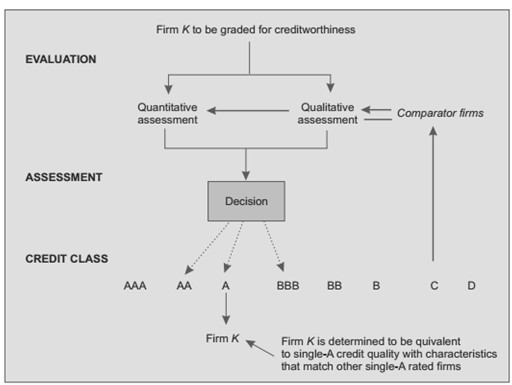

Ratings result from a thorough analysis of public and private information from all relevant sources. The rating process involves a quantitative analysis, which looks at the debt structure, financial statement, balance-sheet data and sector information. The qualitative analysis then looks at management quality, competitive position, and growth prospects. Information is obtained from public sources and from the rated company itself during visits and meetings with the senior management. The credit rating is assigned by a rating committee of experts on different domains and is communicated with the senior management of the issuer that requested the rating. After the first rating assignment, the rating is re-evaluated on an ongoing basis by the agency until the rating is withdrawn.

The original purpose was to distinguish between investment grade and non-investment-grade debt securities. The first credit ratings aimed to pro- vide an ordinal measure of the default or expected loss risk of the issued bond. Nowadays, credit ratings have been aligned to issuer default risk and issue loss or recovery risk.

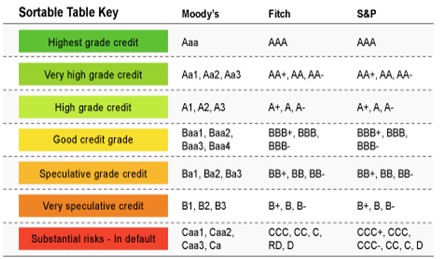

Table: Default ratings by agencies

Default ratings are the most commonly used type of credit ratings and it measures the relative default risk of an issuer in terms of the probability of default (PD). Different agencies use different definitions of default. These definitions are usually based on the occurrence of a delayed payment of interest and/or principal on any financial obligation. The definitions may differ on the method of treatment of missed payments made during a grace period or missed payments because of commercial disputes.

The probability of default (PD) is determined by evaluating the borrower’s current and future ability to fulfill its interest and principal repayment obligations. In order to evaluate the PD several variables need to be taken into account. This includes the characteristics of the borrower (natural or legal person), which should lead to a differentiation of the credit approval processes in accordance with the borrowers. For some finance transactions, the interest and principal repayments need to be financed exclusively from the cash flow of the object to be financed without the possibility for recourse to further assets of the borrower. In cases like this, the credit review must attend to the feasibility of the underlying business structure i.e. the source of the cash flows required to meet interest and principal repayment obligations has to be included in the analysis.