Credit risk refers to the possibility that a borrower will default on a loan, resulting in a loss of principal interest, cash flow interruption, and a rise in the cost of collection for the lender. The Credit Risk Manager, on the other hand, contributes to the organization’s stability and economic viability.

Let us analyse Career as Credit Risk Manager!

Who is a credit risk manager?

A Credit Risk Manager’s role is to make sure the credit risk is kept to a minimum and that the bank or financial institution may recover any losses that may occur. In order to reduce the risk of financial loss to a lending company, a credit risk manager employs a variety of tactics in his or her daily work. The work entails putting in place the appropriate strategies and policies for a financial institution with the goal of lowering risk and increasing income. These policies could include things like monitoring a borrower’s portfolio for early warning signs, restricting the amount of money available for lending, and so on.

Roles and Responsibilities of a Credit Risk Manager

- Credit risk managers lead and deliver credit card fraud mitigation support. They also ensure that alerts are readily available for business channels transactions.

- They utilize customer data for building risk segmentation and mitigation strategies.

- They establish and monitor policies and procedures that will foster the company’s potential to meet its sales and risk management goals.

- Credit Risk managers communicate current policies and procedures to subordinates and other affected parties. Moreover, they also assist in controlling costs associated with operating and collecting credits

- Further, they produce key management reports and respond to ad hoc requests by managing consumer credit risk reporting resources.

- Lastly, they support Senior Management with consumer risk reporting needs. And, ensures effective design and oversight of the consumer quality function.

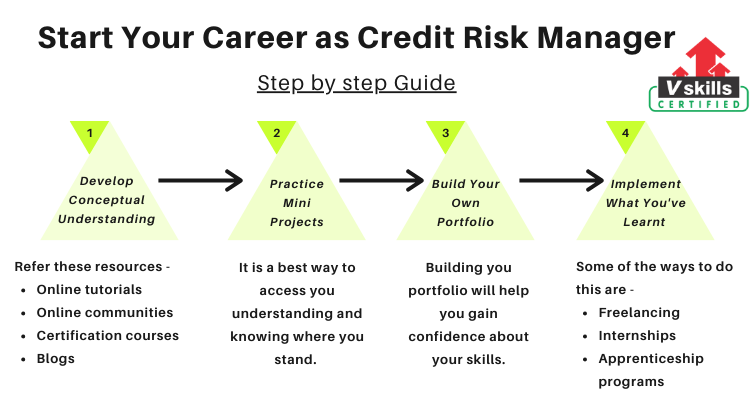

How can you start your career as Credit Risk Manager?

To be acceptable at something, it is critical to have a good start with appropriate assets and learning content. As a result, in order to be a pro in this area, your first steps toward learning must be appropriate. Let’s take a look at some steps you can take to start your learning process –

Step 1 – Learn about the basics and Develop Conceptual understanding

You must first establish a stable foundation before you can become an expert in those fields. And you’ll need to have the right applied skills before you can move on to the practical portion. Everything has to begin somewhere. You must begin small if you want to have a successful career in this field. You may use the following tools to get a complete understanding of the domain:

- Firstly, Online Tutorials for Credit Risk

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Vskills also provide Online tutorials, certification courses and free practice tests for the same. You can check them out on our official site.

Step 2 – Practice Mini Projects

If you want to land in a good position, you must practise. It’s also a perfect way to see where you are in terms of putting your knowledge into effect. In practical aspects such as the application of Credit Risk management in ventures, experience will help you outlast other things. To better understand the practical aspects, you can supplement your learning by reading blogs and tutorials on various websites. You can also attend various conferences – domestic as well as international and various webinars in order to polish your skills.

Step 3 – Build Your Portfolio

Building a portfolio will help you gain trust in your abilities while also giving you a place to practise what you’ve learned. Your portfolio shows the ability to prepare and execute various codes, as well as the quality of your Credit Risk management skills. These tasks can provide a variety of datasets and provide readers with interesting tidbits of knowledge gleaned from your research. Your portfolio doesn’t have to be about a single subject; pick a few that interest you and see what you can do with them.

Step 4 – Implement your skills in Real world

It’s important to practise your skills, which is why you’ve spent so much time learning how to do it perfectly! It’s also important that you stay up to date and continue to improve your own skills. Some specialist courses may also be used to show advanced abilities. You are also welcome to attend. Here are some examples of how you can improve your abilities:

- Freelancing

- Internships

- Apprenticeship programs

The above steps will help you to get this domain started. It’s a long way to go, however. You can take an advanced course to reach a new level of skills.

Eligibility to become Credit Risk Manager

In order to work as a credit risk manager in India, an applicant should have a specialised degree in banking, accounting, or commerce, among other fields. Candidates with prior work experience in a similar field are more likely to be considered for a Credit Risk Manager role.

If you want to work as a credit risk manager in India, you can look into the following courses.

Undergraduate Courses for Credit Risk Management

- Bachelor’s degree course preferably in Finance, Accounting, Commerce etc.

- BBA / BBS / BMS degree course.

Postgraduate Courses for Credit Risk Management

- An MBA in Risk Management / Finance.

- Credit Risk Management Certification courses.

- PGD in Risk Management

Candidates should seek out courses that teach them about economics, financial analytics, business analytics, and analytical methods, among other topics.

Market Demand

Any company that relies on credit as a business model needs the services of a credit risk manager. The top credit risk managers recruiters are listed below –

- Banks like HDFC, SBI

- Non-Banking Financial Institutions (NBFCs)

- Insurance Companies

- Finance Consultancies as CRISIL, Morgan Stanley

- Capital Management Firms

- Investment Banks etc.

Average Salary of Credit Risk Manager

In India, credit risk managers usually receive a sizable salary. However, in the early stages of this profession, an applicant would be expected to obtain some experience in the BFSI industry, possibly in roles of lower pay.

Given below are the average salary details of credit risk managers in India –

- The average salary of a credit risk manager in India can be around Rs. 9 – 10 LPA.

- The salary for entry-level jobs in this field can range from Rs. 4 – 5 LPA.

- Professionals with 5 – 6 years of experience in credit risk management can command higher than average salaries in the range of Rs. 15 – 20 LPA.

- Professionals having 10+ years of experience can easily surpass the Rs. 30 LPA mark.

Conclusion

Senior credit analysts are credit analysts who have gained many years of experience and have impressed their superiors. The more senior a position is, the more obligations it entails. They may be in charge of supervising a team of junior credit analysts, overseeing the analytical department, and making crucial credit department decisions. You can also embark you journey as a Credit Risk Manager/ Analyst if you have right set of resources and proper guidance with you.

Discover the career opportunities as a Credit Risk Manager. Hurry up and start preparing now!