Credit Derivatives

Credit derivatives provide banks and financial institutions a systematic way of evaluating and h the payout is linked solely to some measure of creditworthiness of a particular reference credit and is thus largely independent of the market or other risks attached to the underlying. Changes in market risks, such as increases in interest rates, impact credit quality. Credit derivative is a customized agreement between two counter parties in which

Loan insurance is a form of a credit derivative that has been long used. The typical buyer of a credit derivative is a commercial bank that has made a loan to a corporate client. Since loans attract capital reserve requirement and profits earned from loan attract higher rate of tax than bonds, banks buy a credit derivative on a given loan making it a guaranteed asset.

The International Swaps and Derivatives Association (ISDA) lists the types of credit events.

- Bankruptcy: It is the liquidating of a business which cannot fully pay its debts out of its current assets. Bankruptcy can be brought upon itself by an insolvent debtor or it can be forced on court orders issued on creditors’ petition.

- Credit event upon merger: This is a situation where the counterparty, its credit support provider or any specified entity is taken over by or merges with another entity and this results in a big reduction in their creditworthiness.

- Cross Acceleration: It is a provision in a bond indenture or loan agreement that puts the borrower in default if the borrower defaults on another obligation.

- Cross Default: Common stipulation in loan agreements under which a bank has a right to deny access to balances in all loan accounts to a borrower even if only one loan goes into default.

- Downgrade: This is a negative change in the rating of a security. This situation occurs when the future prospects for the security have weakened from the original recommendation, usually due to a material and fundamental change in the company’s operations, future outlook or industry.

- Failure to Pay: This credit event occurs when there is a failure of a party make, when and where due, any payments under one or more obligations. Grace periods for payment are taken into account.

- Repudiation: This involves disputing the validity of a contract and refusing to honor its terms. In investing, repudiation is most relevant in fixed income securities, particularly sovereign debt. Repudiation occurs if the borrower refuses to honor this contract and stops making the agreed upon payments.

- Restructuring: It is the reorganizing of a business’ assets and liabilities where an organization’s overall structure and its processes are revamped. Although companies can restructure for any reason, it is mostly done when there are serious problems with the business, and to avoid bankruptcy liquidation.

Traditional banking and securities market instrument provide for payments in the event of default or a fall in the credit quality. Credit derivatives constitute a systematic attempt to quantify such risk.

Uses of Credit Derivatives

Credit derivatives are a tool for management and optimization of asset risk profiles. They can be used to reduce concentration in particular credits or to diversify exposure.

Other uses involve,

- Credit derivatives can be used to lock in returns ahead of planned investments in non-government securities or to fix the cost of future borrowing.

- Credit derivatives can be used to modify exposure.

- They can be used to avoid items of cash market transactions such as transaction cost, unfavourable tax treatment or the costly unwinding of associated market risk exposure. Companies adjust their credit risk profiles to certain lenders without transferring the ownership of underlying assets and jeopardizing business relationships.

- Credit derivatives can enable users to gain access to market segments owing to structural or market impediments.

- Credit derivatives increase the ability of market participants to arbitrage the differences in pricing between various underlying asset classes and investments.

- They can be used to reduce sectoral and maturity gaps in the availability of credit by financial institutions.

The transfer of credit risk enables market participants to concentrate more on the management of risks. Credit derivatives by unbundling and hedging credit risk reduce the risk associated with extension of credit which can lower borrowing costs.

Derivative Instruments for Credit

Credit derivatives can be divided into forward (including swaps) and option type contracts.

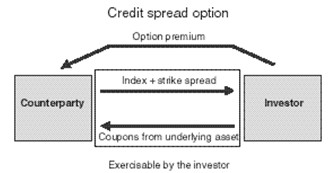

Credit Spread Options: With this, there is a transfer of credit risk from one party to another party. An initial premium has to be paid the buyer for potential cash flows if there is a credit spread change from its current level. The buyer of a credit spread option would receive cash flows if the credit spread between two specific benchmarks broadens or narrows. Credit spread options come in the form of both calls and puts, allowing both long and short credit positions.

The difference between the seller’s payment and the premium paid for the option is the net payout to the buyer. If the option is not exercised the premium paid would be lost.

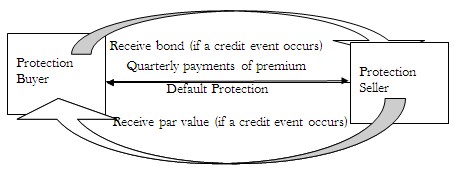

Credit Default Swaps (CDS): This is an agreement where the seller of the CDS will compensate the buyer in the event of a loan default or event. A series of payments is made by the buyer of the CDS to the seller and receives a payoff if the loan defaults. In the event of default, the buyer of the CDS receives compensation, and the seller of the CDS takes possession of the defaulted loan. The value of a default swap is reliant on the credit quality of both, the underlying reference entity and the writer (counterparty). If the counterparty defaults, the buyer of a default swap will not receive any payment if a credit event occurs. If the counterparty defaults, the premium payments end. Therefore, the value of a default swap also depends on the probability of counterparty default, probability of entity default and the correlation between them.

Buying credit default swaps help remove risky entities from balance sheets without selling them, and selling allows higher returns from investments. Diversification is also an added benefit to portfolios by entering markets that are otherwise difficult to get into.

It is believed that derivatives such as CDS are potentially dangerous because they put emphasis on bankruptcy with a lack of transparency.

Figure: Credit Default Swaps

A few types of credit default swaps are:

- Credit Default Swaps on Single Entities: This is the most common type of credit default swaps. Here, a credit default swap is on a single entity.

- Credit Default Swaps on Baskets of Entities: in a basket default swap, the underlying is a basket of entities rather than one single entity.

- First-Loss and Tranche-Loss Credit Default Swaps: FLCDS protects its buyer from losses of a reference pool as a result of credit events. FLCDS compensates its buyer for any losses from credit events of the reference assets up to a certain portion of the total notional of the asset pool.

Credit Default Index Swaps (CDS Index): A credit default index swap (CDIS) is a collection of single-entity credit default swaps (CDS). The basic difference is that in a CDS the notional is fixed during the life of the CDS and the protection buyer is compensated at most once, while in a CDIS the premium notional is variable. Whenever a default in the portfolio occurs, the premium notional is reduced by the loss amount of the defaulted entity and at the same time the protection buyer gets compensated by the lost amount.

Total Return Swaps: One party makes payments based on a set rate (fixed or variable) while the other party makes payments based on the return of an underlying asset. This includes both, the income generated and capital gains. Here, the underlying asset ‘reference asset’, is generally an equity index, loans, or bonds. The asset is held by the party receiving the set rate of payment. Total return swaps let the party getting the total return to gain exposure and profit from a reference asset without actually having to own it.

Asset Swaps: An asset swap is a combination of a defaultable bond with a fixed-for-floating interest rate swap that swaps the coupon of the bond into the cash flows of LIBOR plus a spread. Here, a dealer buys a bond from a customer at the market price and sells to the customer a floating rate note at par. Next, the dealer enters into a fixed-for-floating swap with another counterparty to offset the floating rate obligation and the bond cash flows.

For a premium bond, the dealer pays to the customer the difference of the bond price and its par. For a discount bond, the customer pays to the dealer the difference of the par and the bond price. In the swap with the counterparty the dealer pays a fixed bond coupon and receives LIBOR + a spread. The spread can be decided upon from the cash that the dealer pays/receives, and from the difference of the bond coupon and the par swap rate.

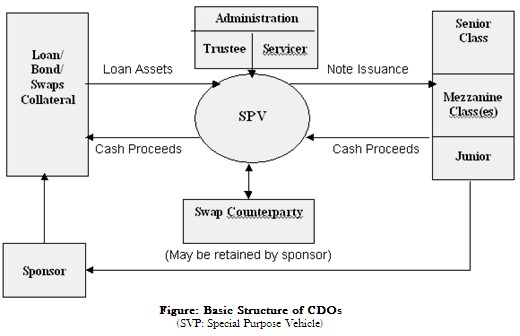

Synthetic Collateralized Debt Obligations (CDOs): These are credit derivatives on a pool of reference entities that are “synthesized” through more basic credit derivatives, mostly, credit default swaps (CDSs) and credit linked notes (CLNs). A common structure of CDOs involves slicing the credit risk of the reference pool into a few different risk levels. The level with a higher credit risk supports the levels with lower credit risks. Due to the complexity and the large sizes of reference pools of synthetic CDOs, their valuation is much more complicated and resource intensive than the ordinary single-entity or basket CDSs and CLNs.

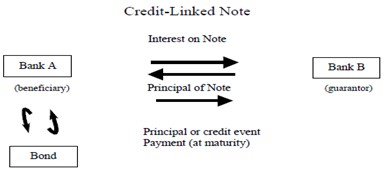

Credit Linked Notes: They are issued by intermediaries combining the features of standard income security with a credit option. Interest and principal are paid on credit linked notes but the credit option allows the issuer to reduce interest payments if a condition in the note deteriorates.