Growth Rate Analysis

Businesses see growth as a good thing. The more and the faster a business can growth the better. Right? Not necessarily. Businesses have to grow at a sustainable rate. In order for a business to grow and not run into problems with financing, it has to grow at a sustainable growth rate. Why? Businesses have to be able to finance their growth with either debt or equity financing. If they do not have enough financing, but they have runaway growth, may find it difficult to get financing to sustain that growth. On the other hand, a business that grows too slowly will stagnate

Sustainable Growth Rate

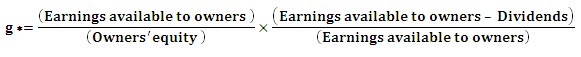

Sustainable growth is the maximum growth rate in a company’s earnings it can achieve without altering its capital structure. Sustainable growth can be estimated as the product of the return on equity and retained earnings.

Sustainable growth = Return on equity x Retention rate

The return on equity is calculated as the ratio of net income to book value of equity.

The retention rate is the percentage of earnings retained by the company – that is, not paid out in the form of dividends. In other words, the retention rate is the complement of the dividend payout ratio (DPO). This growth rate is assumed to be sustainable because the company is growing from internally generated funds – that is, retained earnings. Representing sustainable growth as g*, this formula becomes.

Intrinsic P/E Ratio

There are many ways to value a company or to find its intrinsic value, ranging from dividend discount model to free cash flow to residual value method to P/E value. One new method to value a company is franchise value method.

Given the uncertainty of the company’s forecasted cash flows, a key determinant of value is the growth rate in cash flows. The growth rate depends on relevant country GDP growth rates, the industry growth rates and the company’s sustainable competitive advantage within the industry. Regardless of the valuation model used, some analysis of the growth rate input is useful. Using the dividend discount model as representative model Leibowitz and Kogleman developed the Franchise value method where the Intrinsic P/E is computed as

Intrinsic P/E= Tangible P/E + Franchise P/E

Where:

Tangible P/E: no growth or zero earnings retention P/E value of existing business

Franchise P/E: value derived from prospective new investments.

The franchise value approach focuses on the intrinsic P/E rather than on intrinsic value Po. In the franchise value method the franchise P/E is further broken down into franchise factor and growth factor. The growth factor captures the present value of the opportunities for productive new investments, and the franchise factor capture the return levels associated with those new investments.

Intrinsic P/E= Tangible P/E + Franchise P/E

Intrinsic P/E= 1/r + (FF x G)

Here tangible,

P/E = 1/r (where, r= required rate of return)

Franchise P/E = FF x G where- FF= (ROE-r)/(ROE x r)

ROE= return on equity and

G= g/r-g (g=sustainable growth rate)

Thus,

Po/E (intrinsic P/E) = (1/r) + (ROE-r/ROE x r) (g/r-g)

The growth factor is the ratio of the present value of future increases in the book value (BV) of equity to the current BV of equity. Because the present value of the BV increments is to be given as a ratio to the most recent BV the growth factor is then given as g/(r-g). The franchise factor stems from the fact that a firm has a competitive advantage allowing it to generate a rate of return (ROE) greater than required rate of return (r). The growth rate G will be high if the firm can sustain a growth rate that is high relative to (r).

Consider a consumer durable firm with some attractive new products with large commercial interest. Its ROE will be high relative to the rate of return required by investors for consumer durable stocks. Hence it is has a large positive Franchise factor FF. If it continues to make productive new investments (G) positive such a firm can continue to generate a return on equity well above the rate of return required by the stock market and thus it has a large franchise value and thus a higher P/E.

Apply for Equity Research Certification Now!!

http://www.vskills.in/certification/Certified-Equity-Research-Analyst