk refers to the risk from a borrower who may not repay a loan and that results in the lender’s loss of principal interest, cash flow disruption as well as an increase in the cost of collection. However, the Credit Risk Manager contributes towards the stability and economic sustainability of the organization. Talking about the certification will provide candidates a deeper understanding of credit risk topics for getting advanced. In this certification various topics will be covered like credit analysis, lending types, nature of the obligor, financial statement analysis, ratio analysis, term loan agreements covenants, and failure prediction models. Moreover, Vskills Credit Risk Certification covers the best credit risk practices and helps students and professionals to enhance their career development by gaining skills. Many companies specializing in financial consulting or risk consulting are hiring skilled Credit Risk Managers.

Vskills being India’s largest certification providers gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine Shine.com.

Course Outline for Certified JMeter Tester

Certified Credit Risk Manager covers the following topics –

Introduction

Assessing Credit Risk

- Understanding Financial Statements

- Evaluating the Credit Decision

- Credit Assessment Methods

- Calculation of Risk

Credit Scoring and Rating

- Probability of Default

- Loss Given Default

- Exposure at Default

- Basics of Credit Scoring

- Scoring at Different Customer Stages

- Basics of Credit Rating

- Rating Terminology

Credit Portfolio Risks

- Credit Portfolio Fundamentals

- Major Portfolio Risks

- Firm Risks to Portfolio Risks and Capital Adequacy

Portfolio Risk Mitigants

Credit Risk Pricing

Credit Risks – Project and Working Capital

Credit Risk and the Basel Accords

- Scope of Application

- The First Pillar-Minimum Capital Requirements

- The Second Pillar-Supervisory Review Process

- The Third Pillar-Market Discipline

Risk Management Technologies

Credit Crisis

Preparation Guide for Vskills Certified Credit Risk Manager

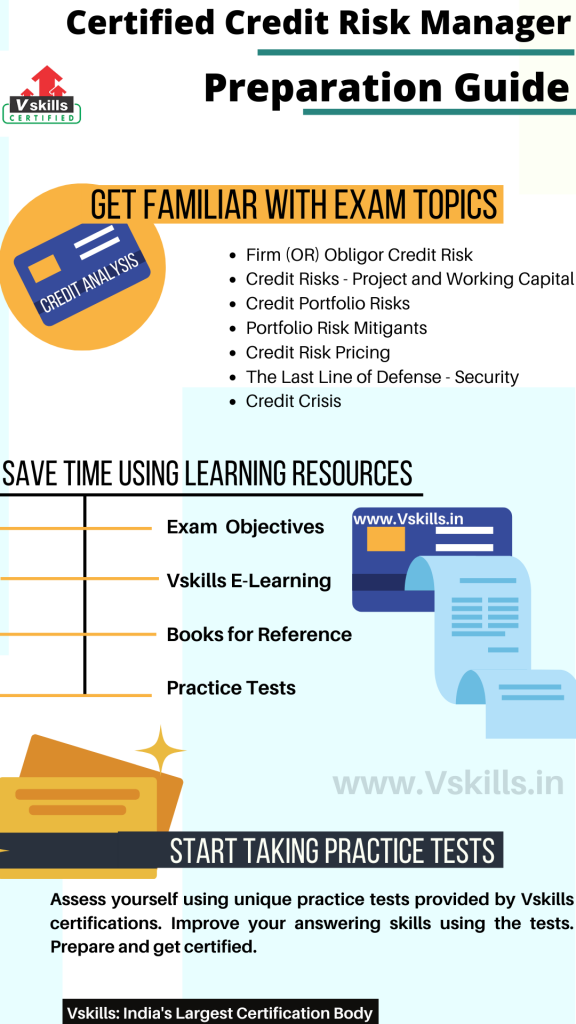

For every exam, it is important that candidates should have all the necessary resources to start preparing with. Doing this will not only help in understanding but it will also help them to follow a sequential manner for completing the syllabus. Further, this will provide an advantage to better understand the concepts. However, In the Certified Credit Risk Manager exam preparation guide, we will discuss some of the most important resources to help you prepare well for the exam.

Review Exam Objectives

The first task for every exam preparation is to get all the exam related details including the important contents and its topic. This will help candidates to easily start preparing for the exam and to understand things more accurately. For the Certified Credit Risk Manager exam the topics include:

- Firm (OR) Obligor Credit Risk

- Credit Risks – Project and Working Capital

- Credit Portfolio Risks

- Portfolio Risk Mitigants

- Credit Risk Pricing

- The Last Line of Defense – Security

- Credit Crisis

Online Vskills E-Learning

Vskills Certified Cyber Security Analyst provides candidates access to prepare for the exam using the online learning material for a lifetime. The online material for this is regularly updated. Furthermore, e-learning comes with hard copy material that helps candidates to improve and update the learning curve for getting better opportunities.

Refer: Certified Credit Risk Manager Sample Chapters

Books for Lifetime

Reference Books can provide an advantage to learn and understand things more accurately. For the Certified Credit Risk Manager exam, there are various books available which you can find online or in libraries. Some of the books are as follows:

- The Handbook of Credit Risk Management Book by Diane Coogan-Pushner and Sylvain Bouteillé

- Credit Risk Analytics Book by Bart Baesens and Daniel Rösch

Evaluate with Practice Test

After completing the topics for the Certified Credit Risk Manager exam, candidates should start assessing using practice tests. Using practice tests will help them for better preparation. By assessing yourself with these tests candidates will know about their weak and strong areas. So start examining yourself to pass the exam and become certified.

Job Interview Preparation

Prepare for Credit Risk Manager job role with our latest interview questions, the sole purpose of these questions is to prepare for you for the job role in credit risk.