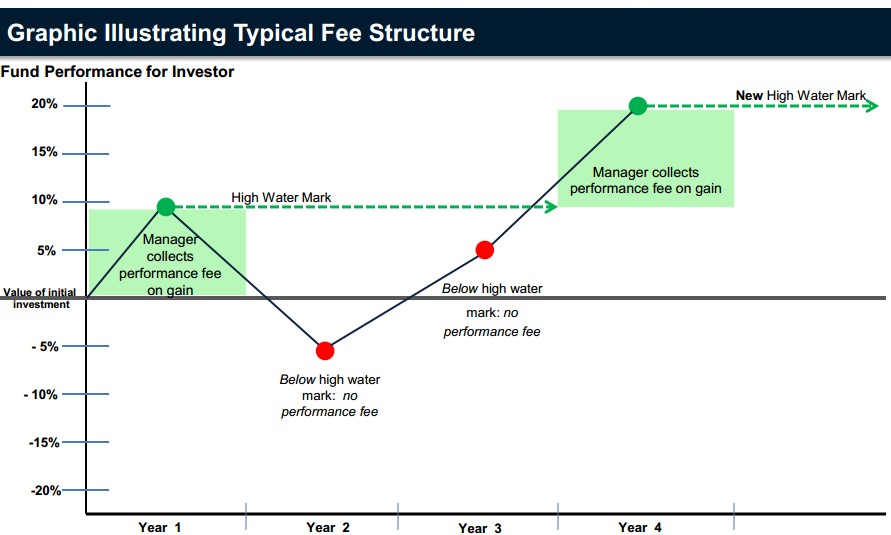

To ensure profits are determined fairly, high water marks and hurdle rates are sometimes included in the calculation of incentive fees. A high water mark is an absolute minimum level of performance over the life of an investment that must be reached before incentive fees are paid. A high water mark ensures that a fund manager does not receive incentive fees for gains that merely recover losses in previous time periods.

A hurdle rate is another minimum level of performance (typically the return of a risk-free investment, such as a short-term government bond) that must be achieved before profits are determined. Unlike a high water mark, a hurdle rate is only for a single time period. Funds with high water marks usually have significantly better performance (0.2% monthly) and are widespread (79% of funds). Hurdle rates are only used by 16% of funds and have a statistically insignificant effect on performance.

Apply for Hedge Fund Certification!

https://www.vskills.in/certification/certified-hedge-fund-manager