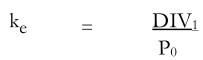

In addition to its use in constant and variable growth situations, the dividend valuation model can also be used to estimate the cost of equity of no-growth companies. The cost of equity of a share on which a constant amount of dividend is expected perpetually is given as follows:

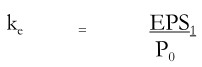

The growth rate g will be zero if the firm does not retain any of its earnings; that is, the firm follows a policy of 100 per cent payout under such case, dividends will be equal to earnings, and therefore above equation can also be written as:

Which implies that in a no-growth situation, the expected earnings-price ratio may be used as the measure of the firm’s cost of equity.

Brighten Your Career Path This Diwali - Invest in Yourself!

Brighten Your Career Path This Diwali - Invest in Yourself!