Accountants are the practitioners and professionals of accounting. Chartered Accountants are the certified experts in these disciplines. Financial accounting, management accounting, auditing, and tax accounting are examples of distinct forms of accounting. Certified public accountants are qualified accountants who work in a variety of nations (CPA).

Let us know about Career in Accounting!

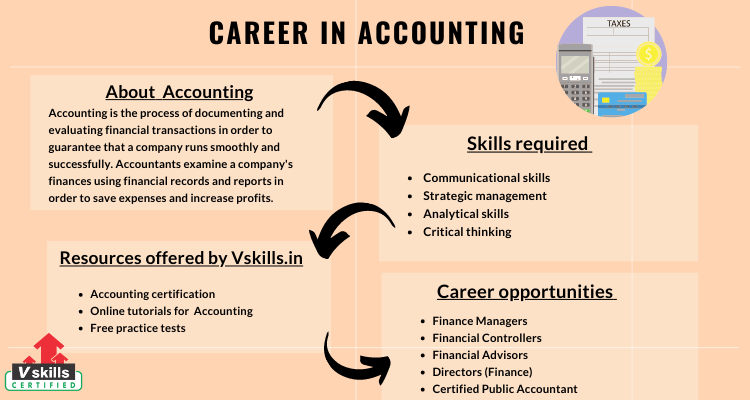

About Accounting

Accounting is the process of documenting and evaluating financial transactions in order to guarantee that a company runs smoothly and successfully. Accountants examine a company’s finances using financial records and reports in order to save expenses and increase profits. Businesses and organisations of all types use accounting practises, and the Bureau of Labor Statistics (BLS) projects careers in the field to grow at an average rate between 2018 and 2028.

What does an accountant do?

An accountant has the following responsibilities –

- They are in charge of preparing an organization’s financial statements.

- Maintain an organization’s financial records.

- They offer suggestions for lowering costs, increasing revenues, and increasing profits.

- They are responsible for ensuring that all taxes are paid on time.

- Create backups of your financial data to keep it safe.

Scope

Accounting jobs range in level from entry-level to executive. In any firm, the accountant performs a critical function. It is a highly important element of a company’s payroll, audits, and financial management. The demand for accountants is rising as a result of the diverse demands of various businesses. Eligible individuals can find work in the public, private, or non-profit sectors. You can choose from a variety of job titles, including clerk, payroll clerk, and accounts clerk.

Financial Accounting vs. Management Accounting

Financial accounting is needed by law for all publicly listed firms in order to provide external financial statements for external decision-makers such as investors and creditors. Financial accounting must follow Generally Accepted Accounting Principles (GAAP), with a focus on delivering accurate, general-purpose, high-level information about an organization’s historical performance.

Management (or managerial) accounting is used for internal reporting and decision-making, and it entails the creation of several comprehensive reports for particular internal users in order to monitor and regulate an organization’s operations. It focuses forward rather than backward, and it might contain subjective, comprehensive assessments and projections of future events and transactions.

In management accounting, GAAP does not apply, and companies are mostly free to design their own management accounting systems and measurement criteria, the majority of which are private. The Sarbanes-Oxley Act of 2002, on the other hand, established minimum criteria for publicly listed firms’ internal reporting systems.

Career options

Some of the career options you can discover after getting enough knowledge about this field are –

Controller – Controllers and assistant controllers are responsible for preparing financial statements and reports that describe and forecast a company’s activities and financial status. They may also create internal rules and processes for the budgeting, cash and credit management, and accounting operations of a company.

Financial Manager – Financial managers are in charge of an organization’s financial health. They provide financial reports and devise plans to assist their company achieve its long-term financial objectives.

Management Consultant – Management consultants, sometimes known as management analysts, provide recommendations for improving operational efficiency in order to make businesses more lucrative by lowering expenses and increasing revenues.

Personal Financial Advisor – Financial advisers assist their customers in gaining a better understanding of their financial situation and making customised investment decisions. They keep track of their customers’ investments and finances and can help them with insurance, mortgages, college savings, estate planning, taxes, and retirement planning.

Financial Analyst -Financial analysts study the financial data of a company. They can give assistance to organisations making investment decisions and predicting for the future by evaluating previous financial and investment data and anticipating future revenues and expenditures.

Treasury Analyst -Treasury analysts keep track of a company’s finances, such as cash flow, obligations, and assets. They look at budgets, costs, and potential investments to see if payments to and from the firm are completed correctly.

Outlook and Salary Potential in Accounting

According to the Bureau of Labor Statistics, accountants make a median annual wage of $70,500, however pay varies according on experience, education, and sector. Accountants working in finance and insurance make the highest annual median pay, according to the BLS, at $74,690. Accountants in tax preparation, bookkeeping, and payroll services make a median annual income of $70,640, while those in administration of corporations and enterprises earn $73,180. Government accountants may expect to make $68,420 per year on average.

Resources for Career in Accounting

Before you can become an expert in desired areas, you must first build a solid base. Before you can move on to practical teaching, you’ll need to have the right applied skills. To gain a full understanding of the domain, you can use the following tools:

- Firstly, Online Tutorials for Career in Accounting

- Professional courses such as CA, CPA and CMA

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Here are some examples of how you can improve your abilities:

- Freelancing

- Internships

- Apprenticeship programs

The above steps will help you to get this domain started. It’s a long way to go, however. You can take an advanced course to reach a new level of skills.

Some resources offered by Vskills

Vskills offer Business Accountant certification for all those interested in working in this field. This certification course covers the following topics –

- MEANING AND SCOPE OF ACCOUNTING

- TAXATION

- BANKING & FINANCE

- COSTING & AUDITING

- Investment Market and its operation

- GST (Goods and Services Tax)

Vskills also offers free practice tests and online tutorials to supplement the learning process. You can check them by clicking on the following links –

Discover the career opportunities and other prospects of Career in Accounting. Hurry up and start preparing now with Vskills.in!