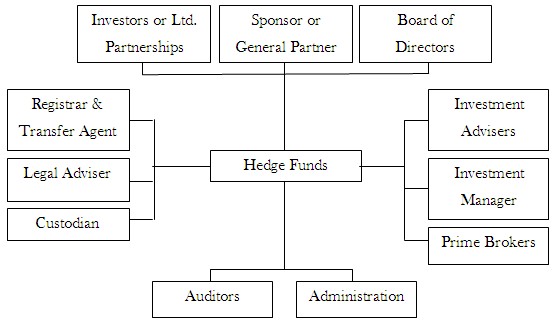

Hedge Fund Operational Structure

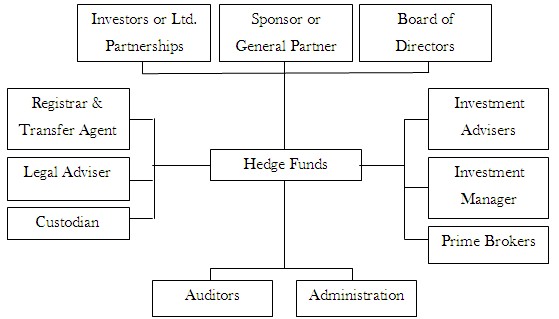

Hedge funds are usually not operated in-house by their employees. They are merely investment vehicles owned by investors and sponsors, and rely on external service providers to conduct the funds day-to-day business, including managing the fund portfolio and providing administrative services. So for this type of operation structure, hedge funds establish relationships with all the necessary industry service providers.

- The sponsors and the investors: The sponsor is the creator of the fund and he will typically hold a member of the founder shares in the fund. That is, the sponsor will be the general partner and the investor will be the limited partner.

- The Manager or Management Company: The manager is responsible for office overhead, and is usually established in a major onshore financial centre like London or New York.

- The Investment Adviser: The role of investment advisor is simply to give professional advice on the funds investment in a way that is consistent with the fund’s investment objectives and policies. The investment adviser may be a part of the same overall organization as the hedge fund he serves, or he/she may be unrelated to it.

- The board of directors: The board of directors is accountable for the overall operations of the fund.

- The fund administrator: The fund administrator’s primary task is to ensure accurate calculation of the net asset value at regular time interval called break periods.

- The Custodian: The custodian’s primary responsibilities include safekeeping of the fund’s assets, clearing and settlings all trades and monitoring corporate actions such as dividend payments and proxy-related information.

- The legal advisor or lawyer: The legal adviser or lawyer assists the hedge fund with any tax code and/or legal matters, and ensure compliance with domestic investment regulations as well as with regulations of countries where the fund is distributed.

- The auditors: The auditors’ role is to ensure that the hedge fund is in compliance with accounting practices and any applicable laws, and to verify the annual financial statement, if any.

- The registrar and transfer agent: The agent keeps and updates a register of shareholders of the hedge fund. He or she also processes and takes required actions for subscriptions and withdrawals of shares in the fund, as well as for the payment of any dividends and distributions.

- The Prime Broker: The role of prime brokers goes beyond just replacing the hedge funds back office. Rather, they should be seen as full service providers across the core functions of execution and operation for example.

- Clearing the trades

- Acting as global custodian

- Margin financing

- Securities lending

Organization Structure

Hedge funds typically prefer to concentrate their efforts on the key activity of maximising investment return, so non-essential operations are outsourced e.g. “back office” functions. Actual trading transactions are also outsourced to Prime Brokers. Hedge funds typically reside offshore to take advantage of more favourable tax treatments and regulations. Hedge funds also need to set up efficient organizational structures.

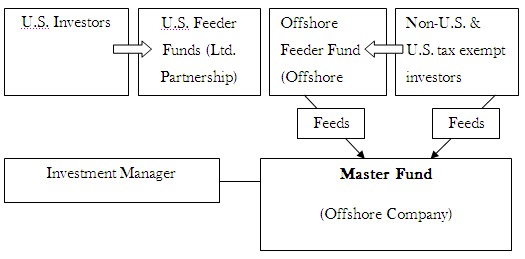

- Side-by-side and master feeders: In side by side structures (also known as mirror funds or clone funds), several funds having identical or to a large extent similar investment policies invest in parallel in a group of cloned portfolio. These portfolios usually share a common investment adviser, portfolio managers and a custodian or administrator, and the cloning process essentially consists in facilitating bunched trades among the cloned funds and rebalancing cloned funds that have experienced different cash flows. The master/feeder structure is an efficient alternative to side-by-side funds. In this structure a series of funds called ‘feeders’ sell shares to investors under the terms of their prospectus and contribute their respective proceeds to another fund called the ‘master fund’ rather than investing directly.

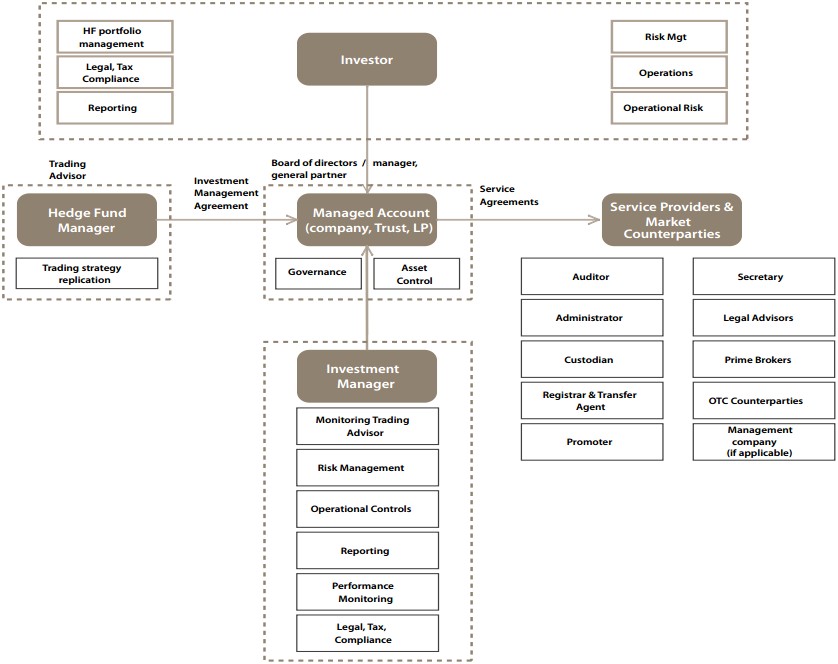

- Managed accounts: A managed account is an investment structure that is set up and governed by the managed account provider/client/independent board of directors (called ‘sponsor’) to manage the assets at tandem with the reference hedge fund. Typically the managed accounts are set up as a separate vehicle enabling the ring-fencing of the assets. The managed account can be fully customized to the sponsor’s specific needs and restrictions. The hedge fund manager is only involved in portfolio management without having any control over the assets or the operating model. All operational aspects are handled by service providers that are chosen by the sponsor of the managed account. The sponsor is usually able to negotiate reduced management fees for a sizable dedicated managed account. The costs of service providers is charged to the fund (account) but it is kept relatively low as the fees can be negotiated on the basis of the sponsor’s total asset under management (AUM). The fund (account) can be set up in the sponsor’s location of choice.

Structure of Managed Account

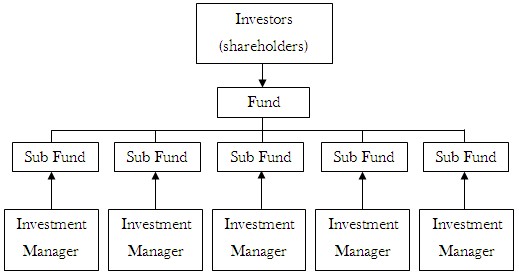

- Umbrella funds: An umbrella fund may be used when different strategies/portfolios are to be offered or where the fund is a multi-manager fund. Rather than create a separate fund for each strategy/portfolio manager, they are offered under one “umbrella”. An umbrella fund may be established using a single company that issues a different class of share for each portfolio to be managed under the umbrella.

Umbrella funds are often used for managed account structures as it is the most cost efficient structure while segregation of liability between the sub funds is (in most jurisdictions) arranged by law. Many managed account providers or institutional investors still prefer to have stand-alone funds because there is still a theoretical risk that there will be contamination between the sub funds as the segregation has not been tested in US courts. In addition the funds may also provide for the establishment of different classes of shares or units within a fund or, in the case of an umbrella fund, within each sub-fund of the fund.

Structure of an Umbrella Fund

Hedge Fund Market Size

Hedge funds are not required to register but the SEC estimates, however, that there are between 6,000 and 7,000 funds that manage approximately $600-650 billion in assets. Though the hedge fund industry is growing phenomenally in size and should require more supervision, it is still exempt from SEC regulations. The reason for this is that hedge funds are only offered to wealthy individuals and institutions.

A combination of statutory provisions and rules under the 1933 Act and the Investment Company Act for private rather than public offerings allow for them — and the securities they issue to investors — to remain unregistered. Many funds take advantage of the 1933 Act that allows them to sell to “accredited investors.” These are individuals with an annual income of $200,000 or more, married couples with a joint income of $300,000 or more, or individuals with a net worth of $1 million.

Hedge Fund Market Size

Hedge funds are not required to register but the SEC estimates, however, that there are between 6,000 and 7,000 funds that manage approximately $600-650 billion in assets. Though the hedge fund industry is growing phenomenally in size and should require more supervision, it is still exempt from SEC regulations. The reason for this is that hedge funds are only offered to wealthy individuals and institutions.

A combination of statutory provisions and rules under the 1933 Act and the Investment Company Act for private rather than public offerings allow for them — and the securities they issue to investors — to remain unregistered. Many funds take advantage of the 1933 Act that allows them to sell to “accredited investors.” These are individuals with an annual income of $200,000 or more, married couples with a joint income of $300,000 or more, or individuals with a net worth of $1 million.

Apply for Hedge Fund Certification!

https://www.vskills.in/certification/certified-hedge-fund-manager