- Profit planning

- Evaluation of Performance

- Make or Buy Decisions

- Closure of a Department or Discontinuance of a Product

- Maintaining a Desired Level of Profit

- Offering Quotations

- Accepting an Offer or Exporting below Normal Price

- Alternative Use of Production Facilities

- Problem of Key Factor

- Selection of a Suitable Product Mix

Profit planning

There are four ways in which profit performance of a business can be improved:

- By increasing volume;

- By increasing selling price;

- By decreasing variable costs; and

- By decreasing fixed costs.

Profit planning is the planning of future operations to attain maximum profit or to maintain a specified level of profit. The contribution ratio (which is the ratio of marginal contribution to sales) indicates the relative profitability of the different sectors of the business whenever there is a change in selling price, variable costs or product mix. Due to the merging together of fixed and variable costs, absorption costs fail to bring out correctly the effect of any such change on the profit of the concern.

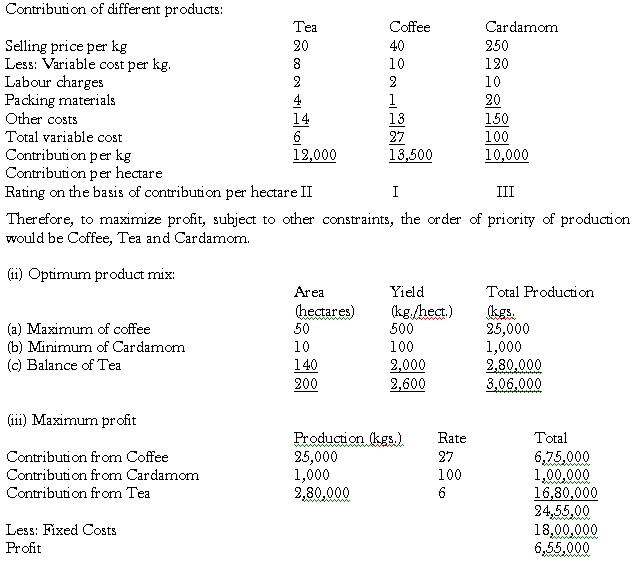

Illustration 6

A toy manufacturer makes an average net profit of 2.50 per piece on a selling price of 14.30 by producing and selling 60,000 pieces or 60% of the potential capacity. His cost of sales is:

Direct material 3.50

Direct wages 1.25

Works overhead 6.25(50% fixed

Sales overhead 0.80(25% variable)

During the current year, he anticipates that his fixed charges will go up by 10%, while rates of direct material and direct labour will increase by 6% and 8% respectively. But he has no option of increasing the selling price. Under this situation he obtains an offer for an order equal to 20% of his capacity. The concerned customer is a special customer.

What minimum price will you recommend for acceptance to ensure the manufacturer an overall profit of 1,67,300?

Solution:

Illustration 7

The following data relate to a manufacturing company:

Plant capacity: 4,00,000 units per annum

Present utilization: 40%

Actuals for the year were:

Selling price 50 per unit

Materials cost 20 per unit

Variable manufacturing costs 15 per unit

Fixed costs 27 lakhs

In order to improve capacity utilization the following proposals are being considered:

Reduce selling price by 10%.

Spend additionally 3 lakhs on sales promotion.

How many units should be made and sold in order to earn a profit of 5 lakhs per year?

Solution:

Revised selling price (50 less 10%) 45 per unit

Variable cost:

Material cost 20

Variable manufacturing cost (per unit) 15

Total variable cost 35 per unit

Contribution 10 per unit

Total contribution required

Fixed costs 27,00,000

Additional promotion expenses 3,00,000

Profit 5,00,000

Total 35,00,000

Total number of units to be made and sold to earn a contribution of 35,00,000

Total Contribution

Contribution per unit

35,00,000 = 3,50,000 units

10

Evaluation of Performance

The various section of a concern such as a department, a product line, or a particular market or sales division, has different revenue earning potentialities. A company always concentrates on the departments or product lines which yield more contribution than others. The performance of each such sector can be brought out by means of cost volume-profit analysis or the contribution approach. The analysis will help the company to take decision that will maximize the profits.

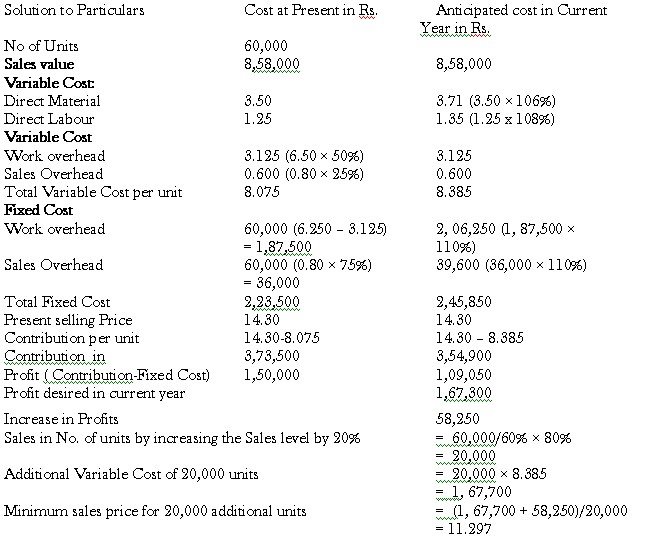

Illustration 8

A business produces three products A, B and C for which the standard variable costs and budgeted selling prices are as follows:

The budgeted fixed overheads amounted to 1,35,000 for each period. In spite of increased sales the profit for the second period has fallen below that of the 1st period.

Present figures to management to show why this fall in profit should, or should not have occurred

Solution:

| Product A | Product B | Product C | Total | ||||||

| Period I | Period II | Period I | Period II | Period I | Period II | Period I | Period II | ||

| A | Sales (Units) | 10,000 | 20,000 | 10,000 | 13,000 | 10,000 | 5,000 | 30,000 | 38,000 |

| B | Selling Price P.U in | 18 | 18 | 25 | 25 | 48 | 48 | – | – |

| C | Sale value in (’000) (A B) | 180 | 360 | 250 | 325 | 480 | 240 | 910 | 925 |

| D | Variable Cost P.U in | 10 | 10 | 15 | 15 | 25 | 25 | 50 | 50 |

| E | Variable Cost (’000) (A D) | 100 | 200 | 150 | 195 | 250 | 125 | 500 | 520 |

| F | Contribution (’000) ( C-E) | 80 | 160 | 100 | 130 | 230 | 115 | 410 | 405 |

| G | Fixed Overhead (’000) | – | – | – | – | – | – | 135 | 135 |

| H | Net Profit (F-G) (’000) | – | – | – | – | – | – | 275 | 270 |

| P/V Ratio | 44.4 | 40 | 47.9 |

Comments: Sales have increased by 8,000 units but the sales value has increased by 15,000. Marginal costs have increased by 20,000 to meet cost of increased units of production, resulting in the fall of profit by 5,000.

Product C which yields the highest percentage of contribution to sales is the most profitable line. Product A comes next and product B is the least profitable of the three.

The unsatisfactory position in Period II is because of unfavorable sales mix as the production of most profitable line C has been cut down and the less profitable products A and B have been pushed up.

Make or Buy Decisions

When the management is confronted with the problem whether it would be economical to purchase a component or a product from outside sources, or to manufacture it internally, marginal cost analysis renders useful assistance in the matter. Under such circumstances, a misleading decision would be taken on the basis of the total cost analysis. In case the proposal is to buy from outside then, what is already being made, and the price quoted by the outsider should be lower than the marginal cost. If the proposal is to make something what is being purchased outside, the cost of making should include all additional costs like depreciation on new plant, interest on capital involved and that cost should be compared with the purchase price.

Illustration 9

A T.V. manufacturing company finds that while it costs to make component X, the same is available in the market at 5.75 each, with all assurance of continued supply. The breakdown of cost is:

Materials 2.75 each

Labour 1.75 each

Variable overheads 0.50 each

- Should the company make or buy the component?

- What should be your decision if the supplier offered component at 4.85 each?

Solution:

Marginal cost per unit of component X

Materials 2.75

Labour 1.75 Variable overheads 0.50

Total 5.00

- The purchase cost of the above component is 5.75 each. If the company is having spare capacity which cannot be filled with more remunerative jobs, it is recommended that the above component be manufactured in the company since the marginal cost at 5.00 each is less than the purchase cost of 5.75.

- In the event of purchase cost of 4.85 each being less than the marginal cost of 5.00 each, it is recommended that the component be bought from the supplier as these results in a saving of 0.15 each. The spare capacity thus available can be utilized for other purposes, as far as possible.

Closure of a Department or Discontinuance of a Product

As discussed earlier, marginal costing technique helps in deciding the profitability of a product. It provides the information in a manner that tells us how much each product contributes towards fixed cost and profit; the product or department that gives least contribution should be discarded except for a short period. If the management is to choose some product out of the given ones, then the products giving the highest contribution should be chosen and those giving the least should be discontinued.

Maintaining a Desired Level of Profit

A company has to cut prices of its products from time to time because of competition, Government regulations and other compelling reasons. The contribution per unit on account of such cutting is reduced while the industry is interested in maintaining a minimum level of its profits. In case the demand for the company’s product is elastic, the maximum level of profits can be maintained by pushing up the sales. The volume of such sales can be found out by marginal costing techniques.

Illustration 10

S. Ltd. manufactures and markets a single product. The following information is available, in per unit

Materials 8.00

Conversion costs (variable) Dealer’s margin 6.00

Selling price 2.00

Fixed cost 2,50,000 Present sales, 80,000 units 20.00

Capacity utilization: 60 per cent. per unit

There is acute competition. Extra efforts are necessary to sell. Suggestions have been made for increasing sales:

By reducing sales price by 5%

By increasing dealers margin by 25% over the existing

Which of the two suggestions you would recommend if the company desires to maintain the present profit? Give reasons.

Solution:

Present marginal cost per unit:

Material 8.00

Conversion costs 6.00

Dealer’s margin 2.00

Total 16.00

Contribution per unit = Selling price −Marginal cost

= 20.00 −16.00 = 4.00 =

Total contribution =4 x 90,000 = 3,60,000

Profit = Contribution −Fixed cost

= 3,60,000 −2,50,000 = 1,10,000

Since in both suggestions fixed costs remain unchanged, the present profit can be maintained by keeping the total contribution at the present level i.e. 3,60,000.

Reducing sales price by 5%

New sales price = (20.00 1.00) = 19.00

New dealers margin = 10% of 19.00

= 1.90

Variable costs = 8 + 6 + 1.90 = 15.90

Contribution per unit = 19.00 − 15.90 = 3.10

Sales (units) required to maintain the present level of profit.

= Total contribution =3,60,000

Contribution per unit 3.10

Increasing dealer’s margin by 25%

New dealer’s margin = 2 + 25% = 2.50

New variable cost = 8 + 6 + 2.50 = 16.50

Contribution = 20 – 16.50 = 3.50

Sales (units) =360,000 / 3.50 =1.02,857 units

The second proposal is recommended because the contribution per unit is higher and the sales (in units) are lower. Lower sales efforts and less finance would be required in implementing the (ii) proposal.

Offering Quotations: One of the best ways for sales promotion is to offer quotations at low rates A company is producing 80,000 units (80% of capacity) and making a profit of 2,40,000. Suppose the Punjab Government has given a tender notice for 20,000 units. It is expected that the units taken by the Government will not affect the sale of 80,000 units which the company is already selling and the company also wishes to submit the lowest possible quotation. The company may quote any amount above marginal cost, because it will give an additional marginal contribution and hence profit.

Accepting an Offer or Exporting below Normal Price: Sometimes the volume of output and sales may be increased by reducing the normal prices of additional sale. In this case the concern should be cautious enough to see that the sale below normal price in additional markets should not affect the normal market. To be on the safe side the product may be sold under the label of a different brand. If there is additional sale because of export orders, goods may be sold at a price below the normal.

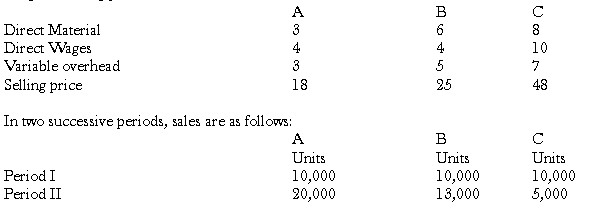

Illustration 11

The cost of a manufacturing company for the product is:

Materials 12.00

Labour 9.00

Variable expenses 6.00

Fixed expenses 18.00

Total 45.00

The unit of product is sold for 51.00.

The company’s normal capacity is 1, 00,000 units. The figures given above are for 80,000 units. The company has received an offer for 20,000 units @ 36 per unit from a foreign customer.

Advice the manufacturer on whether the order should be accepted Also give your advice if the order is from a local merchant.

Solution:

The offer should be accepted because it gives an additional contribution of 1,80,000. The total profit will also increase by 1,80,000 because fixed expenses have already been recovered from the local market. Further some, the order from the local customer should not be accepted at 36 per unit or at any rate below the normal price i.e., 45 because it will result in the general reduction of selling prices of the product.

Note: Acceptance of the additional order should not lead to production being in excess of the present capacity since, in that case, some fixed expenses may also go up substantially. If there is such an increase in fixed expenses, the increase should also be considered by inclusion in the total additional cost to be compared with the additional revenue.

Alternative Use of Production Facilities: When alternative use of production facilities or alternative methods of manufacturing a product are available, contribution analysis should be used to arrive at the final choice. The alternative which will yield highest contribution shall generally and obviously be selected.

Problem of Key Factor: The product giving the greatest contribution will be the most profitable. To maximize profit, resources should be mobilized towards that product which gives the maximum contribution. But contribution is not the only criterion for deciding profitability. In real life, there may be several factors which may put a limit on the number of units to be produced even if the products give a high contribution. These factors are equally important for arriving at managerial decisions because these factors limit the volume of output at a particular point of time or over a period, these are called key factors, scarce factors, limiting factors, principal budget factors or governing factors. The limiting factors may be sale, raw material, labour, plant capacity and availability of capital e.g., for a concern established in a relatively new town, labour may be a key factor or the concern may find it difficult to acquire an unlimited quantity of raw material because of scarcity or the quota system, etc. In the later case material will be the key factor. The extent of influence of these factors should be carefully examined before arriving at a particular decision. Contribution per unit of key factor should be considered and that course of action should be adopted which gives the highest contribution per unit of key factor.

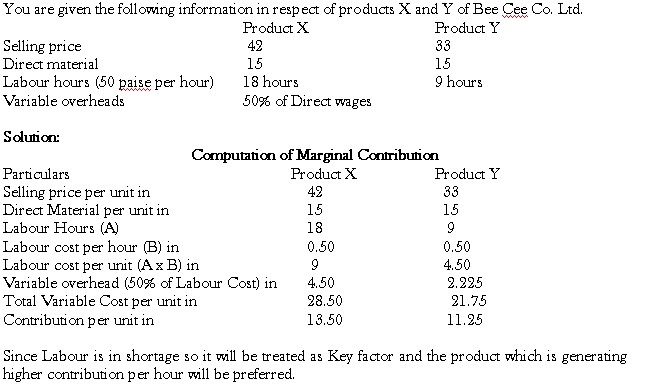

Illustration 12

You are given the following information in respect of products X and Y of Bee Cee Co. Ltd.

Since Labour is in shortage so it will be treated as Key factor and the product which is generating higher contribution per hour will be preferred.

Contribution per labour hour:

Product X = 13.50/18

= 0.75

Product Y = 11.25/9

= 1.25

Since contribution per labour hour for product Y is higher so product Y is more profitable.

Selection of a Suitable Product Mix: A concern, which manufactures more than one product, may have to decide in what proportion should these products be produced or sold. The technique of marginal costing helps to a great extent in the determination of most profitable product or sales mix. The best product mix is that which yields the maximum contribution. In the absence of key factor, contribution under various mix will be found out and the mix which gives the highest contribution will be selected for production.

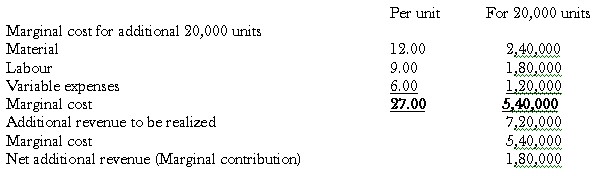

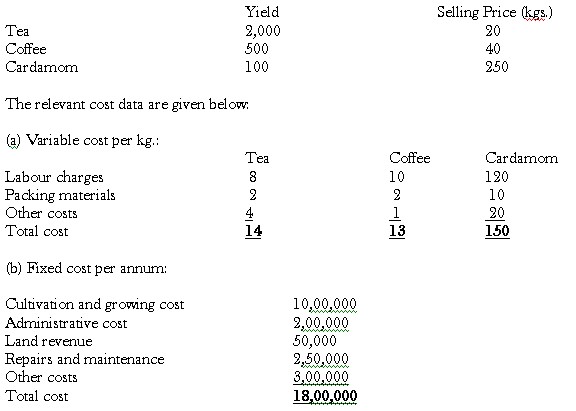

Illustration 13

A company engaged in plantation activities has 200 hectares of virgin land which can be used for growing jointly or individually tea, coffee, and cardamom. The yield per hectare of the different crops and their selling price per kg are as under:

The policy of the company is to produce and sell all the three kinds of products and the maximum and minimum are to be cultivated per product is as follows:

Maximum Area (hectares) Minimum Area (hectares)

Tea 160 120

Coffee 50 30

Cardamom 30 10

Calculate the priority of production, the most profitable product mix and the maximum profit which can be achieved.

Solution: