There are a wide variety of hedge funds with many different investment strategies. Some hedge funds will be diversified among many strategies, managers and investments, while others may take highly concentrated positions or may only use a single strategy. One has to understand the level of risk involved in the fund’s investment strategies and ensure that they are suitable to the personal investing goals, time horizons and risk tolerance. As with any investment, generally the higher the potential returns, the higher the risks that must be assumed.

The investment strategies employed by various mutual funds are well documented, ranging from value investing to buying growth stocks, with each having particular risk and return implications. With hedge funds however, investment strategies are far less well documented and the variety of strategies are greater in number than the ones used for mutual funds.

In order to compare performance, risk, and other features, it is helpful to categorise hedge funds by their investment strategies. Strategies may be designed to be market-neutral or directional. Selection decisions may be purely systematic or discretionary. A hedge fund may pursue several strategies at the same time, internally allocating its assets proportionately across different strategies.

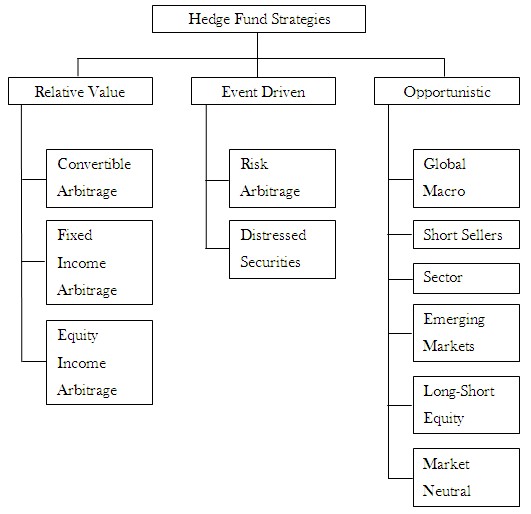

There is no standard categorisation of hedge fund strategies. They differ from theory to theory. For instance, Stoneham identifies 14 hedge fund strategy categories while Fung only has 7. The classification and sub-classifications also differ from place to place. Yet there is a commonality in the use and the names of all the strategies. Below are 3 major classifications of hedge fund strategies that are further divided into sub categories.

Relative value funds use market-neutral strategies that take advantage of perceived mispricing between related financial instruments. Fixed-income arbitrage may exploit short-term anomalies in bond attributes, such as the yield curve or the spread between Treasury and corporate bonds. Convertible arbitrage profits from situations where convertible bonds are undervalued compared to the theoretical value of the underlying equity and pure bond. In these cases, the hedge fund manager takes long positions on the convertible bond and shorts the underlying stock. Statistical arbitrage involves exploiting price differences between stocks, bonds, and derivatives (options or futures) while diversifying away all or most market-wide risks.

Situations for relative-value arbitrage often occur with illiquid assets, so there may be added liquidity risk. Gains on individual trades made be small, so leverage is often used with relative-value strategies to increase total returns.

Convertible arbitrage

Price differences between convertible bonds and the underlying shares can arise because of inefficiencies between the convertible bond market and the share market. The typical investment would be a long position in the convertible bond and a short position in shares in the same company. The profit will then be made on the fixed income security and the short position in the underlying share. By combining the two positions the investment is protected against market fluctuations. A leverage effect is often combined.

Fixed Income Arbitrage

This strategy aims to profit from price anomalies between related interest rate securities. Most managers trade globally with a goal of generating steady returns with low volatility.

This category includes interest rate swap arbitrage, US and non-US government bond arbitrage, forward yield curve arbitrage, and mortgage-backed securities arbitrage. The mortgage-backed market is primarily US-based, over-the-counter and particularly complex.

Fixed income arbitrage strategies attempt to exploit mispricing among fixed income securities. This strategy relies heavily on mathematical models of the term structure of interest rates to identify mispricing and manage positions. There are a various techniques that can be identified within the fixed income arbitrage strategy, and some of these are discussed below. Most hedge fund managers engaged in fixed income arbitrage will use several of the techniques, depending upon perceived opportunities. Fixed income arbitrage has its historical roots in the fixed income trading desks of brokerage houses and investment banks.

Equity Market Arbitrage

This investment strategy is designed to exploit equity market inefficiencies and usually involves being simultaneously long and short matched equity portfolios of the same size within a country. Market neutral portfolios are designed to be either beta or currency neutral, or both. Well-designed portfolios typically control for industry, sector, market capitalization, and other exposures. Leverage is often applied to enhance returns.

Apply for Hedge Fund Certification!

https://www.vskills.in/certification/certified-hedge-fund-manager