Working Capital is an accounting concept and has two forms – Gross and Net. Gross working capital is the sum of all current assets. The net working capital is the difference between current assets and current liabilities. The components of current assets and current liabilities can be explained through the following table.

| Current Liabilities | Current Assets |

| Sundry creditors | Inventories |

| Trade Advances | Raw material and components |

| Borrowings | Work-in-progress |

| Commercial banks | Finished goods |

| Others | Miscellaneous |

| Provisions | Trade Debtors |

| Loans and advances | |

| Investments | |

| Cash & Bank balances |

For management of working capital, the components mentioned above are monitored. Management of working capital assumes critical importance in the operations of a business as.

Out of the total investment in the business, the major portion is in current assets

Keeping pace with the market dynamics, the current assets and liabilities have to be adjusted quickly.

Credit Management (Terms of Sale, Credit Analysis, Credit decision, Collection Policy)

Generally sales transactions between firms for supply of goods and services are on credit. Depending on the nature of product and the customer, the proportion of credit sales would vary.

When credit sale takes place, in the books of the selling firm, finished goods get converted to receivables. If the average credit period extended to customers is 30 days and average daily sales on credit is Rs 1 crore, the average balance in receivables account is about Rs 30 lacs (average credit period X average daily sales on credit. As it is quite apparent that receivables are a significant portion of current assets its management assumes critical importance for the firm.

Terms of sale

A business firm has to determine the terms of sale it would follow which comprises of the following.

- What standards should be followed for granting of credit?

- What would be the length of the credit period?

Standards to be followed for granting of credit

For allowing sale on credit basis, at one extreme end the firm may decide to affect all sales on credit basis and at the other end of the band it may decide not to grant credit to any customer. Normally all firms pursue a prudent mix of both. A liberal term of credit is attractive as it tends to push up sales since the buyer gets indirectly financed. However such liberal policies have the following undesirable effects on the seller.

- Higher incidence of bad debts resulting ion loss,

- Investment in receivables go up with rise in interest costs (where the firm is leveraged)

- Cost of collection increase.

- On the other hand, strict credit terms depress sales, but have opposing effect on the above aspects as

- Incidence of bad debts is low

- Investment in receivables is reduced

- Collection cost is reduced

The following formula can be applied to estimate the effect of loosening the credit terms

Where,

- On the right hand side of the above mentioned relationship,

- The first component represents incremental profit on increased sale.

- The second component indicates the cost of capital locked-up in the investment in receivables

- The third component represents the increase in bad debts

Credit terms

When the credit standards have been established and credit worthiness of the customer has been assessed, the firm has to decide on the terms and conditions on which credit will be made available which are referred to as “credit terms”. The credit terms specify the repayment terms and have the following components.

- Credit period: This is the duration for which credit is given a by the end of which the customer should pay the due amount.

- Cash discount: This discount is sometimes offered as an incentive for early payment by customer.

- Cash discount period: This specifies the duration during which the cash discount can be availed.

The credit terms like credit standards affect profitability and should be determined on the basis of cost benefit trade-off.

Credit Analysis

The main purpose of assessing the credit worthiness of a prospective customer is to assess whether he is worthy of granting credit or not. The basic factors which are considered to be critical in the credit evaluation of customers are.

- Character: Involves the customers’ willingness to pay the debts. Generally this is the most important aspect of credit analysis. The customer’s payment history is the best indicator of character. It reflects integrity.

- Capacity: It is the ability of the customer to make on time payment. Factors like financial condition particularly the working capital position and profitability, business environment determines this aspect.

- Capital: It refers to the mix of debt and equity financing the customer’s business. For credit analysis generally the debt –equity ration and interest coverage ratios are considered.

- Collateral: This refers to the customer’s assets available for use in securing credit. The more valuable the collateral, the lower will be credit risk.

- Conditions: This refers to factors in the economy which may affect the customer’s operations and ability to pay debts. A firm that is marginally able to repay debts in a normal or strong economy may be unable to do so with adverse developments in the economy.

The methods followed in assessing credit analysis of customers are,

- Analysis of financial statements: From the financial statements of customers, information can be obtained. These information and ratios can be used to analyze the profitability, liquidity and long term solvency of the customers. The following financial ratios are important in this context,

- Current ratio

- Acid test ratio

- Debt equity ratio

- EBIT-total assets

- Return on equity

- Obtaining bank reference: The bank of the customer can also provide important credit information about the customer. Such information is obtained by the firm with the help of its bank. Sometimes a firm may ask its customer to direct the bank to provide necessary information. The information like average bank balance of the customer, loan given to the customer, experience with the customer etc can be obtained from the bank of the customer.

- Analysis of firm’s experience: The firm’s own experiences are important in this context should be used as reference. Its prior dealings with the customer or in the industry-segment can provide valuable information for credit evaluation.

- Numerical Credit Scoring: In this method, a customer’s creditworthiness is captured in a numerical credit index which is based on several factors which influence credit worthiness. The credit index is a weighted sum of the factors. The weights are normally subjective in nature. However a better risk index can be generated by using techniques of discriminate analysis.

Credit Decision

After gathering all information about the customer the firm faces the hard decision of either granting or refusing credit. Many firm’s use the traditional and subjective guidelines referred to as the “five Cs of credit” for making the decision on granting or refusal of credit :

- Character : The customer’s willingness to meet credit obligations

- Capacity : The customer’s ability to meet credit obligations out of operating cah flows

- Capital : The customer’s financial reserves

- Collateral : A pledged asset in case of default

- Conditions : General economic conditions

Some firms such as credit issuers have developed statistical models called ‘credit scoring models’ for determining the probability of default. Usually all the relevant and observable characteristics of a large pool of customers are studied to find their historic relation to default. These models determine who is and who is not creditworthy as per the their programmed algorithm.

Collection Policy

An important aspect of a firm’s collection policy involves monitoring of its accounts receivables to detect troubled accounts and over-due accounts. The methods followed for this purpose are summarized as follows.

- On an overall basis, firms generally monitor their accounts receivables by tracking “Receivables Collection Period” over time which is a indicator for the average number of days taken to convert receivables into cash. Unexpected increases in this ratio triggers warning to management.

- A common method used for monitoring accounts receivable is an ageing schedule. An ageing schedule classifies the firm’s receivables by number of days outstanding. This report provides useful insight into the quality of a firm’s receivables. The following format gives typical structure of an Ageing Schedule.

| Age of account | Receivable amount (Rs) | % of total value |

| 0-10 days | ||

| 11-30 days | ||

| 31-60 days | ||

| 61-90 days | ||

| Over 90 days | ||

| Total value | 100 |

The firm can investigate the issues relating to large overdue receivables to find out.

- Whether customers are having temporary financial difficulties

- Whether the customers are unsatisfied with the quality of the products supplied to them

- To determine whether there is any possibility of bad-debts which would have to be

- Written-off subsequently

- Determination of average age of accounts receivable is also used as a tool for managing accounts receivables. This is computed by calculating the weighted average of all the individual outstanding receivables. The weight for each receivable is its proportion of the total receivables. The receivables in a particular class can be considered to be receivables at the mid-point of each class.

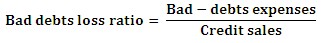

- The bad-debts loss ratio is also a useful way for monitoring outstanding. This is the proportion of total receivables which turn to bad-debts.

A well established collection policy should have clear cut guidelines on the sequence of collection efforts. After the credit period is over and payments remain due, the firm should initiate measures to collect them by contacting the customer. The effort should be polite in the beginning and with time it should become strict. The steps usually followed for this purpose are,

- Letters or reminders to expedite payment

- Telephone calls

- Personal visits

- Help of collection agencies

- Finally, legal recourse

The legal action is an option of last resource and a firm should take such a step when all other options have been diligently pursued and failed. Legal actions are not only costly but also adversely affect the relationship with the customer. Fundamentally the objective of the collection policy is to collect as early as possible with consideration to the real difficulties faced by customers.

Inventory Management

Trading and manufacturing companies generate revenue and profits through the sale of inventory. Trading companies purchase finished goods from manufacturers which are used for sale and have only one type of inventory. Manufacturers purchase raw materials and components from suppliers and add value by transformation of the purchased items into finished goods.

A significant component of total assets is inventory which comprises of raw materials, bought out parts, consumables and spares, work –in-process and finished goods. The importance of inventory management and the need for coordination of inventory decisions and other company policies as marketing, transportation is evident. Each of the elements of inventory requires its own inventory control mechanism. However determining these mechanisms is difficult because efficient production, distribution and inventory control strategies that reduce system-wide costs and improve service levels need to take into consideration the various levels in the chain of operations.

The critical issues for which inventory is required can be summarized as under

- Uncertainty in customer demand: It has become extremely difficult to accurately forecast the customer demand due to, shorter life-cycle of products resulting in non-availability or limited availability of customer data.

- Presence of competing products: With increased proliferation of products it has become increasingly difficult to forecast the demand for a specific product.

- Uncertainty in the quality and quantity of supply, supplier costs and delivery times.

- Delivery leads times.

- Economics of Scale in ordering and transportation

Cash (Cash Management, EFT)

Cash Management

Cash being the most liquid asset, its management is one of the key areas of working capital management.

Cash in the narrow sense covers currency and equivalents of cash as cheques, drafts and demand deposits in banks. In a broader sense, cash includes marketable securities which can be readily convertible to cash.

Motives for holding cash balances

Cash balances are held primarily for.

- Transaction Motive: In this case cash is held to meet the needs of daily transactions. A business has cash-inflows basically arising out of sales and cash outflows. On account of purchases, wages, operating expenses, financial changes and others. These inflows and outflows have a continuous two-way flow of cash but to ensure that the firm is able to meet its obligations in when payments exceed receipts adequate cash balances are required.

- Precautionary Motive: Other than non-synchronization of expected cash inflows and outflows in normal business operations, a firm may have unanticipated payment requirements which may be due to,

- Floods, strikes

- Unanticipated slow down in collection of out standings

- Cancellation of orders

- Sudden increase in cost of raw materials.

The need to hold cash balances for such unexpected contingencies is for precautionary motive.

- Speculative Motive: To take advantage of opportunities outside normal course of business a firm may desire to hold cash. This speculative motive stems from an aggressive approach to exploit profitable opportunities arising out of,

- Opportunity to purchase materials at favorable prices

- Chance to speculate on interest rate movements by buying securities when interest rates are likely to decline.

- Compensating Motive: Generally firms are required to maintain minimum balance in their bank accounts as condition for availing bank services linked to indirect compensation. Banks can use this money for earning return.

Determining Cash need

There are two approaches to derive an optimal cash balance.

- Minimizing cash models – the analytical models available are.

- Baumol Model

- Miller-Orr Model

- Ogler’s Model

- Cash budget

Baumol Model

The objective of this model is to balance the cost of conversion of securities to cash and cost of idle cash balances which could have been invested in marketable securities.

Now,

Conversion cost/period = Tb/C

Where:

T – Total transaction cost needs for the period

b – Cost/Conversion (independent of size of the transaction)

C – Value of marketable securities sold at each conversion

The average lost opportunity cost = i(c/2)

Where:

i: interest rate which could have been earned.

C/2: Average cash balance

So,

Total cost associated with cash management

To determine the optional conversion amount, by applying simple calculus we have

The following are the implications of this model.

- As the total cash needs increase, the optional withdrawal increases less than proportionately.

- Increase in opportunity interest rate reduces optimal cash withdrawal and vice versa.

While this model has simplistic assumptions which do not reflect the reality, it demonstrates the economics of scale and counteracting nature of conversion and opportunity costs.

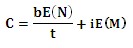

Miller Orr Model

The objective of this model is to determine the optimum cash balance level which minimizes cost of cash management. According to this model,

Where,

b: – fixed cost/conversion

E (M): – expected average daily cash balance

E (N): – expected number of conversions

t: – No. of days in the period

i: – lost opportunity costs

C: -Total cash management costs

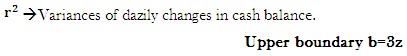

Unlike the assumption of uniform and certain levels of cash balances in the Baumol model, this model assumes that cash balances randomly fluctuate between an upper band (b) and a lower band (o). When the cash levels hits the upper band the surplus cash over the optimal band (z) should be converted to marketable securities. Again, when cash level falls to zero, marketable securities should be sold to restore the balance to the optimal band (z)

Optimal cash level is given by,

Cash budgeting or short term forecasting

This involves short –term forecasting which are regularly prepared and help the business in following ways.

- Estimating cash requirement

- Planning short term financing

- Scheduling of payments for capital expenditure profits

- Planning purchases of materials

- Drawing up credit policies

- Maintaining the long term forecasts.

The principal method of short term cash forecasting is the receipts and payments method. A firm may use weekly, monthly or quarterly cash forecasts as may be needed. The method can be illustrated through the following formats.

Forecast of Cash receipts

(in Rs. Lacs)

| Period 1 | Period 2 | Period 3 | |

| Sales | |||

| Credit Sales | |||

| Collection of accounts receivable | |||

| Cash sales | |||

| Receipts from sale of equipments | |||

| Interest from investments | |||

| Total Cash receipts (3+4+5+6) |

Forecast of Cash Payments

(In Rs. Lacs)

| Period 1 | Period 2 | Period 3 | |

| Material purchases | |||

| Material purchases in credit | – | – | – |

| Payment of accounts payable | |||

| Miscellaneous cash purchases | |||

| Wages | |||

| Manufacturing Expenses | |||

| General administrative and selling expenses | |||

| Dividend | |||

| Tax | |||

| Capital Expenditure | |||

| Total Payments (3+4+5+6+7+8+9+10) |

Summary Cash Forecast

(In Rs. Lacs)

| Period 1 | Period 2 | Period 3 | |

| Opening cash balance | |||

| Receipts | |||

| Payments | |||

| Net Cash flow(2-3) | |||

| Cumulative net cash flow | |||

| Opening cash balance + cumulative net cash flow(1+5) | |||

| Minimum cash balance required | |||

| Surplus or Deficit with respect to minimum cash balance required(6-7) |

The receipts and payments method of cash forecasting has the following advantages.

- It provides a holistic picture of expected cash flows.

- It helps in exercising control over daily transactions.

However this method has the following drawbacks:

- Delays in collection or unexpected demand for large payments affect the reliability of this model.

- It does not clearly portray the changes in the components of working capital as inventories and receivables.

Long-term cash forecasting

Cash forecasts beyond one year are considered to be long-term in nature. These forecasts usually for 2-5 years are useful in planning capital investment outlays and long term financing. The method normally applied in case of long term cash forecasts is the Adjusted Net Income Method which can be illustrated through the following format:

Format for the Adjusted Net Income Method

(In Rs. Lacs)

| Year 1 | Year 2 | Year 3 | |

| Sources: | |||

| Net income after Taxes | |||

| Non-Cash charges (Depreciation/ Ammortisation etc) | |||

| Increase in borrowings | |||

| Sale of equity shares | |||

| Miscellaneous | |||

| Uses : | |||

| Capital Expenditure | |||

| Increase in current assets | |||

| Repayment of borrowings | |||

| Dividend payment | |||

| Miscellaneous | |||

| Surplus/Deficit | |||

| Opening cash balance | |||

| Closing cash balance |

EFT (Electronic Fund Transfers)

The key electronic mechanisms available for making payments are summarized as under:

- Electronic Funds Transfer(EFT): This is a electronic payment mode for same-day inter and intra city funds(transfer). It is now mandatory for all bank branches in 16 large metros in India directly involved in clearing to participate in RBI’s EFT system for inward EFT.

- Special Electronic Funds Transfer(SEFT): This is an electronic payment mode for same-day inter and intra-city funds transfer. This is an extension of RBI’s EFT system but participation is voluntary and only networked branches are allowed to participate. So the location coverage is wider than EFT but all banks do not participate in SEFT.

- Electronic Clearing Service (ECS) Credit: This is an electronic payment mode designed for large volume payments. This scheme is operational in 46 cities and all banks are directly participating in clearing have to process through ECS. The ECS settlement cycle is about four days which is longer than EFT, SEFT, OR

- Real Time Gross Settlement (RTGS): This is a domestic electronic payment system where the beneficiary is required to credit the proceeds of inward RTGS transaction to the beneficiary’s account or return the funds within two hours of receipt of the payment notification. Participation of banks in RTGS customer payments is currently voluntary.

The corporate are gradually migrating from paper based to electronic modes of payment. These have potential for cost savings and have compatibility for system integration with the client’s internal systems.

Marketable Securities

For determination of the mix of cash and marketable securities, quantitative models as Baumol model, Miller Orr model can be used. . While these models provide valuable insight into the matter, practically the decisions are taken subjectively.

The evaluation of marketable securities for the purpose of earning return on temporarily idle funds is based on the following criteria.

- Yield among different financial assets

- Liquidity

- Taxability

- Interest rate risk

- Financial risk

- Financial risk: It refers to the uncertainty of expected returns due to possible changes in the financial capacity of the security issuer. The financial risk is said to be high if the chance of default on the terms of the security is high. As the objective of investment in the case is to utilise the temporary available idle cash for earning some return, high risk return investments may not be considered by the business firms.

- Interest Rate Risk: The uncertainty associated with expected returns from a security due to changes in interest rate is termed interest rate risk. Such volatilities are mostly associated with longer term to maturity. For increase in interest rates this market price of securities get reduced and vice-versa. As this risk increases over time, firms prefer shorter time to security.

- Taxability: The yield on marketable securities is also affected by differential impact of taxes. Tax-exempt securities sell at lower yield to maturity. While interest income is taxed at ordinary tax rates, capital gains are taxed at a lower rate. So fixed-interest securities that sell at a discount due to lower coupon rate in relation to prevailing yields are preferable to tax paying firms as part of the yield is capital gain.

- Liquidity: Liquidity in the context of marketable securities is the case with which they can be transformed into cash. For meeting unexpected demand for cash, a firm would need to quickly convert a part of its investments in marketable securities to cash and would not prefer large reduction in price due to such sudden conversion. So the aspects to be considered in this regard are.

- The time required for selling the security.

- The possibility of selling the security almost at the market price.

- Yield: The preference for yield is influenced by the consideration on financial risk, interest rate risk, taxability and liquidity. The risk return trade off by the firm would determine the proper securities mix for the firm.

Marketable Securities Alternatives

The marketable securities considered by business firms for temporary investment of idle cash are money market investments and the available alternatives can be summarized as under,

- Commercial Paper: The short term unsecured promissory notes sold by firms to raise funds are called commercial papers. These are mostly issued by large companies having sound credit ratings. These can be sold either directly or through dealers. The denominations and maturity vary over a large band. While there is no active secondary market for commercial papers, direct sellers usually re-purchase on request. Due to the lack of marketability, the yield on CDs is comparatively higher.

- Negotiable certificates of Deposits(CDs): The marketable receipts for funds deposited by firms for a fixed period of time constitute this class of security. The amount and maturity are customized and on maturity the owner of the CDS receive the deposit amount plus the earned interest. CDs may be issued in either registered or bearer firm and the presence of a secondary market makes other firms opting for the latter firm which facilitates transfers. Default risk is also very low.

- Treasury Bills: These are reserved by the government and sold on a discount basis, so there is no actual interest payment. The return is the difference between the purchase price and the face (par) value of the Treasury bill. Treasury bills are sold only in bearer firm consequently these are easily transferable. Presence of a very active market for these bills make them highly liquid and with the financial backing by the government these are practically risk free. However due to negligible financial risk and high liquidity the yield is low. Due to the risk free characteristic and presence of active secondary market these bills are very popular inspite of the comparatively lower yield.

- Banker’s Acceptance: Banker’s acceptances are drafts (order to pay) drawn on specific bank by an exporter in order to obtain payment for goods exported by him. The draft guarantees payment by the accepting bank at a specific point of time. The seller who holds such acceptance may sell it at a discount to get immediate funds. They serve a wide range of maturities and are payable to the bearer. Secondary market also exists for the same. On account of their higher financial risk and lower liquidity the yield is higher than treasury bills.

- Repurchase Agreements: Repo Agreements involve the actual sale of securities by a borrower to the lender with a commitment on the part of the former to repurchase the securities at current price plus a stated interest change. The securities are government securities and other money market instruments. The borrower is a financial institution or a security dealer. The reasons for preference to buy repurchase agreements are,

- The original maturities of the instrument being sold can be adjusted to suit the needs of the firm. Even for a very short maturity period of one/two day’s interest can be earned.

- As the contract price of the securities is fixed by the durations, the firm buying repurchase agreements is protected against market fluctuations during the contract period.

- Units: For investing idle cash, units of mutual funds are convenient alternatives as :

- Existence of active secondary market.

- The income from units is tax-exemt up to a limit.

- Units appreciate in a predictable manner.

- Intercorporate deposits: These are short term deposits with other companies. However they have a high degree of risk and one month’s time is required for conversion to cash.

- Bills Discounting: Bills of exchange are drawn by seller (drawer) on the buyer (drawee) for the nature of goods sold to him. Before payment is due the seller can get the bill discounted. On maturity the bill is presented to the drawee for payment. To ensure safety the bills of exchange should be backed by letter of credit/acceptance by banks.

- Money market mutual funds/liquid funds: These are professionally managed portfolios of marketable securities and provide instant liquidity. These are very popular for high liquidity, competitive yields and low transaction costs.

Apply for Equity Research Certification Now!!

http://www.vskills.in/certification/Certified-Equity-Research-Analyst