Structured Products

A Fund of Hedge Funds is simplistically a mutual fund that invests in multiple hedge funds. All these funds provide diversification benefits and a method of investing in hedge funds without requiring the skill to personally assess hedge funds individually. In the context of funds of funds, diversification usually means investing across hedge funds using several different strategies, but may also mean investing across several funds using the same basic strategy. Funds of funds may offer access to hedge funds that are closed to new investors. Given the secrecy in hedge funds, a professional funds of funds manager may have greater expertise to conduct the necessary due diligence.

Funds of funds provide benefits that are similar to hedge funds, but with lower minimum investment levels, greater diversification, and an additional layer of professional management. Some funds of funds are publicly listed on the stock exchanges in London, Dublin, and Luxembourg. FOHF normally have significantly lower minimum investment levels compared to a standard hedge fund, thus increasing investment access to the general public.

The term “structured product” is the name given to an investment product that provides a return that is predetermined with reference to the performance of one or more underlying markets. These include a pre-specified term to termination, allowable leverage parameters, retraction privileges, tax features, issuer buyback obligations, foreign currency hedging (if applicable), and rebalancing (when applicable). The performance of a structured product is therefore based only on the performance of this underlying product and not on the discretion of the product provider.

Most often the product relies on the use of derivatives to generate the return, and contains downside protection or guarantees of some form via options. Structured products are therefore passive in nature, with the cost depending on option and other derivative premia. This contrasts with hedge funds, where the fees are justified on the basis of buying the manager’s active skills.

Structured products may be of the growth variety, offering equity-like returns, but typically including varying elements of capital protection. They also include structured notes, which replicate fixed income products.

The investment policy for structured products might concentrate on a single security, on specific asset classes, or on a related sub-sector (such as preferred shares, bonds, high yield and international bonds, mortgage backed securities etc). The investment mandate may dictate either a quasi-passive or active management approach. The mandate may also include “overlay” strategies — such as option writing — with the aim of generating ongoing cash flows (yield) for investors.

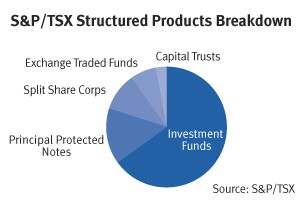

Structured Products provide a variety of investment alternatives in a number of different sectors, using a range of different investment strategies. Structured products have been growing in popularity and can now conceivably be divided into five major categories.

The products are sold in two broad forms.

- The “tranche” variety: With a fixed maturity date (typically 1-5 years), or

- The “continuous‟ product with no fixed maturity date. They may be closed-end funds, or the seller may be able to cancel shares on redemptions like a mutual fund.

While structured products have been around for a long time in various forms, the new-generation portfolios sold use highly complex derivative structures. They use synthetic options replication techniques to tailor products to all combinations of risk and return for investors.

Investment Funds

Investment Funds offer exposure to a number of different asset classes and sectors — including commodities, real estate, large cap or small cap equities, indices, debt securities, income trusts, mortgages and loans. These actively managed products often use leverage and derivatives to increase yield, reduce risk and protect capital.

Asset Classes

Debt as an asset class: When one participates in fixed interest investment, it means that the individual is lending of money to others in the form of fixed deposit, bonds, and debentures etc. in the expectation to receive a fixed interest. The fixed interest return varies with the time horizon of the instrument. During this time horizon, the capital invested gets locked for the period and funds will be unavailable for withdrawal. Contrary to popular belief, this asset class does have risks pertaining to the assurance of return and value fluctuations depending on market and economic conditions. Credit risk, interest rate risk and default risk are other risks related with this asset class.

Equity as an asset class: This involves holding instruments consisting of company shares. It means that the investor has an ownership in a business by owning a share of the company that is listed on a stock exchange and traded daily based on demand and supply. It is the most risky asset class in the short term scenario as the related price fluctuations is the highest. As a tradeoff, this approach also offers the highest return.

Usually, the probability of losses in equity markets reduces significantly if invested for more than 10-15 years. The average return this asset class has produced in last 15-20 years is approx 17% CAGR. On a yearly investment historical data the range of returns vary from 47% to -150%. That is why, equity as an asset class turns out to be the safest class yielding high returns when looking at a long term investment.

Real estate as an asset class: When one buys a physical asset such as real estate i.e. house, building, land etc., and the property may be leased or rented out. Investing in this asset class is done for a long time horizon after which it gives one returns higher than fixed interest. Sometimes difficult situations arise with property investment like any bad development in an adjacent area which may affect the property. This causes trouble in leasing or renting his/her property at the right price. Old or inherited houses also tend to get damaged over time which affects the earnings. Investing in real estate, despite these disadvantages, is the preferred choice for investors for its safety and returns.

Commodities as an asset class: Commodities are acquired and traded largely in the similar manner as stocks and bonds, but there are a few fundamental differences. Commodities are not capital assets and they do not generate a stream of dividends, interest payments, or other income that can be discounted in order to calculate a net present value. Certain models like the Capital Asset Pricing Model (discussed later) do not apply to commodities, for example bushel of corn. Commodities are popular because they can be consumed or transformed into another final product which can be consumed.

The most common way investors gain exposure to commodities has been through equity investment in major exchange-listed commodity producing companies. The introduction of commodity index products as well as Exchange Traded Funds including Exchange Traded Commodities over the past many years has eased an investor’s commodity exposure through these methods.

An individual can have the opportunity to invest in a wide range of commodities through an index which allows diversification, reduces volatility and maximizes the Sharpe ratio (discussed later). Investing through an index also derives the benefits of downward sloping forward curves, which delivering a positive return. Equity investments that pertain to commodities do not give broad coverage to the entire range of commodities available. It provides an investor exposure to only one sector or just one commodity.

Art as an asset class: Art work and its value is the most subjective asset to assess. When one invests in art, they are investing in the expression of culture, and the art’s meaning. Prices of paintings through times have proved that true artistic relevance prevails as well-known and less well-known artists’ work ultimately finds an appropriate market value. The main challenge of art investors is identifying artistic relevance.

Art work is distinct as an investible good. They serve as financial assets while they are also durable consumer goods. The total supply of work by a particular artist is there only for the duration of his/her lifetime. The works are usually one-of-a-kind and extremely heterogeneous, with values that range from a few rupees to a few crores rupees. Their value and future price appreciation is determined only by its demand and hence highly speculative in nature. Paintings, antiques and other similar goods are also referred to as “collector goods”. There are psychological benefits of owning art, which are largely absent in the case of owning financial assets.

Some difficulties of investing in art involve the art market’s inefficiency. From the lack of know-how and expertise about the art market to the uncertainty surrounding tax issues, people are quite often hesitant before investing. In many countries investment in art is one of the major possibilities of escaping or at least reducing the tax burden. And this is even more important as it is often unclear which country’s tax code applies.

Investment in stocks: The market value of a stock is evaluated on the basis of its capitalization or “cap” for short. This is indicative of the size of the stock available. The company’s capitalization is an effective parameter to group corporate stocks.

In India, shares are classified as large-cap, mid-cap, and small-cap made on the basis of the relative size of the market.

The first category, small-cap stocks, consists of shares of small companies that have the potential to grow rapidly. Normally companies that have a market capitalization up to rupees 250 crores are small cap stocks. Small-caps are the best used by an investor when he or she wants to earn good gains in the long run, but at the same time they must also not emphasis on current dividends or price stability.

The second category called Mid-cap stocks belongs to medium-sized companies. By and large the companies that have a market capitalization in the range of Rs. 250-4000 crores are mid cap stocks. The pertinent companies are usually well-known and recognized as seasoned players in the market. There are two advantages offered by trading these types of stocks. They have good growth potential as well as the stability of a larger company.

The stocks being traded of the largest companies in the market such as Tata, Reliance, SBI, Infosys etc. fall in the category of large-cap stocks. Being well-established companies, they have available large disposable reserves of cash to develop new business prospects. Large-cap stocks usually do not growth rapidly because of the large volumes of shares.

Therefore, smaller capitalized companies and the smaller stocks tend to outperform them from time to time. Investors benefit out of possessing these stocks by availing the relatively higher dividends offered by the shares and also ensure the long-term preservation of their capital.

Cash: Investing in simple cash makes funds available as and when required i.e. it has the highest liquidity. Some forms in which an individual can hold cash are through savings accounts and money market instruments. The returns of this asset class out of all the available asset classes which signifies the zero risk associated with it.

Principal Protected Notes (PPN)

PPNs guarantee investors the return of their original investment while providing exposure to any combination of the returns of indices, equities, commodities, mutual funds, fixed income, and inflation. PPNs are typically suited to risk-averse investors who are looking to gain from favourable market movements.

These are structured products that are typically issued by a financial institution such as a bank. The payoffs from such a note are more complex than those for a “vanilla” fixed-income product. A principal-protected note can be thought of as combining the payoffs of a zero-coupon bond with that of a call option. The exact type of call option can vary but the investor should be assured of getting back his or her principal at maturity because the zero-coupon bond component of the product matures at the maturity of the note. It is in this way that the notes are said to be “principal protected.”

Exchange Traded Funds (ETFs)

Exchange Traded Funds are essentially Index Funds that are listed and traded on exchanges like stocks. Until the development of ETFs, this was not possible before. Globally, ETFs have opened a whole new panorama of investment opportunities to Retail as well as Institutional Money Managers. They enable investors to gain broad exposure to entire stock markets in different Countries and specific sectors with relative ease, on a real-time basis and at a lower cost than many other forms of investing.

An ETF is a basket of stocks that reflects the composition of an Index, like S&P CNX Nifty or BSE Sensex. The ETFs trading value is based on the net asset value of the underlying stocks that it represents. Think of it as a Mutual Fund that you can buy and sell in real-time at a price those changes throughout the day. As it tracks a Benchmark Index, the return expectation is the same as that of the Index. For example, if for a particular period, say from 1st April to 30th of June the ROI on Nifty is 10%, then the NAV of the ETF that tracks Nifty should also be around 10%. The small difference in return between the NAV and the Benchmark Indices could be because of the fact that there would be some cost involved in managing the ETF. This is commonly referred as tracking error.

The difference between these two Asset Classes stems from the fact that ETF are traded on the Stock Exchanges and hence investor can derive benefits of trade in ETF just like any ordinary stocks. Therefore, by owning an ETF, an investor get the diversification of an index fund as well as the ability to sell short, buy on margin and purchase as little as one share. Another advantage is that the expense ratios for most ETFs are lower than those of the average mutual fund and are equally tax efficient.

Because of its advantages, ETF has emerged as one of the most popular asset classes amongst the investors.

- Can easily be bought or sold like any other stock on the exchange through terminals across the country.

- Can be bought or sold anytime during market hours at a price close to the actual NAV of the Scheme.

- No separate form filling. Only a phone call to the broker or the Internet is needed.

- Ability to put limit orders.

- Minimum investment is one unit.

- Enjoy flexibility of a stock and diversification of index fund.

- Expense Ratio is lower. Hence low cost invest, even lower than the index funds.

- Provides arbitrage between Futures and Cash Market.

Split Share Corporations

The “split share” structure is another unique type of structured product. The split share structure allows the risk-reward component of common shares to be broken down into two components and then allocated differently for investors who are more or less risk averse.

A split share corporation will hold common shares of one or more companies, typically a portfolio of common shares (based on a sector or industry). The corporation will issue two classes of shares – capital shares and preferred shares. For preferred shareholders, the objective is to generate fixed cumulative preferential dividends and return the original investment. For capital shareholders, the objective is to increase investors’ participation in any capital appreciation (or depreciation) in the underlying portfolio shares and benefit from any increase in the dividends paid on the portfolio shares. With the use of leverage, capital shares holders can realize greater percentage gains relative to the percentage change in the value of the underlying common share comprising the overall portfolio (for example, a 10% increase in value of common shares in the portfolio can mean a 15-20% increase in the intrinsic value of the capital shares).

Capital shares have a higher level of risk than the underlying common shares, while the preferred shares exhibit significantly lower risk than the underlying common shares. The distinction between the two classes of shares issued by a split share corporation is therefore critical. Capital shareholders will typically sacrifice yield in pursuit of the higher growth the leverage can provide, implicitly accepting the higher risk associated with the leverage.

Meanwhile, preferred share holders focus entirely on the higher yield and high quality rating of the preferred shares, and will not benefit from increases in the value of the underlying investment portfolio.

Capital Trusts

Capital trusts are similar to fixed income products and are commonly issued by banks or other financial institutions. These products are intended to provide investors with returns on portfolios of mortgages and fixed income securities.

Advantages of Structured Products

- Diversification: Structured products allow investors to participate in a portfolio of many securities, which helps spread market risk.

- Professional management: The portfolio manager or team selects securities and monitors them full-time, enabling investors to participate in structured products without developing investment expertise or taking time to research and monitor specific investments.

- Clear objectives: Most structured products specialize in either stocks or fixed-income securities and pursue a consistent objective, such as capital appreciation or current income. Some funds are highly specialized, investing in a given region, country, or specific type of security.

- Economies of Scale: The costs of operating a structured product are divided in proportion among all shareholders. The major ongoing cost, a management fee paid to the investment advisor, is based on assets and is very competitive vis-à-vis mutual fund expenses.

- Distributions: Structured products generally have a distribution feature and will make distributions according to a prescribed schedule.

- Tax Benefits: Structured products are often designed to provide investors with enhanced tax benefits. Some products use tax-efficient structures — such as forward agreements — to defer payment of taxes.

- “Pass through” taxation: Like mutual funds, structured products generally do not pay tax at the fund level on amounts distributed to investors. The taxation is said to “pass through” to the shareholders.

- Available for many accounts: Like mutual funds, structured products may be purchased in regular brokerage accounts (individual or joint-name), registered accounts, and trust accounts.

- Efficient portfolio management: Unlike mutual fund managers, who worry about constant inflows and outflows of cash, structured product managers are responsible for a stable pool of capital. Although fund shares trade actively, this fact does not affect the fund manager because no assets are flowing in or out of the portfolio on a daily basis.

- Leverage potential: Structured products may issue senior securities (preferred stock or debentures) or borrow money to “leverage” their investment positions. This gives portfolio managers of structured products — in the fixed-income area in particular — the opportunity to enhance yield and provide investors with superior performance. This also gives investors more flexibility to take advantage of timely market opportunities.

- Clear commissions: One commission is paid to buy structured product shares and another to sell them; these are the only transaction-related costs. Structured products generally have “trailer” or “service” fees, which are calculated on the NAV of the structure.

- Lower expense ratios: Structured products do not incur ongoing costs associated with distributing shares as do many mutual funds; thus, the expense ratios of structured products are usually less than those of mutual funds. Over time, a lower expense ratio provides a boost to investment performance.

Apply for Hedge Fund Certification!

https://www.vskills.in/certification/certified-hedge-fund-manager