The Vskills U.S. GAAP Certification gives the core knowledge required to work with companies included in the U.S. capital markets. An insight into US GAAP can help the aspirant to understand the decisions adopted by other reporting frameworks such as IFRS. The Vskills Certified US GAAP Professional course provides an institution to US GAAP by considering its requirements and accounting treatments. The candidate will develop their global financial reporting volubility and set themselves apart.

Responsibilities of a Certified US GAAP Professional

- Recognizing reporting obligations for financial statements provided using U.S. GAAP.

- Identifying U.S. financial accounting theories.

- Summon U.S. GAAP financial accounting and reporting necessities for particular transactions.

- Understanding U.S. management accounting notions, etc.

Overview: Certified US GAAP Professional

The Generally Accepted Accounting Principles in the US (US GAAP) relate to the accounting rules used in the United States to present, organize, and report financial statements for a collection of entities that involve non-profit organizations, privately held and publicly traded companies, and governments. The Vskills Certified US GAAP Professional course is designed for professionals and graduates aspiring to shine in this area. It is also well satisfied for those who are previously working and would like to take certification for additional career progression. Becoming Vskills Certified US GAAP Professional can help candidates to differentiate in today’s competitive job market, expand their employment possibilities by showcasing their advanced skills, and succeed in higher earning potential.

Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- Become Government Certified Professional!

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and ‘Vskills Certified’ On Shine Shine.com.

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1555

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Course Outline

Vskills Certified US GAAP Professional exam covers the following topics –

Financial Standards

- What are Financial Standards

- Why financial standards are needed

- Objectives of Financial Reporting

- Characteristics and Limitations of a Financial Report

- IFRS

- GAAP

- US-GAAP

ASC 105 – GAAP History and Hierarchy

- ASC 105 Objective

- US GAAP History

- GAAP Hierarchy

- US GAAP Sources

- US GAAP Assumptions

- Generally Accepted Accounting Principles

- Conceptual Framework

- US GAAP Glossary

ASC 205 – Presentation of Financial Statements

- Terminology

- Materiality

- Liquidation Basis of Accounting

- Qualifications and Reports of Accountants

- General Instructions as to Financial Statements

- Rules of General Application

- Interim Financial Statements

- Discontinued Operations

- Strategic Shift

ASC 210 – Balance Sheet

- Current Assets

- Non-Current Assets

- Current Liabilities

- Non-current Liabilities

- Stockholders’ Equity

- Offsetting

ASC 225 – Income Statement

- Income Statement in Brief

- Methods for Constructing the Income Statement

- Operating Revenues and Expenses

- Non-operating Revenues and Expenses

- GAAP and the Income Statement

- Noncash Items

- Statements of Comprehensive Income

- Unusual or Infrequent Items

- Schedule to File

- Income from Continuing Operations

ASC 230 – Statement of Cash flow

- Cash Flow Brief

- Cash Flow Classification

- Noncash Investing and Financing Activities

- Reporting

ASC 323 – Investments – Equity Method and Joint Ventures

- Revenue and Asset Changes under the Equity Method of Accounting

- Equity Method and GAAP

- Initial Recognition and Measurement

- Recognizing Investee Activity

- Investor-level Adjustments

- Presentation and Disclosure

- ASC 323 Equity Method and JV Brief

ASC 326 – Financial Instruments – Credit Losses

- ASC 326 Introduction

- Assets Measured at Amortized Cost

- Measurement of Expected Losses

- Subsequent Measurement of Expected Credit Losses

- Available-for-Sale Debt Securities

ASC 330 – Inventory

- Inventory Basics

- Inventory Valuation

- Absorption Costing

- Retail Inventory Method

- LIFO System

- Lower of cost or market (LCM)

- Inventory under US-GAAP in Brief

ASC 360 – Property, Plant and Equipment

- PP&E Basics

- PPE under GAAP

- Cost Capitalization

- Asset Acquisitions

- Depreciation and Amortization

- Asset Disposal

- Disclosures

- Property, Plant and Equipment Brief

ASC 405 – Liabilities

- Extinguishment of Liabilities

- Derecognition

- Prepaid Stored-Value Products

ASC 605 – Revenue Recognition

- Important Definitions

- Revenue Recognition Basics

- Identifying the Contract

- Performance Obligations

- Transaction Price

- Recognizing Revenue

- Percentage of Completion Method

- Completed Contract Method (CCM)

- Installment Method

- Cost Recovery Method

- Revenue Recognition Model

- Long Term Construction Contracts

- Services Revenue Recognition

- Revenue Recognition Brief

ASC 810 – Consolidation

- Non-Controlling Interest

- Consolidation Models

- The Variable Interest Entity (VIE)

- The Voting Interest Model

- Partnerships

- Research and Development Arrangements

- Joint Venture

ASC 958 – Not-for-Profit Entities

- Revenues

- Expenses

- Gains and Losses

- Reclassifications

Preparation Guide for Certified US GAAP Professional

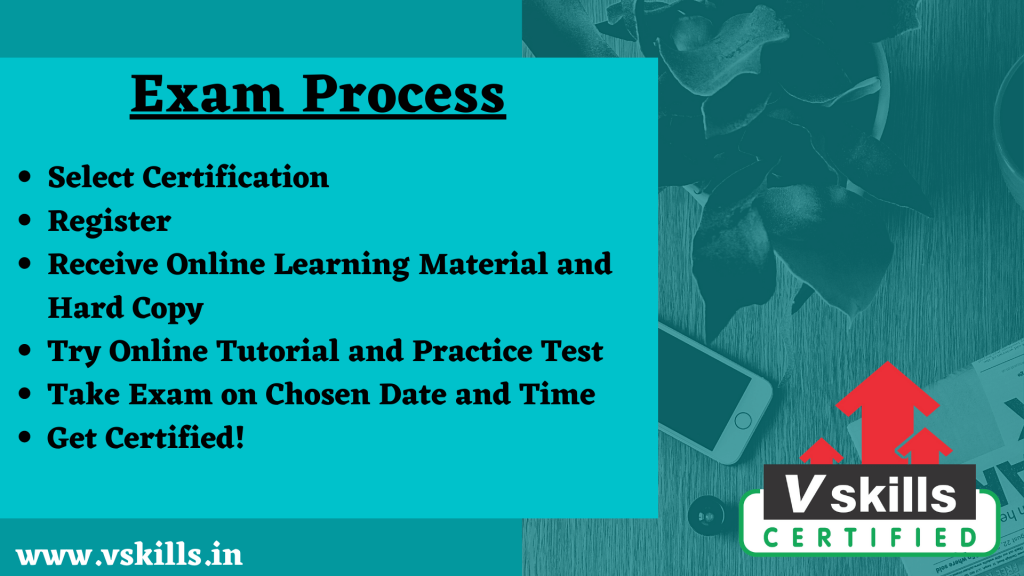

Candidates brewing for the Certified US GAAP Professional exam should recognize the importance of exam resources. During the exam preparation, it is important to get all the necessary exam study sources. This will provide the benefit to understand the concepts and meaning more precisely. In the preparation guide, we will review some of the most significant resources to help the candidate prepare well for the exam.

Exam Objectives

For every examination, the first task should be to get all the exam relevant details including the important contents and its topic. With complete exam objectives, the candidate’s exam preparation time is better spent because they already know what to study. For this exam, the topics include:

- Financial Standards

- ASC 105 – GAAP History and Hierarchy

- ASC 205 – Presentation of Financial Statements

- ASC 210 – Balance Sheet

- ASC 225 – Income Statement

- ASC 230 – Statement of Cash flow

- ASC 323 – Investments – Equity Method and Joint Ventures

- ASC 326 – Financial Instruments – Credit Losses

- ASC 330 – Inventory

- ASC 360 – Property, Plant, and Equipment

- ASC 405 – Liabilities

- ASC 605 – Revenue Recognition

- ASC 810 – Consolidation

- ASC 958 – Not-for-Profit Entities

Vskills Online Learning Material

Vskills provides candidates a way to prepare for the exam using the online learning material for existence. The online material for this is regularly updated. Moreover, e-learning is bundled with hard copy material which encourages candidates to enhance and update the learning curve for superior and better opportunities. The candidate can also download the sample chapter for the Certified US GAAP Professional exam.

Books for Reference

The next step in the preparatory guide should be books and study guides. The candidate needs to find those books which are enriched with information. Finding a good book may be a difficult task, but in order to gather knowledge and skills, the candidate has to find, read, and understand. We usually recommend the following:

- Wiley GAAP 2020: Interpretation and Application of Generally Accepted Accounting Principles (Wiley Regulatory Reporting) by Joanne M. Flood

- GAAP Guidebook: 2020 Edition by Steven M. Bragg

Practice Test

Practice tests are the one who ensures the candidate about their preparation for the exam. The practice test will help the candidates to acknowledge their weak areas so that they can work on them. There are many practice tests available on the internet nowadays, so the candidate can choose which they want. Try the practice test here!