The Certified Project Finance Analyst certification exam is for those candidates who aspire to learn the skills, tools, and techniques in the CMA format to project Financing and Investment Assessing activities. The finance project is mainly designed for the financing of long-term infrastructure, industrial projects, and public services as well but a non-resource limited. The Vskills Certified Project Finance Analyst Professional Certification will increase your potential employment opportunities and financial earnings as well.

Why become a Certified Project Finance Analyst?

For the success of any project it’s first mandatory requirement is financing. In finding big projects financing plays a very crucial role. Therefore, the market holds a great demand for Project Finance Analyst and firms are constantly hiring skilled Project Finance Analysts. The account department also has a space for Project Finance Analysts in both public and private firms. These professionals also work as a financial advisors in banks and different sectors.

Roles and Responsibilities of Certified Project Income Analyst

There are numerous responsibilities of Project Finance Analysts, as stated below –

- Firstly, to prepare a project finance report which requires careful analyses of cost & revenue drivers market trends, interest rates etc.

- Secondly, to perform financial forecasting and reporting and adding operational metrics trading

- Also, Analysis of financial data and design financial models for the decision-making process.

- Then, Proper analysis of past results, performance analysis

- One of the primary significant responsibilities is to keep the track of trends and identify them.

- Also, give proper recommendations after analysis

- Finally, give proper cost analysis process by introducing policies and procedures

Who should Take the Project Finance Analyst certification?

The Vskills Certified Project Finance Analyst Certification focuses on enhancing your skills in long term projects based on limited resources and financial structures. This professional certification course is designed mainly for the candidates who wish to make their CV’s strong, particularly in the finance area.

Moreover, Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine.com.

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1128

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Project Finance Career Path

Project finance is a wide word that refers to the funding of long-term projects such as infrastructure, power plants, and other industrial projects. Finance professionals’ responsibilities have expanded beyond standard accounting and reporting tasks in recent years. Let us know about Project Finance Career Path!

Certified Project Finance Analyst Professional Course Outline

Certify and Increase Opportunity.

Be

Govt. Certified Project Finance Professional

1. Project Identification and Feasibility

1.1 Foreign Investment and Technology

1.2 Project Identification

1.3 Feasibility Study

2. Market Appraisal

2.1 Demand

2.2 Methods of demand Forecasting

2.3 Market Analysis

3. Technical Appraisal

3.1 Appraisal of Project

3.2 Technical Appraisal

4. Financial Appraisal

4.1 Financial Analysis

4.2 Advanced Manufacturing Systems Appraisal

5. Economic Appraisal

5.1 Aspects of Economic Appraisal

5.2 Social Cost Benefit Analysis

6. Financing Capital Structure

6.1 Instruments in Primary Market

6.2 Cost of Capital

7. Choice of Securities and Guidelines for their Issue

7.1 Regulation of Public Issues

7.2 SEBI Guidelines for Debentures

7.3 Non-convertible Debentures(NCD) and Partially Convertible Debentures(PCD)

7.4 Debentures

7.5 Other Debt Securities

7.6 Issue of Shares

7.7 Rights Issues by Listed Companies without SEBI Vetting or Acknowledgement

7.8 Preference Shares

8. Term Loans

8.1 Origin and Nature

8.2 Development Finance Institutions

9. External Commercial Borrowing and Euro-Issues

9.1 External Commercial Borrowing

9.2 Euro-issues

10. Venture Capital

10.1 Nature and Scope

10.2 Venture Capital in India

11. Lease Finance

11.1 Definition and Nature

11.2 International Organizations

11.3 Types of Leases

11.4 Financial Statement Effects and Debt Capacity of Leasing

11.5 Accounting for Leases

11.6 Calculation of Lease Rental

11.7 Factors Affecting Lease Finance

11.8 Borrowing vs Lease Finance

12. Working Capital Finance

12.1 Definition of Working Capital

12.2 Current Assets

12.3 Current Liabilities

12.4 Working Capital Management

12.5 Financing Working Capital

12.6 Ratio Analysis

12.7 Sources of Working Capital

Preparation Guide for Certified Project Finance Analyst Exam

Before you start your exam preparation, it is important to get all the necessary study sources. This will help you understand all concepts thoroughly. In this preparation guide, we have compiled some of the most significant resources that will assist you to prepare yourself well for the exam.

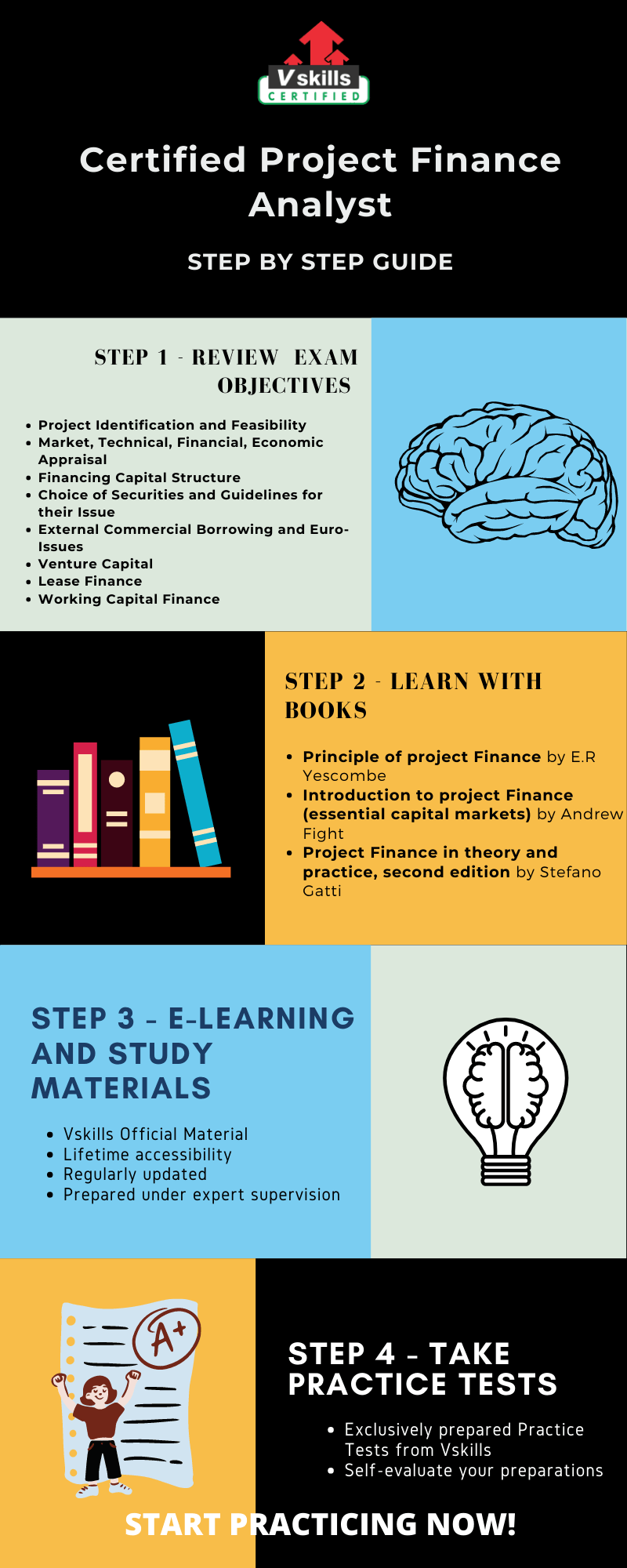

Step 1 – Review Exam Objectives

The first and foremost thing to do before you start your learning process is to know the exam objectives, as it is very important to know the requirements for any exam. Going through the course outline will help you analyze your current level of knowledge and what additional knowledge you must gain, in order to pass the exam, and attain your certification. The objectives of the Certified Project Finance Analyst Exam are given below –

- Firstly, Project Identification and Feasibility

- Secondly, Market, Technical, Financial, and Economic Appraisal

- Financing Capital Structure

- Also, Choice of Securities and Guidelines for their Issue

- Then, External Commercial Borrowing and Euro-Issues

- Venture Capital

- Finally, Lease, and Working Capital Finance

Refer: Certified Project Finance Analyst Professional Brochure

Step 2 – Learning the Traditional Way through Books

Books are our traditional source of learning and have proven to give quality knowledge. Reading from books makes our brain understand the concepts in a more informative manner. Although it’s a tedious learning process, books are always prioritized as a significant learning resource. The top three books for the Project Finance Analyst Professional certification exam are mentioned below –

- Principle of project Finance by E.R Yescombe – One of the finest and highly recommended books which consists of the fundamentals of the project and techniques involved. There is an explanation of the dichotomy between the theory and practice of project finance

- Introduction to project Finance (essential capital markets) by Andrew Fight – It is considered to be one of the best books Of finance which consists of precious insights into the process of project financing and helps identify legal, operational and finance risks among other main aspects.

- Project Finance in theory and practice, second edition by Stefano Gatti – There is a distinct treatment of the subject that reviews the advances made in project finance theory in current times. And industry best practices at length. And amazing insight on transaction structure explaining legal and Industrial aspects of project financing.

Step 3 – E-learning and Study material

After books we prefer is E-learning resources as the matter available online eases the learning process. The animated concepts helps to remember the things better, thereby improving our knowledge to pass the exam. To support your learning, Vskills offers expert-prepared E-learning course, which comes with a lifetime accessibility. Moreover, Vskills also provide hard copies of its study material to help candidates learn better. In addition, these materials offered are regularly updated to meets the changing requirements of the exam.

Refer: Certified Project Finance Analyst Sample Chapter

Step 4 – Check your Progress with Practice Tests

Practice Tests have proven to be one of the most effective learning techniques. Practice tests help us to build our confidence, and also introduces us to different formats, and patterns of exam questions. Giving enough practice tests helps us to identify our potential mistakes, and hence gives us a chance to improve our chances of passing the exam. So Start practicing with free Practice Tests Now!

Job Interview Questions

If you are looking for a new job role in this domain, the you must checkout these online interview questions to prepare for same, the questions will surely help you to pass the interview with ease.