The Certificate in Financial Risk Management demonstrates your knowledge in examining various risks like credit risk, liquidity risk, and market risk. This certification is designed for aspirants who want to specialize in Risk management. Financial Risk management primarily focuses on de-risking the financial aspects of a business firm, basically to curriculum failing to repay principal or interest in a timely manner.

Who should take the Financial Risk Management Certification?

The Financial Risk Management Certification is for working professionals/ job seekers who aspire to improve their skills and make their CVs stronger in today’s time where there is a cut-throat competition in every firm to display their best skill. This certification increases the chances of good employment opportunities.

Roles and Responsibilities of Financial Risk Manager

Following are Roles and Responsibilities of the Financial Risk Manager –

- To identify and analyse the upcoming threats to the assets and raise earning capacity or success of a business

- To work in sales loan inception, trading marketing financial services or private banking

- To judge financial history to determine if a person is capable or decent candidate for a loan

- To allot companies or investors with intelligible market assessment to help them make decision about investment and future business.

- Another responsibility is to analyse new proposed laws to understand how they will affect a company or a firm, and applicable recommendations to ensure compliance

- To investigate how an organisation is running and to look at minor details like what can harm the company

Why become a Certified Financial Risk Manager?

Attaining the advanced skill in Financial risk management increases employment opportunities with great earnings. This course is mainly designed for working professionals who desire good job opportunities in the finance department. Moreover, Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine.com.

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1132

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Certificate in Financial Risk Management Course Outline

Certify and Increase Opportunity.

Be

Govt. Certified Financial Risk Management

1.1. Nature of Risk

1.2. Sources of Risk

1.3. Need for Risk Management

1.4. Process of Risk Management

1.5. Risk Policy

1.6. Risk Management Approaches

2.1. Credit Counterparty Risk

2.2. Market Risk

2.3. Operational Risk

2.4. Other Risks

3.1. Measurement of Credit

3.2. Measurement of Market Risk

3.3. Measurement of Interest Rate Risk For

3.4. Asset Liability Management (ALM)

3.5. Measurement of Operational Risk

4.1. Managing Credit Risk

4.2. Interest Rate Risk Management

4.3. Insurance

4.4. Bull and Bear Spreads

4.5. Delta Neutral Strategies

4.6. Credit Derivatives

4.7. Credit Ratings

5. Other Issues in Risk Management

5.1. Regulatory Framework

5.2. The Basel Committee

5.3. Best Practices

5.4. Challenges to Risk Management

5.5. Accounting Issues

5.6. Tax Issues

5.7. Management Information System (MIS)

5.8. Integrated Risk Management

6.1. Three Pillars of Basel II

6.2. Scope of Application

6.3. The First Pillar-Minimum Capital Requirements

6.4. The Standardized Approach

6.5. The Internal Ratings Based (IRB) Approach

6.6. The Second Pillar-Supervisory Review Process

6.7. The Third Pillar-Market Discipline

6.8. Market Risk

6.9. Operational Risk

7.1. Barings

7.2. Herstatt Bank

7.3. Long-Team Capital Management (LTCM)

7.4. Enron

7.5. Orange County

7.6. Financial Risk Management Conclusion

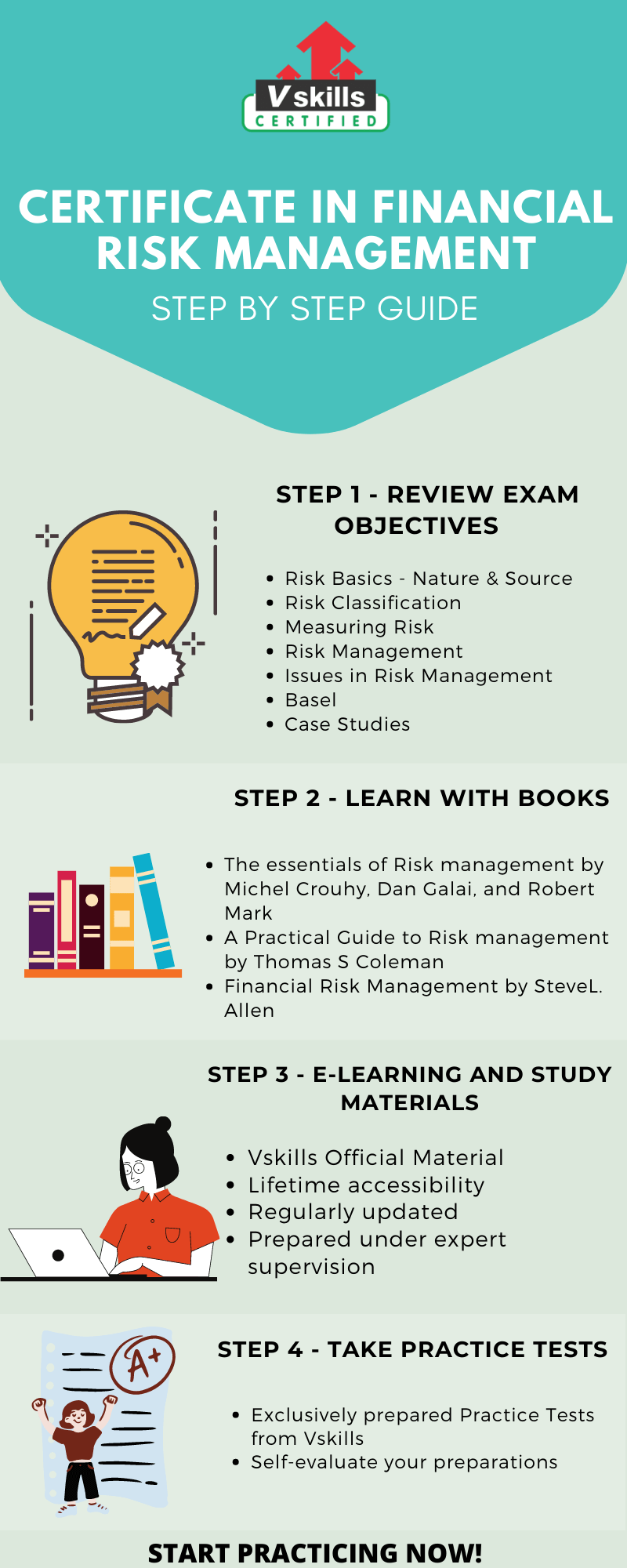

Preparation Guide for Certificate in Financial Risk Management Exam

Success cannot be achieved in a wink of an eye, it requires time, passion and dedication towards our goal. Candidates should be well aware of the exam concept to achieve the desired results. You should be determined and consistent while preparing for any professional level exam, and to cover all the necessary resources, this study guide is the most helpful weapon. This preparation guide will take you to your desired path.

Step 1 – Review Exam Objectives

The first and foremost thing before you start preparing is to get well versed with the objectives of the exam. This will let you understand the way through which you will prepare for the exam and then help attain your certification. Below-mentioned are the objectives of the Certificate in Financial Risk Management Exam –

- Firstly, Risk Basics – Nature & Source

- Secondly, Risk Classification

- Measuring Risk

- Also, Risk Management

- Then, Issues in Risk Management

- Basel

- Finally, Case Studies

Refer: Certificate in Financial Risk Management Brochure

Step 2 – Learning the Traditional Way through Books

The first resource that comes to our mind when you begin to prepare for any exam are books. Besides clearing the general concepts, books also provide us with a large span of other insightful topics as well. Below are the top three books, that you can refer to while preparing for the Certificate in Financial Risk Management exam.

- The essentials of Risk management by Michel Crouhy, Dan Galai, and Robert Mark – This book consists of the nature of financial risk faced by business and how to handle them.

- A Practical Guide to Risk management by Thomas S Coleman – The book showcases ideas of how to measure and manage risks in the firm. Every minor details related to the Risk management is available and how to co-ordinate well with the organisation.

- Financial Risk Management by SteveL. Allen – It has all the definitive concepts of Risk management and expert detailing like every aspect of isolating, quantifying, and managing risk in an effective manner.

Step 3 – E-learning and Study material

E-learning is one of the most effective learning methods today. It helps us to understand concepts well by the visual way of teaching. As it has most of the content available, it adds knowledge with a clearer perspective. Moreover, online availability of the exam matter helps a person understand the topics in an easy way. Vskills offers you its E-Learning Study Material and its hard copy as well, to supplement your learning experience and exam preparation. Moreover, this online learning material is available for a lifetime and is updated regularly.

Refer: Certificate in Financial Risk Management Sample Chapter

Step 4 – Check your Progress with Practice Tests

Practice Tests have proven to be one of the most effective learning techniques. Practice tests help us to built confidence and also introduce us to different patterns and types of exam questions. Moreover, practicing sample tests will help us identify our areas of improvement, thereby leading to much effective preparation. So build your confidence with free practice tests Now

Job Interview Questions

Prepare for your next job interview with our latest expert created online interview questions, the questions are designed to enhance your skills and make you job ready.