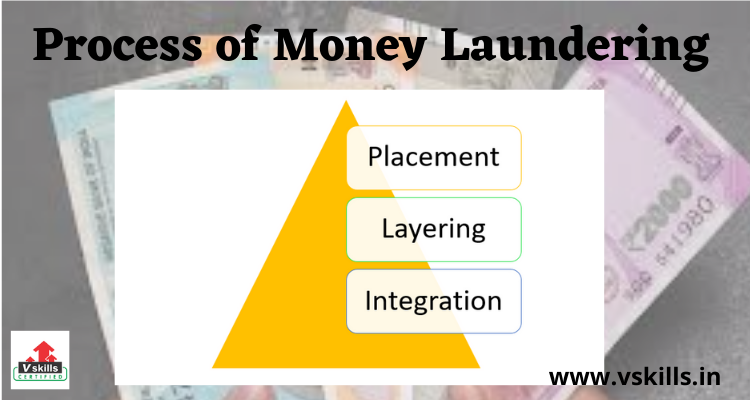

Process of Money Laundering

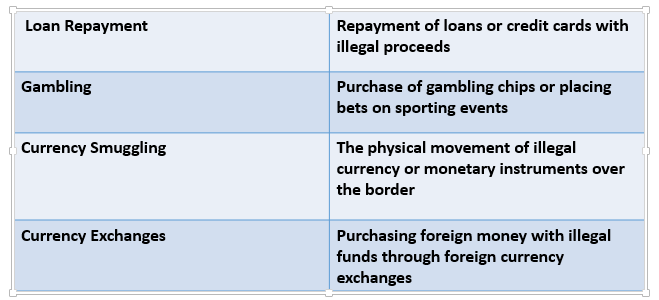

Some common methods of laundering are:

The money laundering process is divided into 3 segments:

- The Placement Stage (Filtering): This stage represents the initial entry of the “dirty” cash or proceeds of crime into the financial system. In this stage, the criminal relieves himself of holding and guarding large amounts of bulky cash, and the money is placed into the legitimate financial system. Money launderers are the most vulnerable at this stage as placing large amounts of cash into the legitimate financial system may raise suspicions of officials and he may get caught. During this initial phase, the money launderer introduces his illegal proceeds into the financial system

- The Layering Stage (Camouflage): The layering stage is the most complex and often entails the international movement of the funds. Here, the illicit money is separated from its source. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime. This stage involves converting the proceeds of crime into another form and creating complex layers of financial dealing to disguise the audit trail

- The Integration Stage (Investment): The final stage is where the money is returned to the criminal from what seem to be legitimate sources. Having been placed initially as cash and layered through a number of financial transactions, the criminal proceeds are now fully integrated into the financial system and can be used for any purpose. For example, the purchases of property, artwork, jewelry, or high-end automobiles are common ways for the launderer to enjoy their illegal profits without necessarily drawing attention to themselves. This stage entails placing laundered proceeds back into the economy to create the perception of legitimacy

It is important to know in-depth information about the process. To help you in knowing more about it, this the module Methods of Money Laundering covers the following topics: