The firm’s external equity consists of funds raised externally through public or rights issues. The minimum rate of return, which the equity shareholders require on funds supplied by them by purchasing new shares to prevent a decline in the existing market price of the equity share, is the cost of external equity.

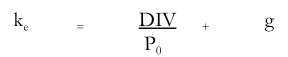

The minimum rate of return, which the equity shareholders require, on funds supplied by them by purchasing new shares to prevent a decline in the existing market price of the equity share is the cost of external equity. The firm can induce the existing or potential shareholders to purchase new shares when it promises to earn a rate of return equal to:

Where 10 is the issue price of new equity. The cost of required earnings will be less than the cost of new issue of equity if P0 > I 0 .