Decision analysis includes many procedures, methods, and tools for identifying, clearly representing, and formally assessing important aspects of a decision, for prescribing a recommended course of action by applying the maximum expected utility action axiom to a well-formed representation of the decision, and for translating the formal representation of a decision and its corresponding recommendation into insight for the decision maker and other stakeholders.

Graphical representation of decision analysis problems commonly use influence diagrams and decision trees. Both of these tools represent the alternatives available to the decision maker, the uncertainty they face, and evaluation measures representing how well they achieve their objectives in the final outcome. Uncertainties are represented through probabilities. The decision maker’s attitude to risk is represented by utility functions and their attitude to trade-offs between conflicting objectives can be made using multi-attribute value functions or multi-attribute utility functions (if there is risk involved). In some cases, utility functions can be replaced by the probability of achieving uncertain aspiration levels. Decision analysis advocates choosing that decision whose consequences have the maximum expected utility (or which maximize the probability of achieving the uncertain aspiration level). Such decision analytic methods are used in a wide variety of fields, including business (planning, marketing, and negotiation), environmental remediation, health care research and management, energy exploration, litigation and dispute resolution, etc.

DA Cycle

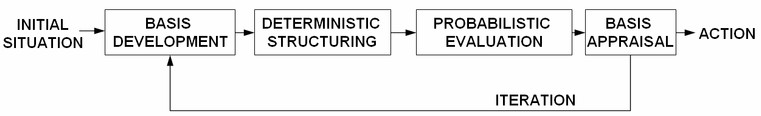

The decision analysis (DA) cycle is the top-level procedure for carrying out a decision analysis. The traditional cycle consists of four phases:

- basis development

- determinisitic sensitivity analysis

- probabilistic analysis

- basis appraisal.

The diagram below depicts the Decision Analysis Cycle:

Decision Modeling

Modeling for decision making involves two distinct parties—one is the decision maker and the other is the model builder known as the analyst. The analyst is to assist the decision maker in his/her decision making process. Therefore, the analyst must be equipped with more than a set of analytical methods. Specialists in model building are often tempted to study a problem, and then go off in isolation to develop an elaborate mathematical model for use by the manager (i.e., the decision maker). Unfortunately the manager may not understand this model and may either use it blindly or reject it entirely.

The specialist may feel that the manager is too ignorant and unsophisticated to appreciate the model, while the manager may feel that the specialist lives in a dream world of unrealistic assumptions and irrelevant mathematical language. Such miscommunication can be avoided if the manager works with the specialist to develop first a simple model that provides a crude but understandable analysis. After the manager has built up confidence in this model, additional detail and sophistication can be added, perhaps progressively only a bit at a time. This process requires an investment of time on the part of the manager and sincere interest on the part of the specialist in solving the manager’s real problem, rather than in creating and trying to explain sophisticated models. This progressive model building is often referred to as the bootstrapping approach and is the most important factor in determining successful implementation of a decision model. Moreover the bootstrapping approach simplifies the otherwise difficult task of model validating and verification processes.

In deterministic models, a good decision is judged by the outcome alone. However, in probabilistic models, the decision maker is concerned not only with the outcome value but also with the amount of risk each decision carries. As an example of deterministic versus probabilistic models, consider the past and the future. Nothing we can do can change the past, but everything we do influences and changes the future, although the future has an element of uncertainty. Managers are captivated much more by shaping the future than the history of the past.

Uncertainty is the fact of life and business. Probability is the guide for a “good” life and successful business. The concept of probability occupies an important place in the decision making process, whether the problem is one faced in business, in government, in the social sciences, or just in one’s own everyday personal life. In very few decision making situations is perfect information—all the needed facts—available. Most decisions are made in the face of uncertainty. Probability enters into the process by playing the role of a substitute for certainty—a substitute for complete knowledge.

Probabilistic modeling is largely based on application of statistics for probability assessment of uncontrollable events (or factors), as well as risk assessment of your decision. The original idea of statistics was the collection of information about and for the state. The word statistics is not derived from any classical Greek or Latin roots, but from the Italian word for state. Probability has a much longer history. Probability is derived from the verb to probe meaning to “find out” what is not too easily accessible or understandable. The word “proof” has the same origin that provides necessary details to understand what is claimed to be true. Probabilistic models are viewed as similar to that of a game; actions are based on expected outcomes. The center of interest moves from the deterministic to probabilistic models using subjective statistical techniques for estimation, testing and predictions. In probabilistic modeling, risk means uncertainty for which the probability distribution is known. Therefore risk assessment means a study to determine the outcomes of decisions along with their probabilities.

Decision makers often face a severe lack of information. Probability assessment quantifies the information gap between what is known, and what needs to be known for an optimal decision. The probabilistic models are used for protection against adverse uncertainty, and exploitation of propitious uncertainty. Difficulty in probability assessment arises from information that is scarce, vague, inconsistent or incomplete. A statement such as “the probability of a power outage is between 0.3 and 0.4” is more natural and realistic than its “exact” counterpart, such as “the probability of a power outage is 0.36342”.

It is a challenging task to compare several courses of action and then select one action to be implemented. At times, the task may prove too challenging. Difficulties in decision making arise through complexities in decision alternatives. The limited information-processing capacity of a decision-maker can be strained when considering the consequences of only one course of action. Yet, choice require s that the implications of various courses of action be visualized and compared. In addition, unknown factors always intrude upon the problem situation and seldom are outcomes known with certainty. Almost always, an outcome depends upon the reactions of other people who may be undecided themselves. It is no wonder that decision makers sometimes postpone choices for as long as possible. Then, when they finally decide, they neglect to consider all the implications of their decision.

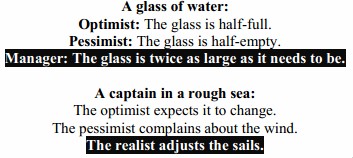

In decision making under pure uncertainty, the decision maker has absolutely no knowledge, not even about the likelihood of occurrence for any state of nature. In such situations, the decision maker’s behavior is purely based on his/her attitude toward the unknown. Some of these behaviors are optimistic, pessimistic and least regret, among others. Consider three following known ideas about a glass of water and a captain in a rough sea:

Whenever the decision maker has some knowledge regarding the states of nature, he/she may be able to assign subjective probability for the occurrence of each state of nature. By doing so, the problem is then classified as decision making under risk. In many cases, the decision maker may need an expert’s judgment to sharpen his/her uncertainties with respect to the likelihood of each state of nature. In such a case, the decision maker may buy the expert’s relevant knowledge in order to make a better decision. The procedure used to incorporate the expert’s advice with the decision maker’s probabilities assessment is known as the Bayesian approach.

In decision making under pure uncertainty, the decision maker has no knowledge regarding any of the states of nature outcomes, and/or it is costly to obtain the needed information. In such cases, the decision making depends merely on the decision maker’s personality type.

One “pole” on this scale is deterministic. The opposite “pole” is pure uncertainty. Between these two extremes are problems under risk. The main idea here is that for any given problem, the degree of certainty varies among managers depending upon how much knowledge each one has about the same problem. This reflects the recommendation of a different solution by each person. Probability is an instrument used to measure the likelihood of occurrence for an event. When you use probability to express your uncertainty, the deterministic side has a probability of one (or zero), while the other end has a flat (all equally probable) probability. For example, if you are certain of the occurrence (or non-occurrence) of an event, you use the probability of one (or zero). If you are uncertain, and would use the expression “I really don’t know,” the event may or may not occur with a probability of 50 percent. This is the Bayesian notion that probability assessment is always subjective. That is, the probability always depends upon how much the decision maker knows. If someone knows all there is to know, then the probability will diverge either to one or zero. The decision situations with flat uncertainty have the largest risk. For simplicity, consider a case where there are only two outcomes, with one having a probability of p. Thus, the variation in the states of nature is p×(1-p). The largest variation occurs if we set p = 50%, given each outcome an equal chance. In such a case, the quality of information is at its lowest level. Due to statistics science the quality of information and variation are inversely related. That is, larger variation in data implies lower quality data (i.e., information). In this tutorial several techniques for decision making under risky, deterministic and uncertain situation are presented. These techniques will enable managers to challenge with nondeterministic outcomes of nature.

Decision analysis in general assumes that the decision maker faces a decision problem where he or she must choose at least and at most one option from a set of options. In some cases this limitation can be overcome by formulating the decision making under uncertainty as a zero-sum two-person game. In decision making under pure uncertainty, the decision-maker has no knowledge regarding which state of nature is “most likely” to happen. He or she is probabilistically ignorant concerning the state of nature; therefore he or she cannot be optimistic or pessimistic. In such a case, the decision maker invokes consideration of security. Notice that any technique used in decision making under pure uncertainties is appropriate only for the private life decisions. Moreover, the public person (i.e., you, the manager) has to have some knowledge of the state of nature in order to predict the probabilities of the various states of nature. Otherwise, the decision maker is not capable of making a reasonable and defensible decision in this case.