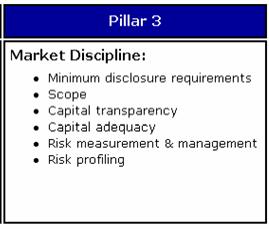

The Third Pillar-Market Discipline

The Third Pillar of financial risk management, also known as Market Discipline, is an essential component of the Basel Accords, a set of international banking regulations designed to promote financial stability and minimize risk in the banking system.

Market Discipline refers to the use of market forces, including transparency and disclosure, to promote sound risk management practices among financial institutions. The goal is to create a market where investors and other stakeholders have access to reliable information about a bank’s financial health and risk profile, and can use that information to make informed investment decisions.

To promote Market Discipline, banks are required to disclose key information about their financial position, risk management practices, and exposure to different types of risks. This information is made available to the public and investors through various channels, including regulatory filings and public reports.

Market Discipline also involves encouraging competition among financial institutions, which can help to promote efficient risk management practices and reduce the likelihood of systemic risks. This is achieved through measures such as removing barriers to entry for new banks, promoting transparency in pricing, and ensuring that regulatory requirements do not disproportionately benefit larger, more established banks.

Overall, the Third Pillar of Market Discipline plays an important role in promoting financial stability and reducing the likelihood of financial crises. By creating a market where investors and other stakeholders have access to reliable information and where competition is encouraged, it helps to promote sound risk management practices and reduce the likelihood of financial shocks that can impact the wider economy.

Market discipline ensures that the market provides yet another set of eyes. The third pillar is intended to strengthen incentives for prudent risk management. Greater transparency in banks’ financial reporting should allow marketplace participants to better reward well-managed banks and penalize poorly-managed ones. There are disclosure requirements to allow market participants to assess key information relating to the scope of application, capital, risk exposure, and risk assessment process. These disclosures include both quantitative and qualitative aspects. Internal methodologies allow banks discretion in assessing capital requirements.

Apply for Financial Risk Management Certification Now!!

https://www.vskills.in/certification/certificate-in-financial-risk-management