Security Basics

Securities help to defend an entity from possible credit loss situation. There are a number of tools or ‘securities’ that an individual or firm can use to best guard themselves in uncertain times. These may be in the form of stocks, property, gold etc. Whether it is the lender or borrower, both can have backup options at their ends to mitigate the financial fix they are in. Security assures the lender that the borrower has a stake, equity, or risk capital to fall back on in the event of a default.

There are two main features to focus on when deciding upon a good security:

- Valuation: The security’s value should be strong and stable so that it may provide the support needed during uncertain credit events. Fixed deposits with banks are known to be the safest as the value is certain and it increases over time through interest. Conversely, share market instruments are known to be volatile and risky.

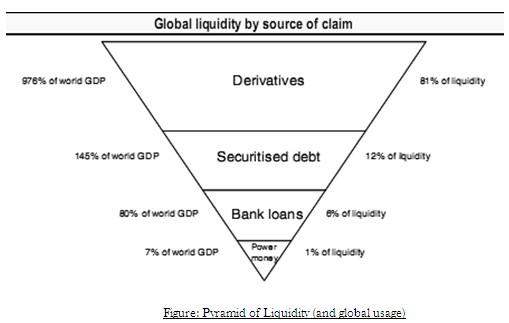

- Liquidity: The security need to be realizable when required. It should be capable of being sold or converted into another acceptable form of payment. Property, for example, is not very liquid. They take time to be sold and converted into cash. Shares on the other hand can be instantaneously be sold and realized.

Types of Securities

- Banks Deposits: These deposits are monetary balances kept with the bank and they do not depreciate in value. In the case of a credit default, the creditor can avail of the security with relatively less legal procedures.

- Stocks and Shares: Stocks and shares are highly liquid, and therefore they are quite often considered as securities. If the stock is chosen correctly with strength and stability in its value, the returns will also be promising and quickly realizable. On the other hand, share market instruments are quite often susceptible to external events (political, legal etc.) and therefore highly risky.

- Real estate: Owned property (land and building) can be placed as security as it is valued at a high price and there are rarely any price fluctuations. Prices appreciate (depreciate) very gradually and hence serves as a stable security. In case a property is bought on mortgage, the lender has the authority to sale the security when the time comes.

- Bonds: Bonds are a type of debt security. When a government, corporation or other entity needs to raise funds, they can borrow money from investors by issuing bonds to them. Investors who purchase a bond from an issuer are in essence lending money to the issuer for a fixed period of time. In return, investors receive a bond promising that they will receive interest payments at certain times and also have their principal returned on a stated future date.