For those with a passion for finance, a career in the Foreign Exchange Markets and Forex Trading can be very rewarding. The Forex markets provide a thorough understanding of the currency buying and selling process. Foreign exchange traders that operate independently or for an organization with a large number of currency exchange transactions fall into this category. They also work for banks and foreign money exchange companies.

Let us investigate career prospects in Forex Trading!

What is Forex Trading?

Forex is a foreign exchange portmanteau. Exchange for a number of purposes, usually for trade, trade and tourism, is the process of transforming one currency into another currency. The annual amount of Forex trade averaged over USD $5.1 billion, according to a three-year 2019 study from the Bank for International Settlements (a global bank for national central banks).

The foreign exchange (forex) market is the world’s largest asset marketplace in terms of trading volume and liquidity, open 24 hours a day, five days a week, and critical to global finance and commerce.

Why to choose a career in forex trading?

There can be many reasons which makes this career your best choice and also serves you many benefits. Some of them are –

- Due to its high liquidity, a 24/7 schedule and easy accessibility for people with a financial background, forex trading has become a common profession for the industry. You have enough incentive for both young graduates and seasoned professionals to consider forex trade as a career, to be your own boss with the ease to make money from your laptop/mobile.

- The forex markets operate all day and allow for the ease of trading which is very good for short term traders who tend to take positions over a short period of time (say a few minutes to a few hours). Few traders do business during full off hours.

- As a global economy, there is no central exchange or regulator for the forex market. As there is a worldwide market. Several central banks of various countries periodically intervene, but, in severe circumstances these are unusual cases. Most of these technologies are recognized and priced in the market already.

- The forex market has the highest number of market participants compared to any other financial market. This offers the highest liquidity, making it easy to efficiently fill even huge orders of currency exchange, without any large price fluctuations. This removes the risk of price manipulation and price anomalies and thus allows tighter spreads which lead to better pricing.

- For shorter period businesses, and a number of key research theories and methods for long term forex trading, there are hundreds of forex technical indicators, which provide traders with different levels of experience with a huge option for quick entry into the forex trading.

- 28 major monetary pairs of 8 major currencies exist. Timing, volatility trend or economic growth can be convenient to choose a pair. A foreign currency trader who loves volatility can turn easily from one currency to another.

Career opportunities

Some of the careers that you can choose to set your foot into are –

Forex Market Analyst/Currency Researcher/Currency Strategist

An analysis and analysis is conducted to provide regular market comments on the market for the forex, as well as to economic and political issues that influence currency values. The analysis and research are called a currency researcher or currency strategist. These professionals are informed by technical, fundamental and quantitative research in order to deliver high-quality content very quickly in order to keep pace with the rapid pace of the Forex market.

Forex Account Manager/Professional Trader/Institutional Trader

You might have what it takes to become a skilled forex trader if you have consistently succeeded on your own. Currency mutual funds and hedge funds dealing with forex trading include the purchase and sale decisions of account managers and experienced forex traders. Institutional investors including banks, multinationals, and central banks who need to cope with fluctuation in the value of foreign currency often employ forex traders.

Forex Industry Regulator

Regulators in the forex industry aim to discourage fraud and can have many responsibilities. Regulatory bodies employ a large number of various professional types and are present in many countries. They work in the private and public sectors as well. The CFTC is the US Government Forex Regulator, while the National Futures Association (NFA) establishes regulatory guidelines and screens private sector Forex dealers’ representatives.

Forex Exchange Operations, Trade Audit Associate and Exchange Operations Manager

Exchanges include processing new customer accounts, as mandated by Federal Legislation, verification of customer identities, the processing of customer withdrawals, transfers and deposits, and the provision of customer service. The work typically involves a baccalaureate degree in economics, business or accounting, problem solving and analysis and an appreciation of financial markets and instruments, in particular forex. There may also be prior experience in brokerage.

Forex Software Developer

The development software creators are working to build proprietary trading platforms, which allow users to access data on currency prices, to evaluate future trade and online forexes by using graphs and indicators. Qualifications include an IT degree, a computer-engineering degree or similar; knowledge of the operating system, including UNIX, Linux and/or the Solaris programming languages, Java script, Perl, SQL, Python, and/or Ruby; knowledge on several other technical aspects, including backend frameworks.

How to get started with forex trading?

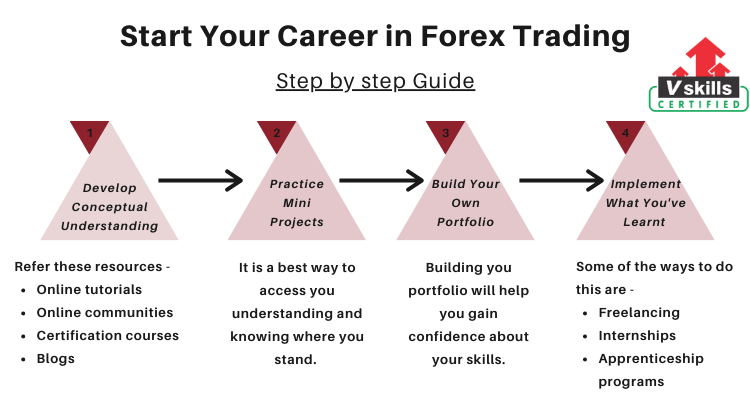

To be acceptable at something, it is critical to have a good start with appropriate assets and learning material. As a result, your first steps toward learning must be appropriate in order for you to be a pro in this field. Let’s take a look at some steps you can take to start your learning process –

Step 1 – Learn about the basics and Develop Conceptual understanding

Before being an expert in any area, it is important to have a strong base. You must have sufficient applied knowledge even before you get started in markets. It is necessary for everyone to begin somewhere. You must begin small if you want to have a good career in this area. You can get full information and a complete conceptual understanding by using the tools mentioned below –

- Firstly, Online Tutorials for Forex Trading

- Also, Certification Courses from verified sources such as Vskills, Coursera, Udemy and so on.

- In addition, Online communities

- Moreover, Blogs and study material from experts in this field and many more.

Vskills also provide Online tutorials, certification courses and free practice tests for the same. You can check them out on our official site.

Step 2 – Practice Mini Projects

Over, over and over, and over, people learn stuff. The more you do, the easier it gets and the better it gets. The uniqueness of forex trading is that almost every broker has demo accounts – the ideal forum to learn. This means you can practice without having to spend your own money.

You can supplement your learning with the help of reading the blogs and tutorials by various sites which will help you to grasp a better understanding of the practical aspects.

Step 3 – Build Your Portfolio

The next step is to bring your own cash up after the demonstration accounts. You should concentrate less on the amount of your investment, and focus more on the quality of trading, if you’re just starting your company. You don’t want to go into your new job for the first week – be intelligent. It is best to keep the risk to a minimum until you have an established record of successful trade. It’s about learning how to make money and stop wasting it afterwards in the early stages.

Step 4 – Implement your skills in Real world

Execution of the ability you’ve mastered is vital because that’s why you learned in the first place – to perfect the skill! You must also remain up to date with latest technical developments and continue to work and improve your own skills. Any of the technical courses can also be used to show that you have a comprehensive understanding of advanced skills. You can put your talents to use in a variety of ways, including:

- Freelancing

- Internships

- Apprenticeship programs

Above mentioned steps will help you to get started in this domain. However, there is a long way to go. You can take up an advanced course to take your skills to a new level.

Market Demand

Treasury departments of various MNCs, treasury departments of banks trading foreign exchange, research departments of banks, corporate treasuries & teachers of finance. Managers of companies who wish to understand foreign exchange, owners of small and medium export import firms who want to have a better control over their foreign exchange exposure and anyone having interest in the Foreign Exchange Markets will also benefit from learning foreign exchange.

People trying to get in treasury departments of bank trading foreign exchange, research departments of banks and corporate treasuries, teachers of finance, managers of companies who wish to understand foreign exchange, owners of small and medium export import firms who want to have a better control over their foreign exchange exposure and anyone having interest in the Foreign Exchange Markets can also start getting the knowledge of forex.

Average Salary

Dealer of foreign exchanges receives a satisfactory wage in various fields. Most enterprises pay more for highly qualified and qualified foreign exchange agents. The Foreign Exchange Dealer’s average pay structure is explained below. There are many other job roles for forex dealing as well which have satisfactory compensation level.

| Job Profile | Starting Salary per annum (in INR) | Mid Level Salary per annum (in INR) | Senior Level Salary per annum (In INR) |

| Foreign Exchange Dealer | Rs. 1,49,000 | Rs. 4,70,000 | Rs. 10,00,000 |

| Forex Market Analyst | Rs. 2,00,000 | Rs. 6,00,000 | Rs. 10,00,000 |

| Forex Account Manager | Rs. 2,00,000 | Rs. 6,00,000 | Rs. 10,00,000 |

However, if you are a freelancer, you can earn in accordance with your skills.

Conclusion

In addition to the skilled, highly technical jobs mentioned above, forex firms need employees to work in human resources and accounting. Consider getting your feet wet in a general business role if you’re interested in a career in forex but don’t yet have the requisite background or experience for a technical position. Many forex companies often offer internships for college undergraduates.

Get started and discover the career opportunities in the field of Forex Trading. Hurry up and try free practice tests now offered by Vskills.in!